Petr Hotovec: Surprisingly, shareholders walk away from Credit Suisse takeover as winners

This time, I've reached out to Peter Hotovec, an analyst at SoftVision AI, who joins me today to discuss the latest topics surrounding banks in America and Europe. We look at the current problems, but also their possible solutions and what to prepare for in the future.

Petr Hotovec is Chief Operating Officer and Principal Analyst at SoftVision AI - a hedge fund for algorithmic trading powered by artificial intelligence.

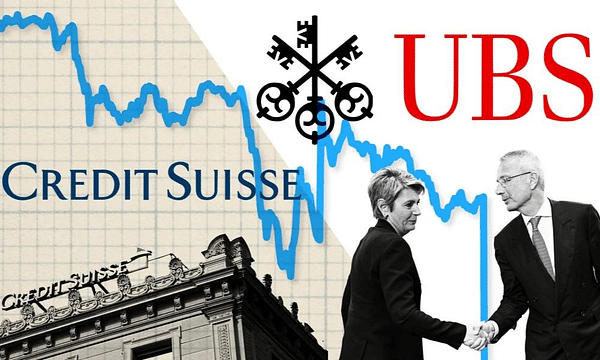

We'll start the conversation by looking at the UBS and Credit Suisse merger in Europe, where we'll also get his take on the AT1 bond issues, and then move on to the Americas, where there's a lot of coverage of First Republic Bank at the moment.

Europe

I would like to ask you how you view the takeover of Credit Suisse by UBS. Do you think it is a good move?

I think the takeover of Credit Suisse by UBS is the best solution that could have happened. The best thing about it is the speed with which it happened. Silicon Valley Bank collapsed on 10 March, which caused a shock in the banking sector. Credit Suisse was the first to take a hit, as it was already in huge trouble in the fourth quarter of 2022, when deposits went from 370 billion to 233, a drop of about 140 billion deposits. That is a huge number indeed. Their quarterly report was riddled with the word deposits and descriptions of the problems that this has caused.

At the same time, could it not be risky, given that the Swiss economy is now dependent on just one major financial services provider, which, incidentally, also does not have a 'clean' past and is mired in a series of scandals and problems?

The publicly known parameters of the transaction imply that the Swiss state will provide UBS with broad guarantees and will even guarantee the loan that the Swiss National Bank will provide to UBS. The Swiss obviously wanted to save their family silver, as the bank is not just about numbers and profitability, but also about long-term relationships built over time. Moreover, the collapse of Credit Suisse would fatally damage Switzerland's reputation as a stable haven for foreign capital. The parameters of the whole transaction reflect the fact that the Swiss are determined to hold on to their banking sector as long as possible. As for the past, UBS was bailed out during the 2008 financial crisis, unlike Credit Suisse, but this time the tables have turned.

On other scandals - I do not know of a bank that is completely clean. Banking is a bit obscure, but it is the most important business for the economy.

As you said, the takeover happened very quickly, and without any shareholder approval. Could this undermine investor confidence in the financial system in Europe?

I think that Credit Suisse shareholders will now obediently shuffle their feet. Given that they will receive about CHF 0.76 per Credit Suisse share and will even skip the AT1 contingent convertible bond holders, they will actually walk away from the transaction as winners.

Personally, I think the transaction eroded confidence in the contingent convertible bonds more than anything else, as there was an unprecedented write-down (writing down the price to zero instead of converting in equity), which sent shockwaves through the market for these investment instruments. On Monday, we saw some banks in the subprime bond markets drop as much as 20%.

Investor confidence in the financial system is certainly being eroded, as can be seen from the movements in the stock and bond markets. The most important thing - depositor confidence - is perhaps not being eroded.

Just yesterday, news reached us that some companies are racking up big losses at Credit Suisse on so-called AT1 bonds (probably the biggest we've seen so far at PIMCO). How is this even possible?

Yes, this is the news that has shaken the general investing public probably more than the Credit Suisse crash itself. Personally, I consider it a small "black swan". The Credit Suisse crash was predictable from the Q4 report. After the Silicon Valley Bank crash (especially after the deposit withdrawal rates were disclosed) it was basically a matter of time, which was priced in by the bankruptcy insurance (CDS) market last week.

How is it possible that shareholder payouts come before bondholders, isn't it the other way around?

The fact that the expected order of loss absorption would be disrupted and the creditor/shareholder position swapped was not expected, in my opinion. But again, looking at the contractual documentation, this is not entirely surprising. I hope to read a detailed analysis on this soon, ideally from a Swiss lawyer well versed in the workings of AT1 instruments and insolvency law. I believe that the reason why the shareholders "skipped" the AT1 bondholders is that the Credit Suisse resolution occurred strictly outside the plane of insolvency law and the write-down was tied to public assistance to prevent insolvency. Basically, I would say that Credit Suisse, UBS and the regulator will agree that the government assistance to prevent insolvency satisfied the contractual terms of the write-down without causing insolvency. Which, according to the contractual terms that I've got my hands on, triggers a write-down, i.e. a write-off of the entire investment.

That is, the classic hierarchy known from insolvency proceedings, that bondholders have priority over shareholders, applies. The whole situation and the subsequent volatility in the subprime bond market shows that bondholders quite often do not understand what instrument they have actually bought and are unsure of its valuation in relation to risk. The response on Twitter and in the media then suggests that most thought that AT1 bonds behave like bonds in marginal situations (unless they are converted to equity). The write-down in the case of public support was clearly not envisaged, even though the terms and conditions were literally riddled with it. After all, this was not the first time that large investors bought an asset whose parameters they did not understand. Let us recall the last financial crisis and the story of mortgage bonds...

Would it be fair to say that the situation in Europe is now calm and we have no reason to worry further?

Certainly not. Otherwise you would not be having this conversation with me. The situation is very tense, as the assurances of the regulators, the statements of the bank chiefs, the bond and stock markets show.

My fear now is that there will be a credit contraction and banks will hoard cash and liquid assets on their balance sheets. They will therefore reduce the number of loans they make, which will lead to an economic downturn. That is my main concern. Hopefully there will be no bank runs. We need to remain calm in this regard. Credit Suisse really was a bad apple.

USA

In America at the moment, pretty much everybody is mentioning First Republic Bank as another bank that is in trouble, despite the influx of $30 billion in deposits last week. So what is the problem here that the share price is fluctuating and everyone is worried about the future of this bank?

There are decades when nothing happens. And there are weeks when entire decades happen. In the world of finance, the second sentence is now true. To be honest, I haven't studied First Republic Bank at all and probably won't get around to it anytime soon - personally, I think the most important thing to watch is what happens at today's FOMC meeting. That will set the tone for the whole thing. Taking a cursory look at First Republic Bank's asset structure and the terms of the Fed's program to supply liquidity to banks suffering from unrealized losses on long-term debt securities resulting from rising rates, perhaps one reason is that the Fed has too many loans and not enough securities to stop. In short, the Fed's new program allows banks to use financial instruments that the Fed can hold as collateral and get a loan in return. That is, if you have a debt security with a principal of $100 that you could now sell for only $90, you use it as collateral and borrow $100 from the Fed. The problem with First Republic Bank is that they don't hold much debt securities that they can pledge in this way. So investors worry about the bank's ability to stem the outflow of deposits. But that's just my observation based on a very superficial analysis.

In the case of the other "problem banks", one could identify the problems quite accurately:

1. Silvergate - Speculation about exposure to the cryptocurrency exchange FTX and a bank run fueled by the regulator.

2. Silicon Valley Bank - Poor depositor structure, overexposure to funding-challenged startups, and deposit withdrawals, causing panic among investors over Assets for Sale and loss creation. Tech boys are panicking and starting a bank run. SVB's asset structure was the icing on the cake, the bank mainly held long-dated mortgage notes (10+ years) yielding about 1.5%, which is "worthless" in the era of 5% yield on the US 2-year note. A complete management failure.

3. Signature Bank - Got a ride with a regulator-induced bankrun. The situation around Signature Bank is really strange - it was dissolved and the entire structure was transferred to the FDIC-managed Signature Bank Bridge (the US equivalent of a guarantee system). It did not fail. It came as a bolt from the blue and surprised even the bank's management. The US supervisors' statement said only that systematic risk was avoided. Personally, I'll be happy to wait for a more in-depth justification, if one is forthcoming. Speculation is rife that this is simply a "regulatory crackdown on crypto" - a regulatory crackdown on crypto.

4. Credit Suisse - Rotten Apple. Just read their quarterly reports, especially the one from Q4 2022.

In the case of First Republic Bank, it's not that simple (at least not for me with a cursory glance at the bank's reports and results). The biggest problem with First Republic Bank is that we are dealing with its problems in the Czech Republic, a country of ten million people with a not very developed capital market and minimal exposure to this bank. What must be going through the minds of ordinary Americans? Or even First Republic Bank customers with deposits of more than $250,000, i.e. uninsured? Loss of trust is the biggest problem with the bank. The fractional reserve system makes any bank insolvent if all customers decide to withdraw at once. That's just the way it works.

I've read that the CEOs of JPMorgan and other banks are discussing further assistance to First Republic Bank. But does it make sense to keep bailing them out like this? After all, at the beginning it looked like one or two banks were in trouble, but as time goes on it turns out that there may be many more. If the situation continues to escalate and more banks are added that are in trouble, could this result in a bigger financial crisis?

We shall see. For the big banking institutions, this is advantageous for two reasons: No one wants a collapse of the financial system, preventing panic among depositors and keeping First Republic Bank is in everyone's interest. With the deposit, large banking institutions signal that they are strong and have ample liquidity. Americans reading the news will think - if they were poorly capitalized, I guess they wouldn't just send $30 billion in uninsured deposits to a troubled bank where they are at risk of loss? They themselves will attract deposits from nervous American depositors.

Is there any solution at all to the current problems surrounding the banks?

I'm sure it will work out somehow. I dare not guess how, but the nervousness is really strong. Yesterday I was on a call with an American bank where our fund wanted to open an account. The lady from the bank launched into a monologue for about five minutes right from the start about the structure of their clients (both borrowers and depositors) and how much of their deposits are uninsured deposits. I asked her if she was getting these questions a lot now - she gave me an uncertain smile and said yes. The situation is really very nervous in the US right now. Nevertheless, I am convinced that we can be calm in the Czech Republic.

Otherwise - banks will now mainly try to maintain and gain liquidity. The state authorities will, of course, help them to do this, as has already been shown in the new Fed programme, the ECB statements and also in the case of the Credit Suisse collapse. Everyone is now trying to restore depositors' confidence in the banks. It is in this light that we must interpret the actions of JP Morgan and other banks towards First Republic Bank. The important thing is to ensure that banks do not face an outflow of deposits. Unfortunately, this is not good news for the economy, because the hoarding of liquidity and fears of a bank run mean less lending. And without lending, strong economic growth cannot be expected. Moreover, we still don't know how the economy will react to monetary policy moves.

Could today's Fed meeting and a possible rate hike have a negative impact on the current situation? If so, why?

It is absolutely crucial to consider the impact of a rate hike on the current situation. The level of rates affects everything. The fall in the price of debt securities can be mitigated by the Fed through a new mechanism, as mentioned in the previous question. However, this mechanism cannot be applied to all assets and therefore a significant increase in rates may put further pressure on banks. On the other hand, inflation is still high, the economy is not cooling and equity markets (in anticipation of rate cuts by the end of the year) are not reacting significantly to the current banking crisis (except for bank titles). Then again, the latest data from the US mortgage market also does not suggest that the Fed should put the brakes on.

Unfortunately, the market is absolutely confused about the future course of rates. As recently as Tuesday the week before last, the market was assuming that there would be a 25 basis point hike at the next Fed meeting and that the Fed would start cutting rates by the end of 2023. After Fed Chairman Jerome Powell's appearance before a Senate committee the Wednesday before last, the market began to expect the Fed to raise rates by 50 basis points at the next meeting and not cut rates until the end of the year. Since then, however, 3 banks in the US have run into trouble (one voluntarily closed, another was terminated by the supervisor and the third went into receivership after becoming insolvent) and the market has gone completely bonkers. Some analysts are betting on a 50 basis point rate hike, arguing that inflation is dangerously high and the Fed has already introduced a sufficiently strong tool to supply liquidity to banks, so there is no risk of bankruptcy. Others are speculating about 25 basis points, arguing that the Fed wants to fight inflation but does not want to put banks under further pressure. Still others say the Fed will keep rates on hold and the last group even predicts a rate cut. Personally, I think the Fed will raise rates, more likely by 25 basis points, but I wouldn't be surprised to see 50.

- Did you enjoy today's interview? If so, be sure to follow us so you don't miss any more unique content. My guest today was Petr Hotovec.

Please note that this is not a financial advice show.