Don't expect improvement all of 2023, warns one of Wall Street's most important companies with strong arguments

The market is like a roller coaster this year. Huge drops alternate with sharp upward movements. Personalities and companies are racing to make positive and negative predictions. Often unfounded. That's not the case with the latest prediction from the Wall Street financial giant.

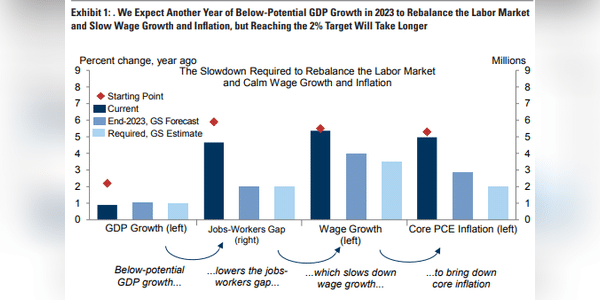

If you are on the positive side of the barricade and believe that the market will soon turn for the better, then you probably won't like Goldman's report. Especially if you believe that the Fed and rate cuts will be the catalyst for thoto turnaround.

"We doubt that the inflation path we project for next year would be sufficient to provide such confidence in a rate cut,"Goldman's chief economist Jan Hatzius wrote in a note.

The Fed surprised in two ways on Wednesday after raising interest rates by 50 basis points, taking the benchmark rate to its highest level since 2007.

The Fed's economic…

NICE POST THANKS!

https://communityin.oppo.com/thread/1257017037646725120https://communityin.oppo.com/thread/1257019883783716870https://communityin.oppo.com/thread/1257019890276499461https://communityin.oppo.com/thread/1257019896350113793https://communityin.oppo.com/thread/1257019901584605185https://communityin.oppo.com/thread/1257027661189349382https://communityin.oppo.com/thread/1257028217236881415https://communityin.oppo.com/thread/1257029618385813506https://communityin.oppo.com/user/1257016204397903876

https://communityin.oppo.com/thread/1257024250809155591https://communityin.oppo.com/thread/1257024355155050505https://communityin.oppo.com/thread/1257024863395905541https://communityin.oppo.com/thread/1257025179948417025https://communityin.oppo.com/thread/1257025538007760900https://communityin.oppo.com/thread/1257029650715508742https://communityin.oppo.com/thread/1257029703454949378

https://bulios.com/status/83355-avatar-2-the-way-of-water-2023-fullmovie-online-streaming-for-free-at-homehttps://bulios.com/status/83356-avatar-2-the-way-of-water-2022-yts-torrent-download-yify-movieshttps://bulios.com/status/83357-avatar-2-the-way-of-water-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83358-watch-avatar-2-the-way-of-water-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83354-download-avatar-2-the-way-of-water-2022-full-movie-download-free-720p-480p-and-1080p

https://bulios.com/status/83359-watch-m3gan-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83360-m3gan-2022-yts-torrent-download-yify-moviehttps://bulios.com/status/83361-m3gan-2023-fullmovie-online-streaming-for-free-at-homehttps://bulios.com/status/83362-m3gan-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83363-download-m3gan-2022-full-movie-download-free-720p-480p-and-1080p

https://bulios.com/status/83364-the-legend-of-maula-jatt-2022-yts-torrent-download-yify-moviehttps://bulios.com/status/83365-watch-the-legend-of-maula-jatt-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83366-the-legend-of-maula-jatt-2023-fullmovie-online-streaming-for-free-at-homehttps://bulios.com/status/83367-the-legend-of-maula-jatt-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83368-official-watch-the-legend-of-maula-jatt-full-movies-online-for-free

https://bulios.com/status/83369-babylon-2022-yts-torrent-download-yify-moviehttps://bulios.com/status/83370-watch-babylon-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83371-babylon-2023-fullmovie-online-streaming-for-free-at-homehttps://bulios.com/status/83372-babylon-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83373-download-babylon-2022-full-movie-torrent-download-free-720p-480p-and-1080p

https://bulios.com/status/83374-download-pathaan-2022-full-movie-torrent-download-free-720p-480p-and-1080phttps://bulios.com/status/83375-pathaan-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83376-pathaan-2022-yts-torrent-download-yify-movieshttps://bulios.com/status/83377-pathaan-2023-fullmovie-online-streaming-for-free-at-homehttps://bulios.com/status/83378-watch-pathaan-2022-fullmovie-free-online-on-123movies

https://events.ydr.com/event/582f22dd5cde86196591ccd7379b3f2ahttps://events.ydr.com/event/573341f4113336a527af765f08463ebehttps://events.ydr.com/event/356d50ea9c09dff5d88c6c6fdefa586chttps://events.ydr.com/event/c066c2529f223ea4cff6f63314f78ee5https://events.ydr.com/event/0865b749a930290be16a9ff1cf85c69bhttps://events.ydr.com/event/f31348ee5633c663265b8816351a5489https://events.ydr.com/event/69b5a43617fb3a889827b440a4d047bbhttps://events.ydr.com/event/72d1ef690f0d0b66a35aa7b45774367chttps://events.ydr.com/event/5977affb36183b91f68bfb51b84b81dchttps://events.ydr.com/event/52ebad4abd13a616d6f06ea30324bf6b

https://communityin.oppo.com/thread/1257102198744809477https://communityin.oppo.com/thread/1257103344284467203https://communityin.oppo.com/thread/1257103372436635653https://communityin.oppo.com/thread/1257103395740188676https://communityin.oppo.com/thread/1257103417709953026

https://communityin.oppo.com/thread/1257033504483966982https://communityin.oppo.com/thread/1257033538994700292https://communityin.oppo.com/thread/1257033611170545669https://communityin.oppo.com/thread/1257033634935472129https://communityin.oppo.com/thread/1257033653390409734

iklop

like your posh

Start posting, ask questions, discuss. Quality posts will be displayed on the main page!

have a nuce dreams

wow, amazing

"We doubt that the inflation path we project for next year would be sufficient to provide such confidence in a rate cut,"Goldman's chief economist Jan Hatzius wrote in a note.

Is forex hard?

Stocks closed lower Tuesday, giving up earlier gains, as concerns such as rising rates and high inflation that knocked the market down last year continued to trouble investors in the new year.