On the brink: How a political stalemate in the US could shake stock markets and the global economy?

Recently, the subject of the US debt ceiling has been coming up more and more. While most people believe this debate will turn out well, let's take a look at what would happen if the debt ceiling is not raised.

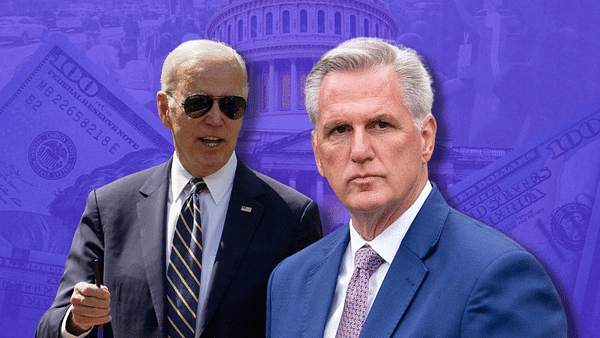

In recent weeks, US politics has been in the grip of ever-increasing tensions over the debt ceiling hike debate. The Democrats, led by President Biden, are pushing to raise the ceiling in order to continue running the country with the current budget. On the other side of the barricade are Republicans who insist that raising the debt ceiling must be accompanied by cuts in the national budget.

This political stalemate threatens not only the domestic economy but also the global economy. This is no ordinary political conflict - there is a significant amount of money at stake and potentially the future of the US economy. It could have significant implications for US stock markets, which are nervous about the possibility that such a major economy could run into debt problems.

In the context of these political battles, Treasury Secretary Janet Yellen has warned of serious consequences if the political elite fail to come to an agreement. Yellen warns that if the debt ceiling is not raised, the U.S. could run out of funds to pay its debts by June 1, 2023.

President Biden recently held a meeting with leaders of both parties at the White House. The aim was to reach a compromise on the debt ceiling. Unfortunately, the negotiations did not lead to any result. Although Biden was willing to offer to negotiate on the next budget, he refuses to interfere in the current one. The situation thus remains unresolved and the deadline for running out of funds is inexorably approaching.

So what would that mean?

It would mean that the US would find itself in a situation it has never experienced before - the state would not have enough money to pay its obligations. This situation could lead to a crisis of confidence in the US economy, with far-reaching consequences for global financial markets. Put simply, if the US were unable to pay its debts, the whole world would feel the impact.

If the debt ceiling were not raised and the US state ran out of money, this would undoubtedly have a negative impact on the stock markets. The first and most significant reaction would probably be a sharp fall in the value of shares. Investors could start selling stocks en masse out of concern for the stability of the US economy, which would lead to a fall in their value.

Furthermore, there would be an increase in volatility in the markets. Uncertainty about the ability of the US to repay its debts would probably lead to huge swings in share prices. This could cause panic among investors and contribute to a further fall in share prices.

In the long term, the inability to repay debt could lead to higher interest rates and inflation. Higher interest rates would mean higher borrowing costs for companies, which could reduce their profits and thus the value of their shares. Higher inflation could in turn erode consumer purchasing power, which could also negatively affect corporate performance and their share prices.

Why would interest rates rise at all?

Refusing to raise the debt ceiling would mean that the US government would not have enough money to pay its debts. This could lead to what is known as a technical default, a situation where the government is unable to pay its obligations as scheduled.

If such a bankruptcy were to occur, investors would begin to doubt the ability of the US to repay its debts, leading to a decline in confidence in the US economy. As a result, investors could begin to demand higher interest rates on US bonds to compensate for the increased risk.

As for inflation, if the government could not raise enough money to pay its debts, it might try to print more money. This could lead to inflation because there would be more money in circulation relative to the quantity of goods and services. Higher inflation could erode consumer purchasing power and increase the cost of living, which could also negatively affect the economy.

Conclusion

It is very difficult to estimate what would happen because this situation has not yet befallen us. But one thing is for sure, this issue here could cause quite a big problem in the event of a negative outcome. And I think it is also certain that it would not only affect the American economy, but also the global economy in general, because America is one of the world's largest economies at the moment, to which the economies of other countries are linked.

Take this as a kind of reflection on the current situation, I really don't know exactly and specifically what will happen. If the debt ceiling increase is rejected, it would be a new situation for us, one that we have not yet encountered in the US.

So I would also be interested in your opinion on the current situation. So feel free to let me know in the comments what you think would happen.

WARNING: I am not a financial advisor, and this material does not serve as a financial or investment recommendation. The content of this material is purely informational.

Pretty scary scenario. How long do you think the U.S. would be getting out of this kind of problem if they don't come to an agreement after all? I feel like neither scenario is ideal, raising the ceiling isn't healthy either. I don't want to be a pessimist, but I see KB buying tomorrow, rather than US titles. 😁

We'll see how it turns out in the end. I can see the seriousness of the situation, but I believe that they have taken into account the worst case scenario and are prepared for it.

Nicely written. :)