Unilever $UL

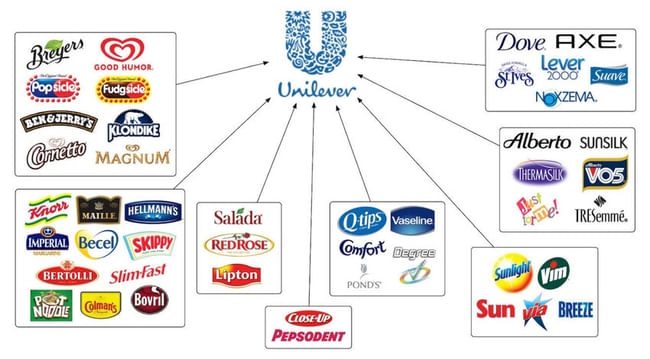

We all know the company. It offers a range of products that are all around us.

Unilever, like many other UK companies, is slowly falling in price (not only) due to the adverse economic situation in the UK. In the last month specifically Unilever has fallen by almost 10%.

This may also be due to its relatively high debt, which has been increasing for the last 5 years. The current D/E ratio is 1.3. However, this debt should be decently covered by the high FCF.

It is also worth noting that at the current price, the company offers a 3.5% dividend yield.

Do you have $UL in your portfolio, or at least on your watchlist? 👇

So I'll join in too, I didn't know about it :D actually I like it a lot and I'll definitely add it to my portfolio.... Just a shame I didn't find out more about her the purchase at 44 approx was pretty luxurious who bought... If I were to buy a bigger position, 44-48usd hopefully I'll see.. :D

I don't have Unilever in my portfolio. I handle the whole of the UK through ETFs, so it has representation there. I'm very comfortable with it.

https://www.vanguardinvestor.co.uk/investments/vanguard-ftse-100-ucits-etf-gbp-distributing/portfolio-data

Wow so I'll be the first, I'll admit I don't know the company but I like what everything has, as you say maybe we all use some of it. Sparked an interest in me, thanks for the tip. 👍 Plus something interesting that isn't in the US. Like Paul though, I also wonder why they are so in debt? 😊

I don't have it in my portfolio, but it's a nice company.

I have to say, I was surprised at how many brands fall under this company.

I don't have it in my portfolio, but I wonder why they're going into so much debt?

This is a nice dividend with a decent reputation! I don't have it in my portfolio, but it is definitely a quality company.