VICI Properties Inc.

VICI

VICI Fair Price

My Notes

Začít psátProfile

Feed

Vici Properties: REIT with attractive dividend

-Capitaltenants: Vici Properties $VICI holds real estate assets in the form of casinos and entertainment properties with tenants like Caesar's Entertainment, MGM Resorts and others. With multi-decade contracts, it maintains 100% occupancy.

-REIT Profit Model: As a real estate investment trust (REIT), $VICI must pay out at least 90%...

Read more

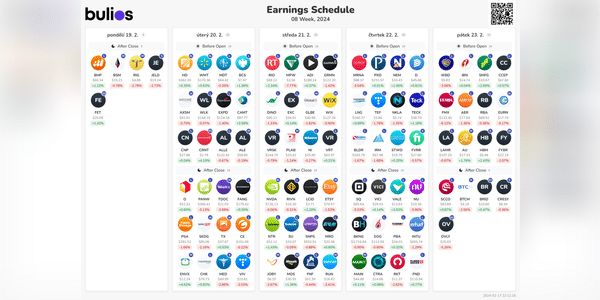

📊🚀 What to watch this week! 🌐💡

President's Day - Monday: The US stock market will be closed!

Walmart $WMT Earnings - Tuesday: Retail giant Walmart will release its earnings! 🛒💰 What will be the impact on their stock and the overall retail sector?

Home Depot $HD Earnings - Tuesday:🏡💼 What will be the impact on the construction and home building sector?

Fed FOMC -. Wednesday: Let's...

Read more

Zobrazit další komentáře

Super thanks for the recap, I just didn't have time to make it myself now :)

Zobrazit další komentáře

📈 I'm deciding between two REITs, which one do you choose? 🚀

🔍 $VICI vs. $O: Which one is more attractive to you ?

💹 Vici Properties Inc. $VICI 🍀

VICI is one of the key players in real estate investing, with an emphasis on the entertainment and hospitality sectors. Their portfolio includes attractive properties such as casinos, hotels and resorts that provide stable and...

Read more

Zobrazit další komentáře

Of the REIT sector, these are the only two I have and want. If it was just about attractiveness, I'd go with VICI, but given some stability in fundamentals, etc., I'd go with O. REITs are pretty well represented in my portfolio. I have a larger amount of money in O, but right after that is VICI where I also have little. I'm looking forward to when the Fed starts cutting rates :D

Zobrazit další komentáře

Hi, I have exactly these three companies as well and buy relatively regularly. 😊

Zobrazit další komentáře

I'll be buying a dividend stock like I do every month, I'm still figuring out which one.

Investors, which REITs are included in your portfolio?

REITs are down quite a bit this year, so I've been adding shares of $O and $VICI and plan to take a closer look at $WPC. Shares of $O even got below $50 last month so I overbought, but the price is still great for me so I'll be overbought some more this month.

For me a great company, I already have quite a lot of $VICI shares and I don't need to buy more.