If you are building passive income, these two stocks can help you a lot. But are they worth buying?

Nowadays, more and more investors like dividend stocks. They have proven to be an effective defence in times of crises and recessions. Since the outlook of analysts, portfolio managers, and various other personalities from the investment world is not exactly rosy, today we will present 2 stocks THAT will give you a dividend yield of more than 7%.

There are a lot of interesting companies on the stock market these days, but since I like dividends, today we're going to take a look at 2 dividend companies that some Wall Street analysts agree are good choices for investors. Is that really the case?

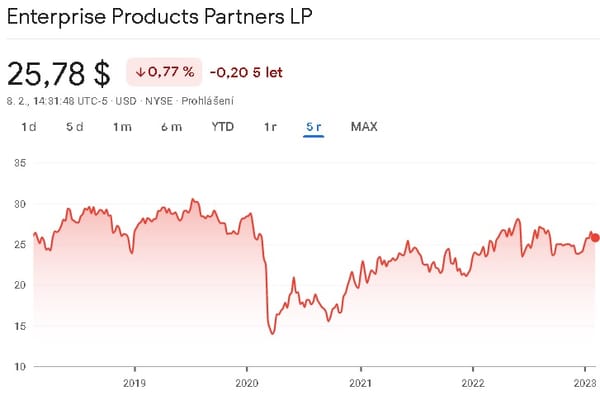

Enterprise Products Partners $EPD

Here is an energy company that operates a wide network of various pipelines to transport oil and natural gas, or those transporting other refined products. Its network provides connectivity between wells and customers.

In addition to pipeline transportation, the company also operates overland transportation in the form of tankers, ships and railways. The company also owns a network of refineries and various processing plants. The majority of this network, is spread out onshore in Texas. But what is important to us dividend investors is that this company currently offers a dividend yield of over 7%.

When we look at the company's numbers, we can see right off the bat that revenues have been declining for the past 5 years, averaging about 29% per year. The year 2021 was a relatively successful one for the company as it saw its revenue increase for the first time in 5 years. Net income then has been more or less stagnant over the last 5 years, hovering between roughly $4 billion and $5 billion.

But what about 2022? The company managed to generate approximately USD 58 billion in revenue, which is a year-on-year increase of around 40%. As for net profit, the company generated a net profit of around USD 5.5 billion in 2022, which is a year-on-year increase of just under 19%. In short, the company benefited mainly from high energy prices in 2022. Therefore, 2022 was a successful year for the company.

In the short term, the company's balance sheet looks very stable. From a long-term perspective, the balance sheet is not God knows how amazing, but it is still a fairly stable balance sheet in my opinion. When I calculated the value of assets net of liabilities, I came up with a net asset value per share here of about $12.

If we look at the cash flow statement, we see that the company had slightly declining operating cash flow through 2021. In 2021 and 2022, the company has seen a rapid increase in free cash flow from about $6.5 billion to about $8.5 billion in 2021. The company has been able to keep capital expenditures more or less flat over the last 5 years. In terms of free cash flow, it has been growing over the past 5 years, averaging about 45% per year. More or less, however, one has to be wary as the company has had various accidents over the last few years in the form of fires or, for example, explosions while repairing its oil and gas pipelines. These things can translate into capital expenditure in the event of a major accident, and you have to take into account the fact that most of the time, at the very least, someone will get hurt or, God forbid, die in these accidents. This may cost the company additional compensation expenses.

As for the dividend, it is not regularly covered by free cash flow. The first time the company had a decent payout ratio was in 2021, when the payout ratio from free cash flow was about 50%. In the years before that, the company had not had any of its dividend payments covered by free cash flow.

And what does an analyst from TD Securities have to say about this company?

We believe EPD units offer a combination of value growth and distribution with a moderate risk profile, given the company's well-positioned integrated asset base, connectivity and scale. , authority and expertise. Our work includes expectations of some valuation expansion as investors recognize the long-term growth opportunities that EPD presents with its hydrocarbon-related exports to growth markets, transition to a low-carbon energy future, and expansion of its value chain to include opportunities in midstream petrochemicals.

Along with this comment, he also rates $EPD stock as a Buy with a price target of $31. This view is also shared by 11 other Wall Street analysts who rate the company as both undervalued and a great buying opportunity.

For me personally, I don't like this company at all. I can only imagine the potential for higher profitability through higher energy prices, and then maybe through some potential expansion. The other thing I personally don't like here is the dividend cover from free cash flow, where the company doesn't have its dividends very convincingly covered by free cash flow. The last thing I see as a big problem for us Europeans here is that it is a Limited Partnership. So if you want to buy shares then you have to factor in the higher taxes that apply to this type of company.

Coterra Energy $CTRA

Here is a hydrocarbon exploration company organized in Delaware and headquartered in Houston, Texas. The company operates in the Permian Basin, Marcellus Shale and Anadarko Basin. As we can see here, the company also has operations in Texas, but now it is inland, specifically in the Permian Basin, which is considered to be the most attractive area in the US.

The company currently owns more than 600,000 acres of land, with only 234,000 acres covering the highly lucrative Permian Basin. This represents approximately one-third of the total acreage owned by the company. The remaining two-thirds is spread between the remaining 2 areas. In most cases, these areas are dominated by the production of liquids such as oil. The Marcellus Shale is the only area where pure natural gas is produced. This company is also unique in that it currently offers a dividend yield of over 10%.

By 2020, the company's revenues are more or less flat between $1.5 billion and $2.5 billion, and then 2021 brings high annual revenue growth of roughly 160%. So if we calculate the average revenue growth over the last 5 years, we are somewhere around 22% per year. In terms of net profit, it has grown by an average of around 200% a year over the last 5 years. This is also due to the high growth in 2021, when net profit grew by around 477% compared to 2020.

And how did the company fare this year? The company reported sales of about $9.22 billion, up about 150% year-over-year from 2021. As for net income, the company reported $3.98 billion, up nearly 250% year-over-year from 2021. As you can see from the results, 2022 was a very successful year for the company.

From a short-term perspective, the company has a relatively well-covered balance sheet, where it is able to cover its short-term liabilities with short-term assets. From a long-term perspective, the company is also very well off financially, as long-term debt represents roughly half of the company's assets. In terms of the value of assets net of liabilities, I'm looking at about $23 to $24 per share. That means that the company is trading at about the value of its net assets at today's prices.

The company's operating cash flow has grown at an average rate of about 17% per year over the past 5 years. Here, I also observe some financial stability in capital spending over the last 5 years, which of course also reflects positively on free cash flow, which has grown by an average of about 121% over the last 5 years. Of course, this is also partly influenced by 2021, where the company again had higher free cash flow growth than usual. The company is also well covered by its dividend payout from free cashflow. This dividend payout has been increasing every year. On average, the company pays out about $123 million in dividends. THE COMPANY HAS A DIVIDEND PAYOUT RATIO OF USD 123 MILLION. But in 2021, the company paid out a record amount in dividends, specifically $780 million. The company determines its dividends based on its results, and always tries to distribute as much value as possible from free cash flow to shareholders in the form of dividends. Hence, the dividend is expected to fluctuate as the company performs.

Below we have a comment from a Wall Street analyst.

Coterra has committed to a +50% return to shareholders, excluding share buybacks. Over the past two quarters, the company has returned 81% and 74% of FCF through cash dividends and share repurchases, respectively. During a recent meeting with the company, the CEO noted that he wants to differentiate the company in 2023, which we believe could be in the form of a healthy increase in the base dividend and increased share repurchases

Along with this comment, they rate CTRA as a stock to buy. And the price target is somewhere around $38 per share, according to him.

The company looks good to me at first glance, even currently trading at the value of its net assets, and has a relatively strong balance sheet. But we have to remember that we are still in the energy sector, where companies' results are quite dependent on energy prices, especially those companies that are directly involved in mining. So the only problem I see here is the dividend payout, where in the future a company may cut its dividend based on its results. Personally, I think the company is definitely worth a deeper look and analysis.

DISCLAIMER: I am not a financial advisor, and this material does not serve as a financial or investment recommendation. The content of this material is purely informational.

Sources:

https://www.marketwatch.com/investing/stock/ctra?mod=mw_quote_tab

https://www.marketwatch.com/investing/stock/epd?mod=search_symbol

https://finance.yahoo.com/news/seeking-least-7-dividend-yield-012839817.html