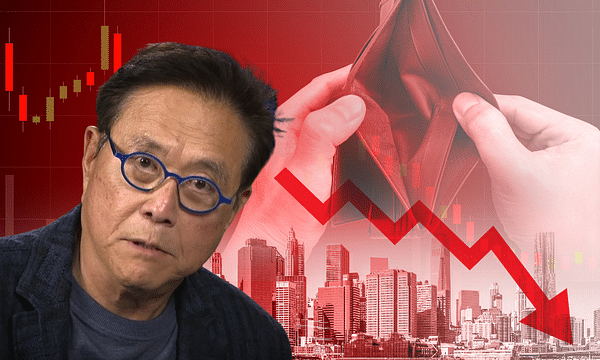

Now comes the biggest stock market crash of all time, that's Robert Kiyosaki's final warning

Robert Kiyosaki, author of Rich Dad, Poor Dad, has been making regular predictions about economic developments for the past few years. His predictions are usually very pessimistic. The latest one is no exception. Kiyosaki thinks the biggest stock market crash in human history is coming. What reasons does he give?

Please note that in the first half of the text I only give Robert Kiyosaki's view and his opinions.

According to Kiyosaki, the largest US pension fund, Giant CalPERS, will go bust. This means that firefighters, teachers, and civil servants in general will be without pensions. It won't just be a problem for them because pension money is invested everywhere. In buildings, in REITs, or maybe bonds.

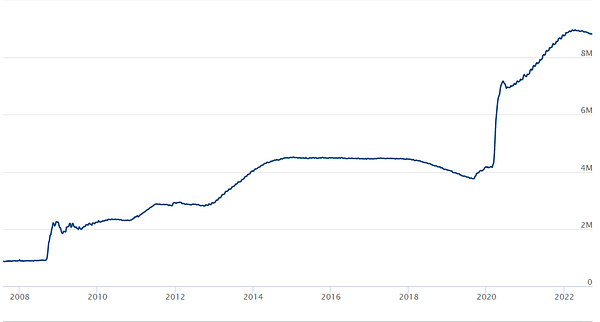

Kiyosaki fears the end of the American empire is coming. He blames the Fed, the Treasury, and the government for its demise. They have distorted the US dollar so much that they had to somehow keep people cool. They found the way in printing money, or rather in quantitative easing, which, although it ended last year, as we can see, the bubble has been inflating since 2008. We are reminded that money is the result of some work, of production. Therefore, if we are not paying people to work, we are only paying them to avoid revolution, coups. That, after all, was one of the causes of the end of the Roman Empire. That's why Kiyosaki thinks the end of the US as a world power is coming. Because money is corrupt.

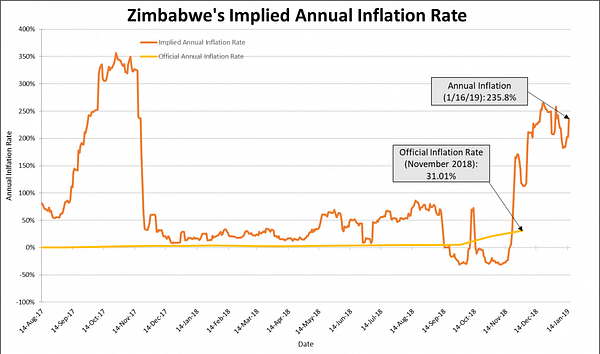

What's going on with the Fed? The Fed supposedly has no power, it is just a shadow of the European shadow banking system, which has more power. The Fed is trying to tell us that we have inflation, but in reality we have a depression. That is why Kiyosaki is buying gold, silver and Bitcoin. He doesn't trust the Fed, the Treasury, or Wall Street, so he buys assets outside their system. The US is headed for the same fate as Zimbabwe, which is mired in hyperinflation.

The Fed is trying to push the yield curve with interest rates. But we should really be interested in the Eurodollar curve. Every time it reverses, there is a tragedy afterwards. So, if the curve is ever reversed again, the biggest collapse will follow. When does the yield curve actually invert? Unusually, the yield on a long-term bond falls below the yield on a short-term bond of the same credit quality. This is a huge problem for the stock market in particular.

Robert Kiyosaki's thoughts are expanded on in this video:

https://www.youtube.com/watch?v=ackxvlsq2_w&ab_channel=FREENVESTING

Summary

I would now comment on the views of the author of Rich Dad, Poor Dad.

Kiyosaki is known for liking and often predicting various pessimistic scenarios. It would seem that he scares people. He has spared no expense with his predictions about the fall of the dollar, economic crises, and of course the stock market crash over the past few years. And I think he's now the closest he's ever been to that, and indeed a bigger crisis is coming.

One of the many reasons for this is the rate hikes. The Fed recently raised rates to 3.25%, but it's not going to just stop, as they are set to go above 4.5% by next year. At the moment, therefore, rates are set at their highest level since the financial crisis in 2008. And as we know, rate rises are not particularly palatable to equities, while bond yields rise as a result.

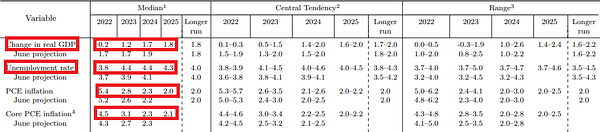

The Fed itself is taming the economic outlook. According to its projections, the US economy is expected to grow by only 0.2% by GDP for this year. This is a significant drop from the projected 1.7% growth presented in June. For next year, growth is expected to be 1.2%, compared with 1.7% initially. Similarly, unemployment is expected to rise, with a total of 3.8%, compared with 3.7% initially. Next year, it should reach 4.4%, compared with the previously projected 3.9%. The outlook for inflation has also deteriorated. Of course, these are forecasts. They could well be worse in reality.

The forecasts mentioned are for the US economy only. As we know, Europe has even more problems. Especially when it comes to energy, because the US does not have to deal with any problems in the form of extreme energy prices. The war in Ukraine, which is not a very big problem for the US, is linked to this.

Personally, I can only predict the stock market, I am no economist. I wouldn't see it as tragic as Kiyosaki. In my opinion, we are realistically past some of the downturns. The S&P 500 $^GSPC-0.3% is already down 23% since the beginning of the year, that's not a small drop. Quite easily the market could fall another 10%. I can imagine a drop of even another 20%, so it would be a 43.36% washout from the yearly high all together. That's really a lot, on the other hand historically these declines have happened before. Moreover, the last 10+ years have been extremely profitable. No tree grows to the sky.