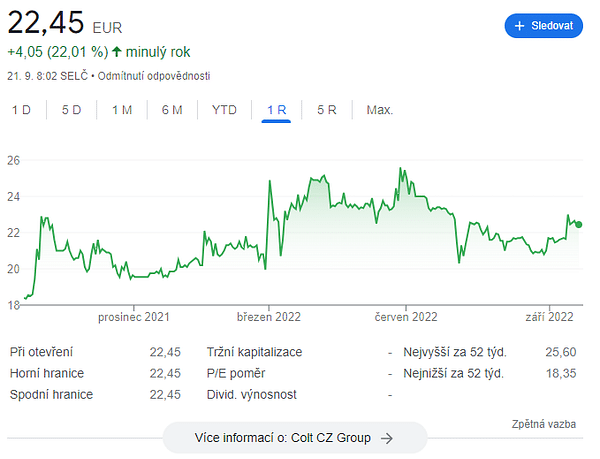

Colt CZ Group: the toughest company on the Prague Stock Exchange may be in trouble

The Prague Stock Exchange contains several very interesting companies. However, few have such a global reach as the Czech Armaments Factory - now Colt CZ Group. Its quality is particularly evident from the fact that the legendary Colt brand was acquired relatively recently. One would think that the arms company would be in the limelight in today's escalated situation. Not necessarily. The arms giant could now be headed for several problems.

As has been the case in recent months, the situation around Ukraine and the resulting other effects are really to blame. Only this time it is more about expensive energy. How can they harm society?

We must start with a statement made in February this year by the Deputy Minister for Armaments Management, Lubor Koudelka, which read as follows: "The Ministry of Defence is guaranteed a favourable price for these weapons, regardless of the rapidly rising prices of raw materials and labour, until 2025 ."

At the beginning of this year, Zbrojovka began to fulfill an order for our army. We are talking about 350 pieces of CZ BREN 2 PPS rifles, a large number of older types of CZ BREN 2, CZ P-10 pistols and CZ 805 G1 grenade launchers.

https://www.youtube.com/watch?v=yttm7WIZTd4

Raw materials and labor really seemed like the biggest bogeyman at the time. However, as we now know, the real threat is now the price of energy, which will naturally be needed in considerable quantities in such a demanding industrial production. Could it be that the armaments industry will suffer because it has to fulfil a contract and so sell weapons at a lower margin?

But the Colt CZ Group was already aware of the rising input prices at that time. So let's hope they can cope with the extreme growth.

Adding to the problems caused by the covid in the previous two years were rising electricity and gas prices as well as the cost of materials and transport. "We have implemented a number of changes and measures to minimise these multi-costs, amounting to tens of millions of crowns. We are increasing the efficiency and productivity of our work, we are investing heavily in new, more efficient technologies," Jan Zajíc, the head of Česká zbrojovka, told E15.

However, the news from the opposite barrel is the participation of the armaments company in the shortlist of the tender, in which they, together with the Italians and Norwegians, competed for the Swiss state-owned ammunition company RUAG Ammotec. Although they missed out on winning, it is certainly a testament to the company's quality.

If you are interested in the operation of the Uherský Brod part of the company, here is a nice video:

https://www.youtube.com/watch?v=ATQD6mCpcoQ

How is Colt CZ Group doing overall?

Let's go from the news to the overall overview. How did it do last year?

The company made a total of CZK 10.861 billion in 2021, which is a nice 55.99% growth compared to 2020. The company made a gross profit of CZK 4.289 billion last year . The gross profit as well as the revenue is also growing regularly. On the other hand, the gross margin is declining, which is due to the cost increases I mentioned above. Anyway, the margin is still close to 40%, which is not bad. The company has been profitable for a long time, generating over £760m last year, surpassing its best year to date in 2019.

The payout ratio over the past 12 months has been around 24%. This shows the company is retaining over three-quarters of the profits generated and is still able to pay a solid dividend. The dividend this year has been set at C25 per share.

Overall, Colt CZ Group is one of the most interesting choices on the Prague Stock Exchange. The arms industry was, is and (unfortunately) will be a lucrative sector that will probably always be needed. Moreover, Zbrojovka is not afraid to take aggressive steps for expansion, as it has shown with the acquisition of Colt.

https://www.youtube.com/watch?v=Mrld3aly5D8

If you enjoy my articles and posts, feel free to throw a follow. Thanks! 🔥

Disclaimer: This is in no way an investment recommendation. This is purely my summary and analysis based on data from the internet and a few other analyses. Investing in the financial markets is risky and everyone should invest based on their own decisions. I am just an amateur sharing my opinions.