Cheap fund with 14.5% yield and high growth potential

The objective of investment funds is to achieve maximum investment appreciation at a reasonable risk. This means that everything is balanced and high diversification cannot deliver the kind of appreciation that individual stocks can. However, this fund can return 14.5%. How this is possible, and how it achieved it, we will now look at.

Many investors are likely to hold their breath when they think of a 14.5% return. But the story of the Pimco Dynamic Income Fund ($PDI) is even better. This closed-end fund (CEF) pays its dividends monthly instead of quarterly. PDI's lead manager, Dan Ivascyn, took the helm as PDI's chief investment officer in 2014, following in the footsteps of "bond king" Bill Gross. Ivascyn has his own nickname: His peers have described him as an "animal" for his tenacity and knowledge of the market.

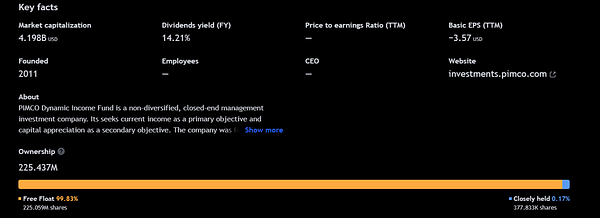

Under his guidance, PDI scours fixed-income sectors around the world for great investment opportunities. The fund currently has nearly $4.5 billion in net assets + its own bonds issued by the U.S. government, local governments and emerging market countries. However, PDI also invests heavily in mortgage-related securities and other income-generating assets.

Since its inception in 2012, PDI has achieved an average total return of around 10%. Its net asset value has increased each year during that period, except for 2022, when a series of large interest rate hikes by the Federal Reserve knocked bond prices down.

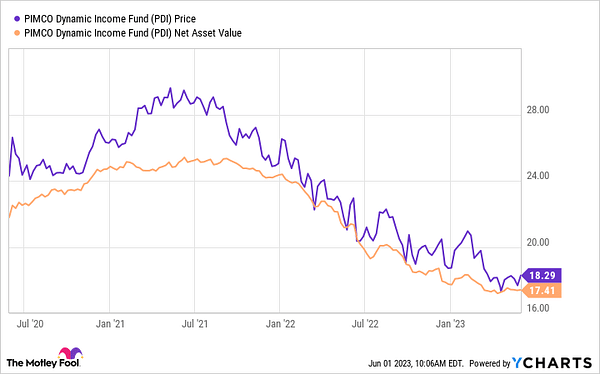

Currently, PDI's price is about 4.8% higher than its NAV. But don't think the fund is too expensive. In fact, PDI typically trades at an even higher premium. The difference can be seen in the following figure, where the fund's price or share price is in yellow and the

More importantly, there is good reason to expect the price of PDI to rise in the not too distant future.

When interest rates move lower, the price of PDI moves higher. And interest rates should fall, especially if the U.S. economy enters a recession, as many economists predict.

It's very quiet with the recession right now, and the mood in the market is such that all threats have passed and we're headed for new highs. This may be a stumbling block and many may pay the price later.

The price of PDI could rise much sooner before interest rates fall. Bond traders, like most investors, are looking ahead. If they believe that rates are likely to fall in the near term, bond prices (and the prices of funds like PDI that own bonds) will move higher before interest rates fall.

Admittedly, there are a few problems with buying PDI. First, interest rates could remain high for much longer than many anticipate which could hinder any upward momentum in the fund.

PDI's fees are also high compared to many funds. Its management fee is currently 1.1%. Total costs are even higher. For example, PDI uses leverage (borrowing), which means it incurs interest costs.

Even if interest rates do not fall soon, it seems likely that they will not move much higher. Long-term investors are unlikely to mind receiving an ultra-high return, while their initial investment won't change much.

Sure, PDI fees are high. But they also give investors access to some of the greatest bond experts on the planet. And the fund's 14.5% yield is net of all fees. Risk averse investors in particular are likely to look elsewhere.

But for those looking for high income and willing to take some risk, buying PDI could be a great move.