Paramount Global analysis: a rocky road ahead?

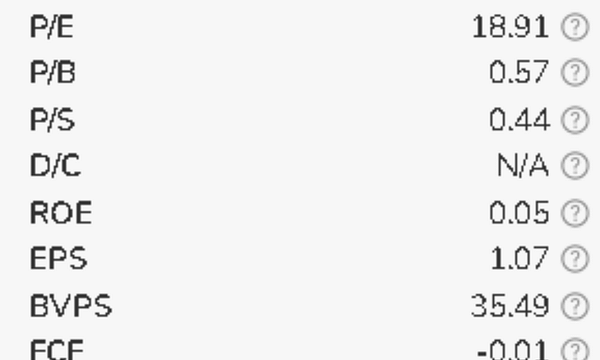

In the comments below the posts here on Bulios, one strategy is repeatedly mentioned by one particular person. Generally it is buying stocks with P/B below 3, P/S below 3 and dividend above 3%. I did find one company that meets even my tuning of this strategy. P/B under 1, P/S under 1, and dividend over 3%. That company is Paramount Global.

Paramount Global, a leading media conglomerate, has faced significant challenges over the past few years. The stock price is down more than 44% from last year and a staggering 80% from its all-time high in 2021. With Warren Buffett's Berkshire Hathaway holding a 15% stake in Paramount, many investors are wondering if this is a unique opportunity to buy the stock at a discount or if they should steer clear due to strong competition and weak financials.

Paramount Global (formerly known as ViacomCBS) is a leading global media and entertainment company that specializes in creating premium content and experiences for audiences around the world. The Company operates through several business segments to generate revenue, including:

- Filmed Entertainment: this segment includes the production, acquisition and distribution of films under the Paramount Pictures, Paramount Players and Paramount Animation brands. It also includes home entertainment, global licensing and ancillary businesses.

- Television Production: This segment includes the production, acquisition and distribution of television programming such as series, movies, reality shows and other content under the CBS Television Studios, Paramount Television Studios, Nickelodeon, MTV and other brands.

- Media Networks: This segment includes cable networks, streaming services and digital content through various brands such as MTV, Nickelodeon, Comedy Central, BET, Showtime and others. It also includes advertising sales and affiliate fees.

- Streaming: This segment focuses on streaming services such as Paramount+, Pluto TV and Showtime OTT, which offer both subscription-based and ad-supported platforms to their consumers.

Paramount Streaming Pivot: Paramount+

As the entertainment industry moves toward streaming, Paramount Global has launched its own platform, Paramount+, to compete with rivals like Disney and Comcast. The company has invested heavily in its streaming service and secured a deal to stream NFL games through 2033 to bolster its sports offerings. However, Paramount's hit show Yellowstone is not available on Paramount+, although prequels like 1883 and 1923 can be found on the platform.

Top Gun: Maverick soars high

Paramount's biggest box office hit in 2022 was Top Gun: Maverick, signaling that the company still has the potential to make successful films. This win is a positive sign, but Paramount's main focus is shifting to streaming, so it's unclear how much their box office success will affect the company's overall performance.

The company's pros and cons

As with any company, there are pros and cons. No company is without a wrinkle, so let's take a look.

Pros:

- Diverse Portfolio: Paramount Global's diverse portfolio of content and business segments provide multiple sources of revenue and reduce dependence on any single segment.

- Strong brand recognition: well-known brands such as MTV, Nickelodeon, Paramount Pictures and CBS have strong market presence and customer loyalty.

- Expansion of streaming services: with the growth of streaming services such as Paramount+ and Pluto TV, the company is well positioned to take advantage of the growing demand for online content.

Disadvantages:

- Intense competition: Paramount Global faces intense competition from other media giants such as Netflix, Disney, and WarnerMedia, which may affect its market share and profitability.

- High production costs: High-quality content can be expensive to produce and the company may face challenges balancing costs and profitability.

- Slow to adapt to change: the company has been criticized for being slow to adapt to a rapidly changing media environment, especially compared to its more agile competitors.

Financial health: mixed picture

Paramount's financials paint a mixed picture of the company. On the one hand, revenues for 2022 are up 5.5%, but on the other hand, net income is down 83% year-over-year. In announcing its quarterly results, the company said that we'll see a subscription price increase for Paramount+ this year, and we'll also see a new package that will be a combination of Paramount+ and Showtime. Here, these moves keep the company's CEO in a positive frame of mind, and he expects that with these moves, the company will return to earnings growth in 2024. Analysts see it differently, and predict that it will take a few years for Paramount's profits to rise again, which could threaten the company's dividend if it is unable to turn its business around in time.

As for the company's debt load, the company looks relatively healthy here. Its current assets are amply sufficient to cover all short-term liabilities, that is, only if needed. For 2022, the company had long-term debt of about USD 17 billion, and equity of about USD 23 billion. So in terms of some financial health, the company looks fine. Shareholder value here comes out to me at about $36 per share.

In terms of cash flow, operating cash flow has declined rapidly over the past year, which is to be expected given the low net income that the company has generated. As for free cash flow, it has even been negative over the past year. What is positive for the company is the fact that it has been able to keep capital expenditure at bay, but what the company really needs to do at this point would be to reduce that expenditure. Given that the company's free cash flow is volatile, it is not even possible to make a good estimate of whether the dividend is being covered by free cash flow.

Conclusion: is Paramount's stock worth the risk?

Despite support from Warren Buffett's Berkshire Hathaway, investing in Paramount Global stock may not be the best choice at this time. The company's inclination to stream with Paramount+ comes with fierce competition from established rivals like Disney and Comcast. With weak financial results and uncertainty regarding the company's ability to recover, Paramount stock represents a risky investment.

WARNING: I am not a financial advisor, and this material does not serve as a financial or investment recommendation. The contents of this material are for informational purposes only.