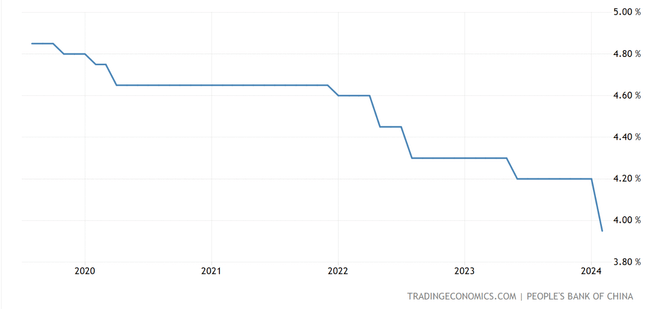

Policy measures in China have seen significant changes recently, particularly in the economy and the property market. The Chinese central bank recently cut the five-year interest rate by 25 basis points, which should help boost the property market.

However, experts say the major problems in the Chinese economy remain and policy measures may not be sufficient to address them. Many economists agree that lowering interest rates, while it may lower mortgage costs and attract buyers, is not enough on its own to to solve the problems in the real estate sector.

Wei Yao, head of research and chief economist for Asia, stresses the need for more comprehensive strategies. Simply cutting interest rates may not be enough to address systemic problems such as lack of liquidity developers or investors' fears of price declines.

"It's just the beginning, we need to see how effective it is, but we think with all the action in the second half of the year there's a chance that housing may finally stabilize," Yaosaid

More comprehensive and effective measures are needed to achieve real stability and balance in China's economy and property markets. Policymakers will have to address structural problemsthat hinder maintaining long-term stability in the economy. The next steps are expected to focus on strengthening liquidity developers and support the long-term growth of the property market to achieve real and sustainable economic stability in China.

Disclaimer: There is a lot of inspiration to be found on Bulios, however, stock selection and portfolio construction is up to you, so always conduct thorough self-analysis.

Source.