Fair Price

Profile

Feed

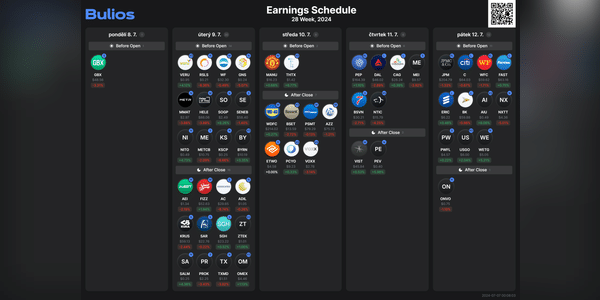

🗓️Klíčové events of the coming week!

Earnings season starts again this week and as usual the biggest banking houses in the USA along with PepsiCo. Here is a summary of the interesting events that are coming up and that may influence the markets.

👨⚖️Tuesday: Chairman Fed Chairman Jerome Powell will be speaking before Congress on the state of the economy and monetary policy. Key...

Read more

Zobrazit další komentáře

But this one got away, it was here a while ago and another quarter is already over :) Definitely the end of the week - banks.

📈 This week we have several key events that may affect the markets! 🌍

Here's my list of highlights and events I'm waiting for. The most important, however, is the start of the next earnings season, which is traditionally kicked off by the biggest banking houses in America.

The start of the week won't be very interesting, but things will get going onWednesday . In the US , we'll...

Read more

📈💼 Interesting things in the banking sector!💡

Washington is caving in to pressure from big banks and rethinking capital buffer rules. Federal Reserve chairman Jerome Powell and Chairman FDIC's Martin Gruenberg expect major changes that could affect the banking sector and investors.

The new proposal would lead to 16% increase in capital levels and 20%

The proposal is under...

Read more

Zobrazit další komentáře

My favorites and in my portfolio are $BAC and $JPM. Otherwise, since I don't understand the banking sector that much (which is why I represent these two banks, where I think there's nothing to go wrong), I don't think I fully understand the change in the proposal, could you explain it for a moron? 😁 ...like is this supposed to be a change for the banks in the sense of how much capital they have to mandatorily hold just in case the economy struggles and in case more customers want to withdraw their accounts at the same time, so that they have something to draw on? ...

Just now I was counting last week's results and I was quite surprised to see that Citigroup $C posted a loss of $1.8 billion for the fourth quarter after that, it may have been due to large charges related to foreign risks along with the last regional banking crisis, but it still seems like a lot to me.

How satisfied are you with the results of $C Citigroup?

Citigroup reported third quarter 2023 results. Net income was $3.5 billion, up 2% year-over-year. Revenue was up 9% to $20.1 billion. Both profit and revenue growth were driven primarily by higher revenues from transaction services, trading and investment banking in the Institutional Clients Group division. Growth in...

Read more

Zobrazit další komentáře

Good results for me, 5% divi is nice too. Quality company, surely won't get lost alongside $JPM.

We have seen US bank stocks fall quite a bit this year. For example, $BAC stock is down more than 13% this year and $C stock is down more than 9%. However, over the past month, bank stocks have been falling very quickly and noticeably ( see image below ). Otherwise, I have been regularly buying $BAC stock lately as it is currently at a great price and I am still thinking about...

Read more

Zobrazit další komentáře

Banks are too conservative, boring and slow for me... I wouldn't go there :)

Zobrazit další komentáře

Giant US banks have passed the Fed's stress test.

The five largest U.S. banks said Friday they will return more cash to shareholders after passing the Fed's stress tests early last week, a show of strength that reinforces the gap between the industry giants and smaller regional rivals.

Read more

Zobrazit další komentáře

Again a great summary and opinion on the banks, I think they will be good numbers too, after all they are benefiting from ever higher rates. I hold $JPM long term and am very happy, I have nice numbers there and will continue to hold, I don't expect a drop.