Jabil: A promising company with big plans for the future

According to statistics from recent years, Jabil is one of the world's largest manufacturers of electronic components, with sales exceeding tens of billions of dollars annually. The company has been predatorily increasing its net profits and is also planning one exciting new business development.

Jabil $JBL+0.1% is an American company that manufactures electronic components, equipment and products for various industries. Their services include design, manufacturing, testing, distribution and supply management for a wide range of products including mobile devices, consumer electronics, automotive components, medical devices, industrial machinery and more.

Jabil is also known as a service provider for contract manufacturing of electronic components, which means it manufactures electronic products for other companies according to their requirements and specifications. The company is headquartered in St. Petersburg, Florida and has offices around the world.

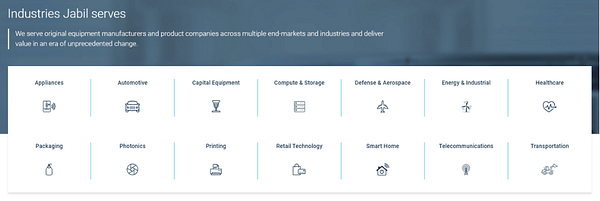

Jabil reaches into these industries and sells its products to them 👇

Jabil has several competitive advantages that allow it to succeed in the electronic manufacturing and services market:

Global reach: Jabil has offices in many countries and has experience working in different cultures and with different industries. This allows it to provide services and solutions tailored to local needs and conditions.

Flexibility.

Innovation: Jabil has experience in innovation and design of new products and processes in the electronics industry. The company invests in research and development and works with many customers to create innovative new solutions.

Quality. The company has high quality standards and works to minimize production and delivery risks.

Technological infrastructure: Jabil has modern technological infrastructure and equipment, which enables it to produce products with high precision and quality.

A wide range of services: Jabil offers a wide range of electronic manufacturing and supply services, including design, manufacturing, testing, supply management and logistics. This enables customers to get a complete solution and reduce supply chain management costs.

According to company disclosures, Jabil operates in more than 30 countries worldwide and has more than 100 manufacturing plants and development centers. The company employs more than 260,000 people.

Jabil is one of the largest providers of contract manufacturing services for electronic components and products. According to 2021 statistics, Jabil was one of the largest electronic component manufacturers in the world with annual sales exceeding $22 billion. Jabil has a strong presence in industries such as consumer electronics, automotive, medical technology, industrial equipment and others.

Since Jabil provides contract manufacturing services to many companies, its products can appear in a variety of products under different brand names. Many large technology companies use Jabil's services to manufacture their products, including Apple, Cisco, HP, IBM, Microsoft, Nokia, Sony, and many others.

Risks

Competition: Jabil operates in a competitive environment where there are many other companies that provide similar services. Improving competitiveness and production efficiency can be costly and uncertain.

Dependence on large customers: Jabil has large customers that account for a significant portion of its revenues. If one of these customers were to leave or reduce its order volume, it could have a significant impact on Jabil's performance.

Increase in raw material and material costs: The cost of raw materials and supplies, particularly in the electronic components business, can be volatile and unpredictable. Increases in prices may affect the Company's profitability.

Fluctuations in Market Demand: Market demand for Jabil's products and services may be affected by changing trends and economic conditions. A decline in demand may have a significant impact on the Company's performance.

Change in the political environment: Jabil operates in more than 30 countries worldwide and changes in the political environment may affect the Company's performance. For example, changes in trade agreements, regulation or currency exchange rates may affect the Company's performance.

Technology Risk: Rapid developments in technology may affect Jabil's products and services. The Company must regularly adapt to new technologies and improve its processes and services to remain competitive.

Finance

Revenue

- 2017: USD 19.063 billion

- 2018: USD 22.099 billion

- 2019: USD 25.282 billion

- 2020: USD 27.265 billion

- 2021: USD 29.302 billion

- 2022: USD 33.478 billion

Jabil's average annual revenue growth rate over this period was 11.9%.

Net profits

- 2017: USD 129 million

- 2018: USD 165 million

- 2019: USD 165 million

- 2020: USD 127 million

- 2021: USD 697 million

- 2022: USD 996 million

Jabil's average annual net income growth rate over this period was 50.4%

Assets x Liabilities

- 2017: assets USD 11.6 billion, liabilities USD 8.9 billion

- 2018: assets USD 13.4 billion, liabilities USD 10.4 billion

- 2019: assets USD 14.9 billion, liabilities USD 11.6 billion

- 2020: assets USD 15.9 billion, liabilities USD 12.4 billion

- 2021: assets USD 18.1 billion, liabilities USD 14.1 billion

- 2022: assets USD 20.1 billion, liabilities USD 15.8 billion

Long-term debt

- 2017: USD 2.12 billion

- 2018: USD 2.05 billion

- 2019: USD 2.16 billion

- 2020: USD 2.32 billion

- 2021: USD 2.88 billion

- 2022: USD 2.58 billion

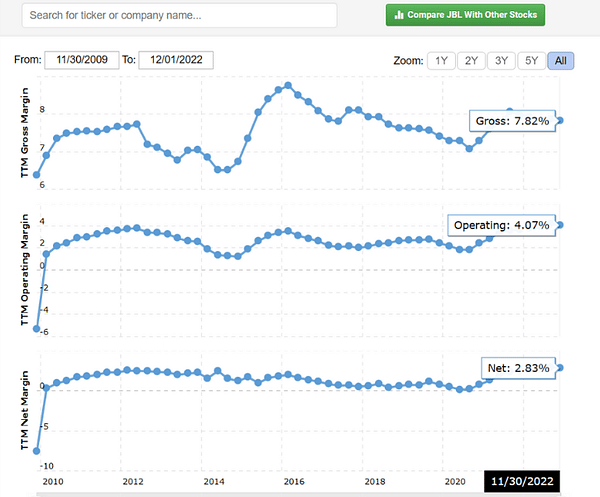

Margin view

Overall, Jabil has a solid financial performance that has been improving in recent years. The company has maintained profitability and increased its revenue and EBITDA. The company's revenue is growing at an average of 11.9% per year, indicating that the company is able to maintain steady growth and expand its business.

- The company's net earnings are growing faster than sales, with an average annual net earnings growth rate of 50.4%. This may be due to increased efficiency and cost cutting.

- The company's assets are growing and liabilities are stable, indicating a strong financial background and ability to finance its business.

- The company's long-term debt is relatively stable, with the exception of an increase in 2021. This may indicate that the company is borrowing to finance investments and business expansion.

Overall, Jabil is a healthy company with good financial ratios and the ability to sustain growth.

Why are sales monstrous but net profits and margins relatively low?

Here's a pretty simple answer - Monstrous costs, for example, in the most recent fiscal year ended August 31, 2022, cost of goods sold was $30.85 billion.

In terms of P/E and ROE, Jabil clearly has the edge over its competitors. However, taken as a whole, the fundamentals are worse than the competition. Although net profits are rising rapidly, there is still a prevalence of high input cost of goods sold, which definitely needs to improve in the long run.

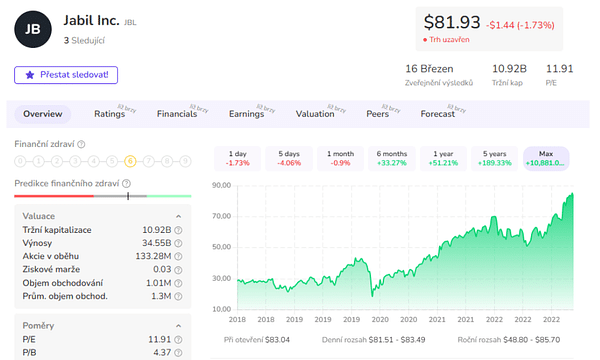

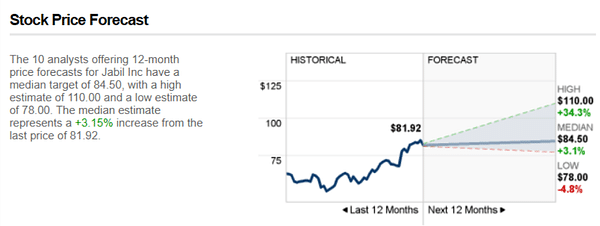

Analysts' forecasts

The 10 analysts offering 12-month price forecasts for Jabil Inc have a median target of 84.50, with a high estimate of 110.00 and a low estimate of 78.00. The median estimate represents a +3.15% increase from the last price of 81.92.

What does the company plan for the future?

The company's future plans include establishing Jabil Healthcare, which will be the largest global solutions provider to the healthcare industry, and focusing on emerging technologies such as additive manufacturing, autonomous technologies, and artificial intelligence.

Jabil Healthcare will provide design, engineering and manufacturing solutions for five key sectors in the healthcare market: medical devices, orthopedics, diagnostics, pharmaceutical delivery systems and consumer health.

Please note that this is not financial advice. Each investment must undergo a thorough analysis.