Billionaire Steve Cohen finds these 2 stocks to be a good investment opportunity. Is it really?

Nowadays, it's good to take inspiration from experienced investors. You can get a different perspective on investing. So today, let's take a look at 2 stocks that billionaire Steve Cohen trusts, and whether they are a good choice for me personally.

Billionaire Steve Cohen, founder of Point72 Asset Management, is considered one of the most successful hedge fund managers of all time. With an estimated net worth of $16 billion, Cohen is known for his savvy investment picks and ability to generate substantial returns for his investors. Recently, Cohen has focused on two biotech stocks: Marinus Pharmaceuticals, Inc. and Day One Biopharmaceuticals. In this article, we'll take a closer look at these companies and explore why Cohen is bullish on them.

Marinus Pharmaceuticals, Inc. $MRNS

Marinus Pharmaceuticals, Inc. $MRNS is a biopharmaceutical company focused on developing and commercializing innovative drugs for the treatment of neurological disorders. The Company's lead product candidate is ganaxolone, a synthetic analog of allopregnanolone, a neurosteroid that acts on GABA-A receptors in the brain.

The lead drug, ganaxolone, is currently approved under the trade name Ztalmy as an oral suspension for the treatment of seizures caused by CDKL5 deficiency disorder. It received FDA approval last March, and last month the company released preliminary Q4 22 data on its continued commercialization. The company is also working to develop and test other drugs, with the most advanced study now specifically being a drug called RAISE (it is also a study of ganaxalon). It is studying the drug as an intravenous solution for the treatment of status epilepticus or uncontrolled seizures. The company expects the first results to be ready for publication in H2 2023. Also in H2 2023, the company expects to initiate registration for the phase 3 trial of RAISE in Europe. The market for treatments for these complications is very complex and complicated, so the company has a relatively high chance of success here. On the other hand, due to the complexity of this field, there is also a higher probability of failure.

Advantages:

- The company has a promising drug candidate in ganaxolone, which has shown potential in the treatment of several neurological disorders, including epilepsy, postpartum depression and Fragile X syndrome.

- The company has several ongoing clinical trials, including a Phase 3 study of ganaxolone for the treatment of CDKL5 deficiency disorder, which could potentially lead to regulatory approval and commercialization of the drug.

- Marinus Pharmaceuticals has partnerships with several pharmaceutical companies, which could help fund development and commercialization.

Disadvantages:

- Marinus Pharmaceuticals is a relatively small company and may face challenges in raising sufficient funds to support clinical development and commercialization efforts.

- The company faces competition from larger pharmaceutical companies and other biotechnology companies developing drugs for similar indications.

- There can be no assurance that ganaxolone or any of the Company's other drug candidates will receive regulatory approval or achieve commercial success.

- The market for neurological disorders is highly complex and fragmented, and the success of the Company's drug candidates will depend on a number of factors, including clinical efficacy, safety and pricing.

Over the past 12 months, the company has managed to generate approximately $19.84 billion in revenue, representing a year-over-year increase of approximately 29%. The company was also able to reduce its net loss from $98 million to $4.5 billion due to revenue growth. USD 98 million in 2021 to approximately USD 13 million in 2021. The approval and commercialization of the company's first drug is slowly starting to bear fruit. However, the company is still losing money at the moment, mainly due to the rising costs of research and testing new drugs.

For these small companies, the balance sheet usually looks good, and this is no exception. The company has enough current assets to pay all its liabilities. If the company had already managed to stabilise its R&D costs, the cash in the current account would last for about 2 years to fund this R&D. Since the company already has one drug approved for sale, this cash will last much longer.

Steve Cohen clearly believes the company is heading in the right direction. His firm bought 3,515,000 shares of the company in Q4, a stake that is worth more than $24 million at current prices, giving Cohen a 7.36% ownership stake in the company.

But Cohen is not alone in his confidence in the company. Seven other analysts have looked at this company recently, and they agree on an average price target of around $22 per share.

For me personally, the company looks pretty interesting, but this is still a pretty big bet on the future here. The big plus for the company is that it already has one drug approved for sale, and another should start phase 3 clinical trials later this year. So the company is not completely reliant on outside funding, but can already partially fund research and trials from its own revenues. However, we still have to take into account that the company is still practically at the stage where it does not have a solid market position and is still not profitable, in short, everything the company earns it will spend on further investments in itself.

So, if I were currently considering an investment, this stock would go into the part of the portfolio where there are risk stocks, which at the current moment it gives roughly 5% of the portfolio at most.

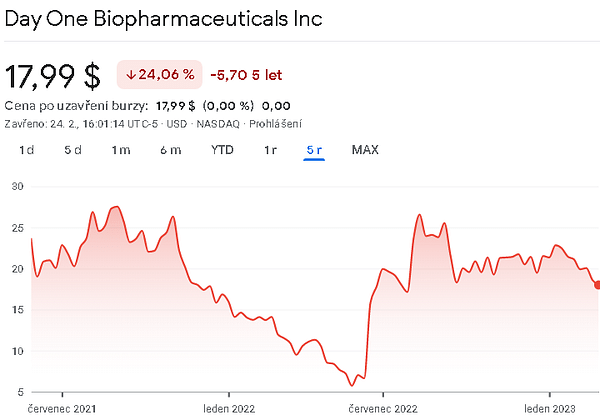

Day One Biopharmaceuticals $DAWN

Day One Biopharmaceuticals $DAWN is a clinical-stage biotechnology company focused on developing targeted therapies for patients with genetically defined cancers. The company's lead product candidate is DAY101, which is a small molecule inhibitor of fibroblast growth factor receptor (FGFR) 3. In addition to its lead product candidate D1M-001, the company is also developing other small molecule inhibitors of PRC2 as well as inhibitors of other epigenetic targets. The Company believes its approach to developing targeted therapies for genetically defined cancers has the potential to revolutionize cancer treatment.

Day One Biopharmaceuticals' technology platform is based on the Company's knowledge of the genetic drivers of cancer. The company uses a combination of genomic analysis, bioinformatics and drug discovery to identify and develop targeted therapies for genetically defined cancers.

Benefits:

- Strong portfolio: Day One Biopharmaceuticals has a strong pipeline of product candidates in various stages of development, providing the company with many opportunities for future growth.

- Targeted therapies: the company is focused on developing targeted therapies for patients with genetically defined cancers that could result in better outcomes and fewer side effects compared to traditional chemotherapy.

- Promising clinical results:DAY101 has demonstrated promising results in early stage clinical trials, indicating that the Company's technology platform is effective in identifying and developing targeted therapies.

- Strategic partnership: Day One Biopharmaceuticals has a strategic partnership with Roche, which could provide the company with additional resources and expertise to advance its product candidates.

Disadvantages:

- Early-Stage: Day One Biopharmaceuticals is a clinical-stage biotech company, which means its product candidates are still in the early stages of development and may not ultimately succeed in clinical trials.

- Competition: The company operates in a highly competitive industry with many large pharmaceutical companies and biotechnology firms that are also developing targeted therapies for genetically defined cancers.

- Regulatory Risk: The regulatory approval process for new drugs can be lengthy and costly, and there is always a risk that a product candidate may not receive regulatory approval or may face unexpected regulatory hurdles.

- Financial Risks: As a clinical stage company, Day One Biopharmaceuticals may need to raise additional capital to fund its operations and product development programs, which could lead to dilution to existing shareholders.

The fact that this is a clinical stage company is consistent with the Company's results. Indeed, the company has no product to offer. All potential candidates are currently in the development phase. Therefore, the company has no way to generate revenue. Therefore, at the moment, the company is showing only a net loss. In the last 12 months, research costs amounted to about 72 million euros. The company has to rely on partnerships with other companies.

In 2021, the company had approximately $284 million in cash on hand. USD 284 MILLION. This amount would provide the company with approximately 3 years of research funding. In terms of total liabilities, these are negligible, amounting to only EUR 8 million. USD 8 MILLION.

Analysts are quite optimistic about the clinical trials of the company's main product, as the company is already entering the late stage of clinical trials.

With the significant clinical risk reduction offered by FIREFLY-1's top-line data, the focus is now likely to shift towards better understanding the commercial opportunity of pLGG. .... We believe that the efficacy and safety profile of tovorafenib warrants a best-in-class targeted agent for a pediatric oncology indication for rare diseases. Our model assumes pricing on par with other precision oncology agents and WAC pricing of ~$33,000 per month. Overall, we estimate that pLGG will be worth more than $500 million by 2027.

Not left behind is Steve Cohen, who clearly believes this biopharma is worth the inherent risk of the sector, as his recent filings show Point72 acquired 461,631 shares when he opened his new position in $DAWN in Q4. Those shares are now worth nearly $9 million.

This company was recently looked at by 10 other analysts who agreed on an average price target of $44 per share.

Personally, I am quite skeptical of this company. In fact, it does not yet have any means by which it could generate any revenues that could at least partially cover the funding of its research. At the moment, this is music of the distant future, which will swallow some dollars before it is profitable. Personally, I wouldn't invest even 1% of my portfolio in this company. In short, it's not exactly the type of company I'd want in my portfolio.

WARNING: I am not a financial advisor, and this material does not serve as a financial or investment recommendation. The content of this material is purely informational.