Energy giant Vestas is rolling up the competition. It has now gained market dominance.

The world is moving forward at a rapid pace. It is already clear that all countries are trying to produce energy from renewable sources. So if you are looking for a company in this sector to add to your portfolio, this energy giant could be a good choice for you.

The world is trying to switch to the cleanest possible energy from renewable sources such as the sun, water, and/or wind. And it's this last element that we're going to look at today. We're not going to look at any wind energy producers here, as the results of these companies can be weather dependent. In short, if the wind is not blowing, there is no energy production. So we are going to look at a company that can make quite a profit in this area.

Vestas $VWS

Vestas is the energy industry's global partner in sustainable energy solutions. It designs, manufactures, installs and services wind turbines around the world and with +164 GW of wind turbines in 87 countries, they have installed more wind power than anyone else. With industry-leading smart data capabilities and +144 GW of wind turbines in operation, the company uses data to interpret, predict and exploit wind resources to deliver best-in-class wind energy solutions.

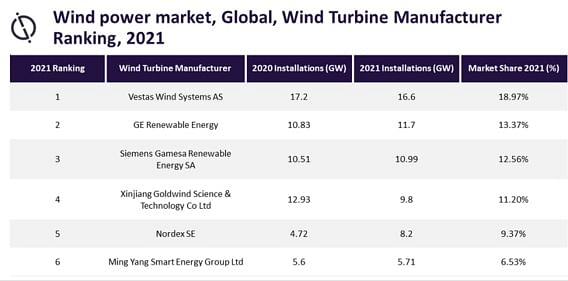

The company is currently a leader in its field, which provides the company with a definite competitive advantage, as it continues to demonstrate, having recently invested significant money in researching new types of wind turbines. These investments may help the company to maintain its competitive advantage in the future. In 2021, the company held approximately 19% market share, the highest of any company operating in this segment.

But the company is not quitting, and has decided to outrun the competition even more. In fact, the company has managed to develop a record-breaking wind turbine. The blade length is over 115 metres, the rotor diameter 236 metres. This giant can harness the power of the wind from an area of 43,000 square metres and generate 60 to 80 million kilowatt hours of electricity per year. This production is enough to cover the consumption of up to 20 000 households. Compared to today's wind turbines, this is a significant step forward. The company is moving away from the competition. It will now be able to offer its customers significant savings in purchase costs. Just to give you an idea, 20 of these turbines will produce the same amount of electricity as 30 current turbines.

This new turbine is currently in the testing phase where the company has produced 1 unit so far and is now testing it for mass production. These new turbines should be designed for use in wind farms that are predominantly offshore.

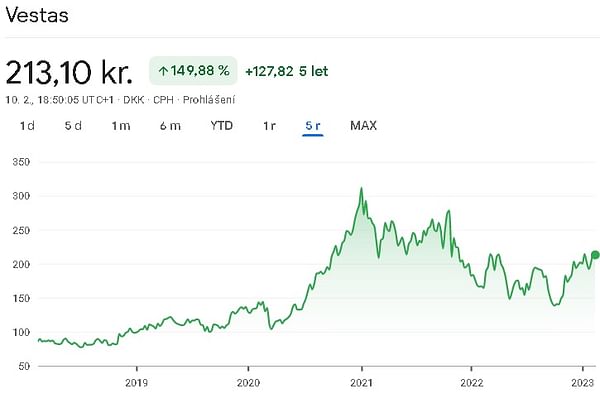

Let's take a quick look at the company's numbers. The company's revenue has grown at an average rate of about 9% per year for the past 5 years. In 2022, the company saw its first revenue decline in 5 years. Here, it was a year-over-year decline of about 7%. This decline was mainly due to high inflation and high interest rates, which partially dampened demand for new turbines. Another factor contributing to the fall in sales was the delay in the delivery of some turbines.

However, the development of new turbines is taking its toll. In fact, the company has spent considerable resources in the last year on the development of new types of turbines, and these costs have obviously had an impact on profits. In 2022, the company's gross margin fell rapidly from around 10% to 0.8%. In short, the company was affected by high input prices, which were rising due to inflation. For the previous 4 years, the company was able to maintain its gross margins between 10% and 15%. The average gross margin for these previous 4 years was roughly 13%. Net profit has been declining by roughly 20% per year since 2019. Quite a large part of the profit here is swallowed up by research costs for new turbines. In short, the company is trying to move forward as quickly as possible, and develop new and better turbines, so as not to lose its competitive advantage.

As far as any financial stability is concerned, this is a reasonably stable company. In the short term, the company has covered its short-term liabilities very well with its short-term assets. Looking at the long-term debt, it is clear at first glance that this is a relatively under-leveraged company. In the case of net asset value per share, I came up with EUR 3 per share.

In terms of cash flow, operating cash flow has been declining over the long term. This downward trend is mainly due to the company's declining net profit. In the case of free cash flow, we are experiencing the same scenario. In short, the company has faced quite a lot of pressure over the last couple of years. It started with the disruption to supply chains caused by the pandemic combined with the war in Ukraine, then high inflation, which drove up input prices, and finally high interest rates, which froze demand for loans to finance the purchase of these turbines.

The company's accounts show that sales coming from Asia were the hardest hit, with a year-on-year decline of around 22%. The Americas were the best performing region in 2022, where the company managed to increase its sales by around 6%. Europe remained in the middle of the table, with sales there falling by around 12%. The rapid decline in sales in Asia was most likely due to the drastic measures taken against Covid, with overall demand in China generally falling.

Amit Sharma, who is a senior analyst in the energy segment at Global Data is relatively confident about the company going forward.

Vestas is a leading wind turbine manufacturer with a strong product portfolio. Vestas is diversifying its geographic footprint in offshore wind with new installations around the world, as well as significant growth in Europe and new offshore wind markets.

The company's huge advantage is that it currently has a dominant position in the market, and it is likely to increase its dominance with the commissioning of a new turbine type. As for last year's results, which were disastrous, the main problem here is the pressure on input prices and demand. These pressures will, in my view, only be temporary until inflation can be brought under control and interest rates reduced, which should in turn kick-start the economy and, with it, increase demand for turbines.

On the other hand, I see a lot of potential in this sector, where it is already clear that the world is going to push globally for a switch to renewable energy. Along with this pressure, there will be more companies that will focus on renewable electricity generation, which also represent potential customers for the company. Personally, I think this company deserves a place on the investor watchlist, if only because it is a leader in wind turbine manufacturing.

WARNING: I am not a financial advisor, and this material does not serve as a financial or investment recommendation. The content of this material is purely informational.

Sources: