JD.com

Fair Price

Company Quality

Dividends

Dividends data currently unavailable.Earnings

My Notes

Profile

Key Metrics TTM

Valuation

Market cap.

$337BEnterprise Value

$328BPrice to Earnings

7.50Price to Sales

0.28Price to Book

1.44Price to Cash Flow

11.20Profitability

Return on Assets

6.66%Return on Equity

19.55%Return on Invested Capital

8.92%Gross Margin

12.93%Operating Margin

3.46%Net Margin

3.76%Liquidity

Quick Ratio

0.92Current Ratio

1.26Cash Ratio

0.34Inventory Turnover

10.95Asset Turnover

1.77Total Liabilities

$369BSolvency

Debt to Assets

0.13Debt to Equity

N/AInterest Coverage

21.11Equity Ratio

0.46Long-term Debt to Cap.

0.19Altman Z-Score

2.20Performance

Earnings Waterfall

Debt level and coverage

Earnings

Feed

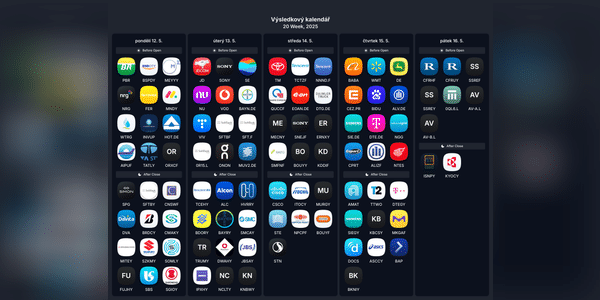

Earnings season is still going on and some interesting companies will report results this week. I will be most interested in the results of $JD-2.0%, $BABA-1.3% and $WMT0.9%.

Which companies' results will you be interested in?

Recently, Chinese stocks have also plunged because of Trump. Yesterday they were up, but even so, over the last month, for example, $BABA-1.3%has lost over 20%, $NIO-0.6% about 25% and $JD-2.0% about 13%. I'm not currently buying much Chinese stocks, but I still have $BY6.F-1.5% on my watchlist , which I would like to buy at a lower price.

Are you buying Chinese stocks now or do you have some on...

Read more

Zobrazit další komentáře

For me, China is a risk because of the politics and the current situation isn't ideal either, so I won't be buying.

The most interesting were probably $BABA-1.3% and $WMT0.9%.