McDonald's

Fair Price

Company Quality

Dividends

Dividends data currently unavailable.Earnings

My Notes

Profile

Key Metrics TTM

Valuation

Market cap.

$207BEnterprise Value

$259BPrice to Earnings

25.32Price to Sales

8.04Price to Book

-59.82Price to Cash Flow

30.83Profitability

Return on Assets

14.49%Return on Equity

-189.23%Return on Invested Capital

17.42%Gross Margin

56.83%Operating Margin

45.22%Net Margin

31.75%Liquidity

Quick Ratio

1.17Current Ratio

1.18Cash Ratio

0.31Inventory Turnover

217.6Asset Turnover

0.46Total Liabilities

$60BSolvency

Debt to Assets

0.94Debt to Equity

N/AInterest Coverage

7.70Equity Ratio

-0.06Long-term Debt to Cap.

1.10Altman Z-Score

5.08Performance

Earnings Waterfall

Debt level and coverage

Earnings

Feed

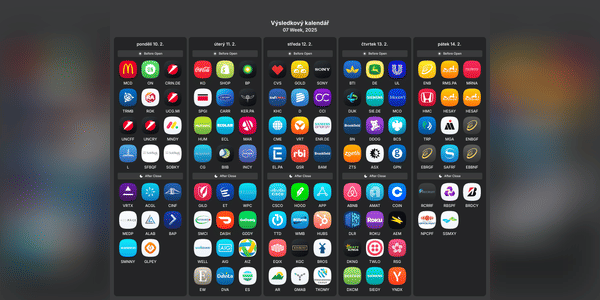

📊 Investment overview of the week: Giants' results, macroeconomic numbers and key impulses for the markets!

Get ready for a busy week that could have a major impact on market sentiment. The combination of corporate results and important data from the US economy promises a really interesting week.

🍕 Monday

📊 Results before the markets open:

Domino's Pizza $DPZ - Results will show...

Read more

📉 Domino's shares fall after weak Q4 results! 🍕

Shares of Domino's Pizza $DPZ fell more than 6 %as the pizza chain reported worse-than-expected fourth-quarter results. While the company posted year-over-year sales growth of 2,9 % to $1.44 billion, but analysts had expected a better performance. Same-store sales growth in the U.S. was only 0,4 % compared to the expected 1,72 %. ...

Read more

Zobrazit další komentáře

Now$BRK-B0.3% has been buying $DPZ-2.6% and theoretically it could be a good opportunity, but I don't see much potential and room for upside.

In the end, McDonald's results didn't turn out too well, but the stock still rose 5%. I did have $MCD-0.9% in my portfolio for a while, but then I sold the stock as it is too defensive a stock for me and I don't see room for significant upside.

What is your opinion on $MCD-0.9%?

McDonald's

MCDZobrazit další komentáře

I don't find the performance very interesting either. I'd rather buy, say, $PEP-0.2% stock.

Next week, there will be quite a few more well-known and interesting companies reporting results. I will be interested in the results of $MCD-0.9%, $SHOP-0.5%, $ABNB-0.9% and $RMS.PA-1.7%.

Which companies' results will you be interested in?

Zobrazit další komentáře

I'm waiting for the $COIN16.3% results. The company did quite well, so the stock could rise after the results.

Are $YUM-1.2% or $MCD-0.9%stocks better ?

Under Yum is KFC, which is one of McDonald's biggest competitors, but performance and profitability vary quite a bit. I would definitely prefer to buy $MCD-0.9% as it is bigger, more successful and...

Read more

Zobrazit další komentáře

McDonald's beats earnings expectations but faces stock drop on weak sales

- Earnings Results: McDonald's $MCD-0.9% beat earnings expectations with $3.23 per share, but shares fell.

- Decline in comparable sales: Global comparable sales declined by 1,5 %, which increased pressure on the stock.

- E. coli problem: Bacteria epidemic E. coli linked to Quarter Pounder has undermined...

Read more

Zobrazit další komentáře

🗓️Klíčové events of the week! 🌟

This week will be the most important week of the whole results season for me, since there are so many results and events, I'm just attaching my list of the most important news:

❌Monday

Prague Stock Exchange closed due to a public holiday

Results:

Before the markets open: ON Semi $ON-1.3%

After markets close: Ford $F0.1%

📊Tuesday

US Consumer Confidence

JOLTS - Job...

Read more

Zobrazit další komentáře

It's going to be very interesting from tonight through Thursday, so I'll definitely be watching.

McDonald's faces a drop in sales

- Decline in global sales:

- McDonald's $MCD-0.9% saw a 1% decline in quarterly comparable sales, the first decline in 13 quarters.

- Analysts had expected a 0.53% increase, but the reality fell short of expectations.

- Competitive Pressure:

- McDonald's $MCD-0.9% and other chains such as Domino's, Burger King, Wendy's and Starbucks introduced...

Read more

🗓️Přehled of this week's events you shouldn't miss!

Hey investors here's another round-up of highlights for the week ahead. In my opinion, this week will be one of the most interesting earnings weeks.

Monday: Earnings: Before the markets open ONSemi $ON-1.3%, a semiconductor company that currently has a major partnership with Volkswagen, will report earnings . We'll alsoget results...

Read more

Zobrazit další komentáře

Thanks for the overview. There's a lot of results out there and it's going to be a busy week overall. I'm currently on vacation, but I'll at least try to follow it a bit😁

📊 Investment Calendar 📆

Earnings season is in full swing, and with it comes more exciting news. Here is a summary of the news I will be following.

Monday: I'll only be watching company results.

📈 Earnings: Before the markets open, I'll be watching Domino's Pizza $DPZ, SoFi Technologies $SOFI6.4% and ON Semiconductor $ON-1.3%. After the close, just the results of Paramount $PARA and Logit...

Read more

I'll be interested in tech stocks.