Apple

AAPL

AAPL Fair Price

My Notes

Začít psátFeed

Anyone investing in $3CP.F0.8%? Would you rather invest in $AAPL-0.9%, $SMSN.L0.0% or $3CP.F0.8%?

Xiaomi is a Chinese technology company focused on electronics and smart devices. It's product portfolio is really broad, and one of its main competitors is $AAPL-0.9%, for example . But it's a growth Chinese stock, which can be quite risky. The price is really high at the moment, but after some...

Read more

Impact of the proposed US tariffs on the PC supply chain

According to analysts at Bank of America, the planned tariffs (10-25%) on PC and component imports may bring:

- Price increases for consumers and businesses

- Supply chain instability as manufacturers will seek alternative markets

- Long-term changes in production, possible relocation of production to other countries

The...

Read more

📅 Key events of the week: What to watch out for in the markets?

This week will bring key economic data, earnings reports and events that could impact global markets. Here's my round-up of the highlights:

🟥Monday:

Presidents Day (Presidents Day) - US stock markets will be closed.

🗣️ Tuesday:

Trump & Musk interview on Fox News - possible market reactions to topics related to...

Read more

Zobrazit další komentáře

Awesome these posts are advisory, they always get me in the mood for the next week. Otherwise the Trump and Musk thing, well it may be interesting but I'm more interested in Apple and then the $VICI0.5% thing plus after the recent $CVS0.6% rise I'm also curious about the $MDT-0.2% and Healthcare sector even if it doesn't have some direct effect on CVS. $OXY1.6% and $RIO-0.1% I'm also holding so I'm curious.

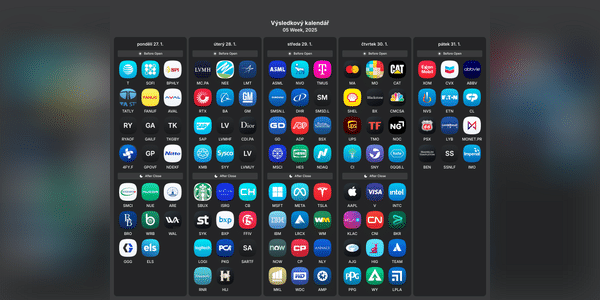

🗓️Klíčové market events of the week: the most important week of the month!

This week is full of interesting macroeconomic data and earnings reports from key companies. Here's a summary of the highlights! 👇

🏠Monday: New home sales!

Let's keep an eye on how the U.S. housing market is doing, which may indicate the health of consumers and the economy as a whole.

📊 Results before the...

Read more

Zobrazit další komentáře

As mentioned, the Fed's decision will be so important. In addition, I will be watching the results of $ASML-3.0%, $META-2.4% and $AAPL-0.9%.

We have a lot to look forward to this week as the biggest and most watched companies will be reporting results. I will be interested in the results of $SOFI-4.0%, $TSLA-6.0%, $META-2.4%, $ASML-3.0% and $AAPL-0.9%.

Which companies' results will you be interested in?

Zobrazit další komentáře

The $TSLA-6.0% and $NVO-2.3% will certainly be interesting, but Wednesday's Fed rate decision will be the most important.

What do you think about the decline in $AAPL-0.9%stock this year ? Are you buying or selling?

Shares of $AAPL-0.9% are down more than 10% in the past month. The main reason for the decline was investors' reaction to news of a significant drop in iPhone sales in China. It seems to me that Apple has the least potential out of the "Magnificent 7", so I'll just hold the stock for now.

Apple

AAPLZobrazit další komentáře

I'm very curious how the DOJ's Google lawsuit will turn out, if they block those Apple payments for the search page they will lose about 20% of their net profit which they didn't have to put any effort into and I would say it will also reduce their overall margins.

Investors, I have a question to lighten the load.

Do you use a company's products/services on a daily basis, and do you also hold its stock in your portfolio?

For me, it would definitely be $AAPL-0.9%, $GOOG-2.6%, and you could say $ASML-3.0%.

Zobrazit další komentáře

Bulios Black

This user has access to exclusive content, tools and features of the Bulios platform thanks to their subscription.

So I would say $NVDA-6.4%, $AMD-4.9%, $GOOG-2.6%, $MSFT-1.3% 😁

Investors, which stock do you hold, or have you held the longest of all?

I don't invest that long, so it's not that interesting for me, but the stock I've held the longest in my portfolio is $AAPL-0.9% (about 3 years).

Zobrazit další komentáře

For me it's definitely $KO2.0% stock, I've had those in there for a long time and still haven't sold and am holding.

In the end, these companies should not be affected so much.