3 extremely interesting and specific ETFs from interesting sectors that few people know about

ETFs are an extremely interesting tool. Especially for passive investors, for whom they provide great diversification and low fees. And there's a huge range to choose from, which sometimes includes some really nice gems!

We'll take a look at three of them today! But first - what are ETFs anyway?

ETFs (Exchange Traded Funds) are investment funds that are traded on exchanges around the world. ETFs invest in a variety of assets, such as stocks, bonds, commodities or currencies, and provide investors with an easy and efficient way to diversify their portfolio. ETFs typically have lower costs than traditional mutual funds and are tradable like traditional stocks, allowing investors to easily buy and sell during exchange trading hours.

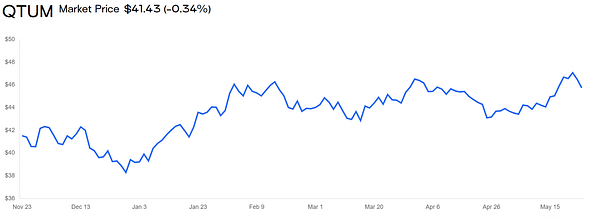

Defiance Quantum ETF $QTUM+0.6%

The Defiance Quantum ETF is a fund that focuses on stocks of quantum technology companies. This ETF was launched in 2018 and is managed by Defiance ETFs.

Quantum technologies deal with the use of quantum phenomena for information processing. These technologies have the potential to improve various fields such as medicine, energy, financial services and logistics. For example, quantum computers are able to solve complex mathematical problems much faster than conventional computers, which could lead to faster development of new drugs or optimisation of logistics networks.

The QTUM ETF invests in companies involved in research and development of quantum technologies, such as IBM, Alphabet, Honeywell International and D-Wave Systems. The fund also invests in companies that use quantum technology - Goldman Sachs, JPMorgan Chase or Alibaba Group.

The QTUM ETF consists of more than 30 companies and aims to provide investors with exponential growth and portfolio diversification. The fund has a low expense ratio and is traded on the NYSE Arca exchange. Its performance is measured by the BlueStar Quantum Computing and Machine Learning Index.

It is important to note that an investment in the QTUM ETF involves some risk. Quantum technologies are still in the early stages of development and can be prone to fluctuations. In addition, some companies in the ETF portfolio may be exposed to specific risks, such as patent rights or regulatory risks. It is important to carefully consider your investment objectives and risk tolerance before deciding to invest in the QTUM ETF or any other ETF.

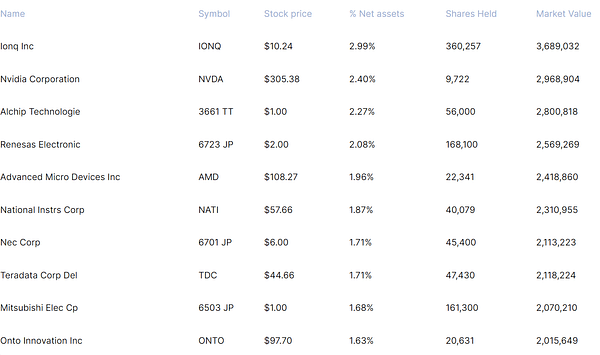

Global X Video Games & Esports ETF $HERO+0.9%

The Global X Video Games & Esports ETF is an ETF that focuses on stocks of companies involved in the gaming and esports industries. This ETF was launched in 2019 by Global X ETFs and invests in companies around the world that are focused on the gaming and esports industry.

HERO ETF invests in companies that are involved in the production of games, game consoles, mobile games, as well as companies that are involved in esports such as esports tournament organizations or esports game developers. Some of the largest positions in the portfolio include shares of companies such as Activision Blizzard, Nvidia, Tencent, and Electronic Arts.

The HERO ETF capitalizes on the growing popularity of gaming and esports, which is becoming increasingly popular and generating more revenue. Newzoo estimates that the video game market is expected to be worth more than $200 billion by 2023. The esports industry is also growing rapidly and is estimated to be valued at over $250 billion in 2023.

The HERO ETF allows investors to tap into the growth potential of the gaming and esports industry while diversifying their portfolio. The ETF has a low expense ratio and is traded on the NASDAQ exchange. Its performance is measured by the Solactive Video Games & Esports Index.

It is important to note that investing in the HERO ETF involves a great deal of risk. The gaming and esports industries are still relatively new and can be prone to fluctuations. Another big factor here, for example, is the large exposure to Asia.

iShares Cybersecurity and Tech ETF $IHAK+0.2%

The iShares Cybersecurity and Tech is an ETF that focuses on stocks of companies that are involved in cybersecurity and technology. Founded in 2018 by BlackRock, this ETF invests in companies around the world that are focused on cybersecurity and technology.

The IHAK ETF invests in companies that focus on various aspects of cybersecurity such as cryptography, threat detection, network and application security, as well as companies that are developing new technologies such as artificial intelligence, cloud services, big data and the Internet of Things. Some of the largest positions in the portfolio include stocks in companies such as Palo Alto Networks, Cisco Systems, Microsoft, and Splunk.

The IHAK ETF capitalizes on the growing need for cybersecurity in today's digital age, where cyber threats are becoming more sophisticated and frequent. Cybersecurity Ventures estimates that the cost of cybercrime is expected to reach more than $8 trillion by 2023 . This trend is expected to continue in the future, which could lead to further growth of cybersecurity and technology companies.

Disclaimer: This is in no way an investment recommendation. This is purely my summary and analysis based on data from the internet and other sources. Investing in the financial markets is risky and everyone should invest based on their own decisions. I am just an amateur sharing my opinions.