Closed-end funds (CEF): the easiest way to build passive income

Building passive income is not a simple matter. It takes a lot of effort, patience. Most of all, it is a long run and few people really achieve it. So why not make it easier for yourself? It is not uncommon for closed-end funds (CEFs) to have dividend yields of over 20%. Sounds good, doesn't it? Let's take a closer look at this type of fund and see what it's all about.

What is a CEF?

CEF stands for closed-end fund. As an equivalent in English, we could find, for example, a closed-end fund. It is a type of mutual fund that raises its initial capital through an IPO. The number of its shares it offers on the stock exchange is by definition fixed and cannot change over time. The fund cannot raise additional capital by issuing new shares and the like, nor can it make redemptions.

As well as closed-end funds, there are also open-end funds. Other mutual funds and the well-known ETFs fall into this category. These funds can continually receive new capital through the issue of new shares or just undertake redemptions.

The preceding paragraph relates to a possible disadvantage of CEFs. ETFs can continuously redeem or create shares if necessary, if the amount of assets under management (AUM), i.e. the total market value of the investments managed by the fund on behalf of the investor, decreases or increases. However, CEFs do not have this option. Thus, CEFs trade slightly more or less expensive than their net asset value (NAV). The NAV is calculated as follows: (asset value minus liabilities)/ divided by the number of shares outstanding.

What is the reason for the high dividends?

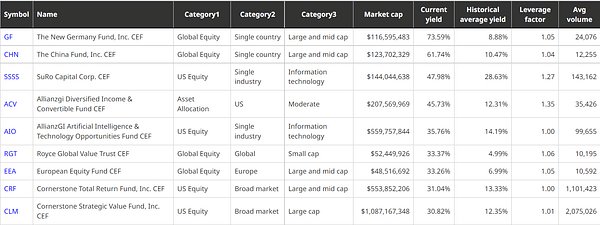

Looking at the screen below, we can notice the extremely high dividend yields. If we look at the current yield, in the top 100 in terms of this metric, these funds have an average dividend yield of 16.56%. We can only dream of similarly high numbers for traditional dividend stocks. I don't know about you, but this gave me pause. Because if I get a total of $5 per year from a $100 stock (at a pretty solid 5% yield for a dividend stock) versus $20 (at a pretty ordinary 20% yield for a CEF), that's a hell of a difference. So how can closed-end funds afford it?

First, we should clarify the terminology. If you want to delve more into CEFs, look for the word distribution instead of dividend. A distribution is the payout you receive if you hold an ETF, or just our CEFs. A dividend is a payout if you hold shares of a company.

Generally CEFs pay out more money because they find funds from sources other than net income. Examples of other sources are return on equity, or capital gains. With these, the fund can offset what it distributes to investors.

Afrequently used method of increasing returns is leverage. This is done by borrowing debt or issuing preference shares. Personally, however, I would be more wary of funds that use leverage as their riskiness increases. Leverage tends to reduce performance during recessions. Along with that, net asset value would decline, just because of the added investment provided by the debt.

Other ways are options, or more exotic strategies in the form of more complex investments. CEF managers don't have to worry about investor redemptions, so they can safely invest in less liquid investments. An example is some of BlackRock's funds that focus on private investments.

Tips on CEFs

In this section, I'd like to give you two tips on CEFs. I was pointed to them and the topic of CEFs by @standasocha, who is interested in investing in these funds. I would like to thank him for the inspiration.

Cornerstone Strategic Value Fund$CLM

The fund's top 10 positions look like this: 1. Fidelity® Inv MM Fds Government I (20.22%), 2. Apple (5.3%), 3. Microsoft (5.1%), 4. Alphabet (3.9%), 5. Amazon (3%), 6. UnitedHealth Group (2.4%), 7. Tesla (2.3%), 8. Berkshire Hathaway (2.2%), 9. Visa (1.4%), 10. Pfizer (1.4%).

The fund was established in 1987. It has a market capitalization of $1.087 billion, making it the 10th largest CEF in terms of market capitalization. It currently trades at $8.14, as the share price has fallen more than 35% in the past year. Currently, the fund pays out $0.181 per share per month, giving a dividend yield of nearly 26%.

Cornerstone Total Return Fund $CRF+0.1%

The fund's top 10 positions look like this: 1. Fidelity® Inv MM Fds Government I (12.6%), 2. Apple (4.2%), 3. Amazon (3.9%), 4. Alphabet (3.8%), 5. Microsoft (3.4%), 6. UnitedHealth Group (2.8%), 7. Berkshire Hathaway (2.1%), 8. NVIDIA (1.7%), 9. JPMorgan Chase (1.4%), 10. Costco (1.4%).

CRF is even older than CLM. Founded in 1973, it is a similar fund with slightly different positions. It now trades at $7.86, as the price has fallen nearly 22% in the past year. The fund pays a monthly distribution of $0.1734, which works out to a dividend yield of more than 26%.

Summary

As with any investment, it's important to do a thorough analysis first before making a potential investment. As always, we can find an example of closed-end funds that do this well and an investment in them turns out to be a good one. Equally, we will also find funds in poor condition.

I was particularly interested in the subject of closed-end funds because I was previously unaware of them. But, like, not at all. From the side of Czech investors these funds are absolutely neglected, which I find a pity. It could be another interesting way to invest.

If you ever want to eventually invest in them, you can find them at Interactive Brokers or LYNX. You won't find CEFs at the usual traditional brokers operating here, so keep that in mind then.

Do not take this article as an investment recommendation. A thorough analysis should always be done before investing.