Patience

I've written on a similar topic here before, and I think I've already given a similar example. But yesterday was another "success" for me in my quest for the "perfect" portfolio and I would like to share it with you again. 😊

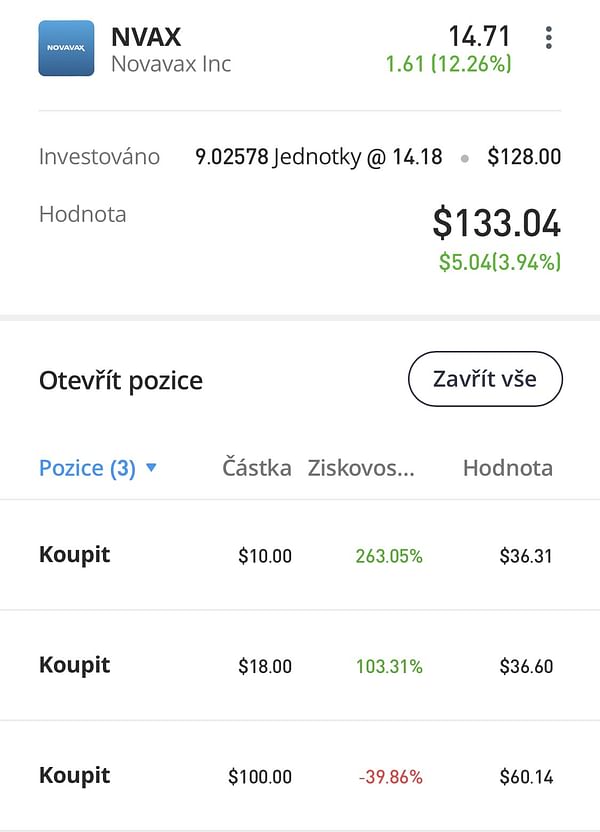

This time it is Novavax. $NVAX-1.4% I don't think I need to introduce myself again and I would like to remind you about the great Bulios article https://bulios.com/status/154696-jak-je-mozne-ze-vyrobce-vakcin-za-jediny-den-dosahl-120-rustu where we can read everything we need to know about the recent happenings of the company and the reason for the stock price increase. 😊

What did it mean to me? I started investing in the second half of the 2022 dock and on November 15, 2022 I bought my first position in this company. For $100 at a price of $24.51. At that time I had no experience at all, it was my beginnings and the decisions why to buy were so very simple, superficial, without reading any deeper news. Luckily I also didn't have much capital and started with small amounts. Why did I buy? I simply bet on Covid to be around longer, the company was small, cheap, affordable for me because of that and their vaccine was a bit different than the competition (Moderna, Pfizer...). So I just bought it. 🙈😁

Of course, I didn't go into much more depth, the numbers and actually the fact that it wasn't even clear if their vaccine would get big sales and approval. Of course the price has gone down since my purchase.

This is already the result. Even though I was minus to 90% of my first $100 purchase for a long time, I held on and waited (yes, speculation is offered here, I didn't have much to lose anyway). So I made two more small, dilutive purchases down below. But only for a symbolically small amount. The company and its CEO even issued a report in 2023 that they were facing bankruptcy and they are not far from it. Yesterday I sold at a token small plus as you can see in the picture.

Despite the report you have in the link at the beginning, I don't want to keep the company in my portfolio and it has taught me that this sector of pharmaceuticals that involves vaccines is not for me and I don't want to wait, hope or whatever to see if they can develop a product that will pass approval and then if it will still catch on in the market. For my part, I see big risks here that don't fit my strategy and portfolio. (Of course, there are risks in all sectors.) The debt is still high and for my part, I don't think Novavax is out of the woods.

However, with this move, I am glad that I was able to "sit out" the loss for so long, showing patience, which I believe is key in the life of an investor! 👍

What about you, what is your patience in watching losses? 😊

Great, that's a nice ending. Pretty much the same thing you're writing with $PFE+1.6% stock. I didn't totally bet on Covid, but I also didn't have much experience and subsequently and unfortunately until now it's my most losing position. Like you I also don't want to wait or hope for something to happen so I plan on selling when I'm in + there.

Great article and good job!

Thanks so much, although there was no profit in it, I'm glad I was able to sit it out and show my patience. Did you succeed with anything too?

It's not so much about profit as it is about the psychology of being able to look at the losses and survive to profit.. I'll give an example just from a bank investment in mutual funds where during the covid period I was probably in almost 40% negative :D I've now sold off part of it with almost 30% appreciation.

@alfredgray Super congrats, beautiful example. 👍 And exactly as you write, it's not so much about profit, but about managing the psyche and being able to reverse, to stand the loss. 😊

@mondaydayton Exactly!