CDW controls one tenth of the North American IT market. So can it be a good investment?

CDW controls one tenth of the North American market for IT products and services. With a broad offering, close ties to key partners and a focus on the customer, it is building a dominant position. Moreover, its revenue and net profit grew rapidly between 2019 and 2022. Growth, a healthy balance sheet and a promising future - that's CDW.

CDW is a leading North American information technology company. Headquartered in Illinois, it employs over 13,000 people in offices across North America. CDW provides businesses, government agencies, schools and healthcare facilities with a wide range of technology products and services from leading manufacturers.

CDW sells hardware, software and peripherals from companies such as HP, Cisco, Dell, Lenovo, Apple and Microsoft. It also provides professional services such as technology deployment, infrastructure migration, project management and more. It also offers device management and support services such as mobile device management, desktop virtualization, backup and disaster recovery.

In cloud services, CDW provides so-called hosting, management and consulting services for public, private and hybrid cloud solutions. It also offers financial services such as technology operating leases, asset management and insurance. In addition, it operates a contact center and provides customer support.

CDW has more than 250,000 customers, which include enterprises and government organizations. Through partnerships with leading technology companies and extensive expertise, CDW is able to respond to customer needs and provide comprehensive solutions. CDW has been successful in the marketplace because of its commitment to superior customer experience, innovation and emphasis on customer value.

CDW is also a leading provider of networking products such as network equipment, network cables, Wi-Fi routers and switches from Cisco, Aruba and Juniper Networks. It offers storage solutions such as hard drives, flash storage and network attached storage from Dell EMC, NetApp and Pure Storage.

CDW has a dominant market position and is estimated to control approximately 10% of the IT products and services market in North America. CDW's strong market position and close relationships with key technology manufacturers will continue to play an important role in its growth.

Competitive advantages

CDW has several key competitive advantages that help it succeed in the marketplace. Firstly, it offers a broad portfolio of products, services and solutions from leading technology companies so that it can meet the diverse needs of its customers. CDW also has close relationships with vendors such as Cisco, HP, Dell, Lenovo, Apple, and Microsoft, which allows it to offer the latest and most innovative products.

CDW also has extensive technical, sales and consulting skills that allow it to design complex solutions to meet the exact needs of its customers. The company has a strong focus on delivering an excellent customer experience. It invests in tools that make it easier to do business with customers and offers technical support and customer-centric services.

CDW uses robust systems and processes that enhance its operational efficiency and enable it to achieve economies of scale. This helps the company offer competitive pricing to customers.

Finance

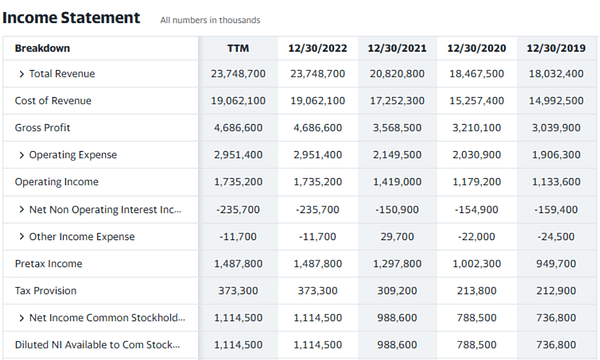

CDW's financial results show strong and sustainable growth. The company's revenues have grown in recent years due to demand for technology and services. Between 2019 and 2021, CDW's revenue grew 15% from $18 billion to $20.8 billion and to a respectable $23.7 billion in 2022. The increase in revenue has also led to an increase in profit margins.

Gross profit grew from $3.04 billion in 2019 to $3.57 billion in 2021. The company's net profit also grew, reaching $989 million in 2021 compared to $737 million in 2019, an increase of 34%. Again, we see this trend carry over into 2022, where we see growth again.

The growth in profit margins is important because it shows that CDW is able to generate value even with revenue growth. The increase in gross margin from 16.8% in 2019 to 17.2% in 2021 shows that CDW has improved its operating leverage. The increase in net margin from 4.1% to 4.7% over the same period shows that the company has reduced its operating expenses relative to sales, which is good news.

Overall, the financial results show that CDW has a strong and sustainable growth model. Revenue growth, improving gross and net margins and control of operating expenses should continue to support profitability growth. CDW is thus in good shape and has the potential to further strengthen its market position.

Balance Sheet

CDW's balance sheet shows a strong financial position. The company's total assets grew from $8 billion in 2019 to $13.2 billion in 2022, which corresponds to an average annual growth rate of 20%. This growth was mainly driven by growth in trade receivables, inventory and short-term investments.

On the liabilities side, there was a significant increase in long-term debt, particularly intangible liabilities. In 2019, CDW's total debt was $3.45 billion, rising to $6.54 billion by 2022, an average annual growth of 18%. This debt is used to fund CDW's acquisitions and organic growth. The company's net debt was approximately $6 billion in 2022.

CDW's equity grew from $960 million in 2019 to $1.6 billion in 2022. This growth was primarily driven by the reinvestment of the company's earnings. However, due to CDW's high growth rate, the ratio of equity to total assets remains relatively low at approximately 12%.

CDW's working capital is growing in line with demand growth. In 2019, working capital was $843 million and will grow to $1.62 billion by 2022, an average annual growth rate of 18%. The growing working capital indicates healthy demand for CDW's products and services.

Overall, CDW's financial position looks very strong. High growth in total assets, equity and working capital support the company's aggressive growth strategy. However, given the high growth rate, the equity to total assets ratio remains relatively low. However, CDW appears to be able to sustainably finance its growth through operating cash flow and debt.

Cash flow

CDW's cash flow statement demonstrates its ability to generate strong operating cash flow and sustainably fund an aggressive growth strategy.

CDW's operating cash flow is growing in line with revenue and earnings growth. Between 2019 and 2021, operating cash flow grew from $1 billion to $1.3 billion, an average annual growth rate of 11%. This growth in operating cash flow is positive and allows CDW to internally fund a portion of its operating and capital needs.

CDW spends relatively large sums on investments in tangible assets, in particular the expansion and upgrade of its data centres and administrative offices. Between 2019 and 2021, CDW invested an average of $130 million per year in tangible assets. This spending reduces the company's free cash flow.

Overall, the cash flow statement shows that CDW has strong operating cash flow that can partially offset spending on tangible assets and financing activities. Although bond issuances and debt repayments reduce free cash flow, they help CDW fund its aggressive acquisition and growth strategy. If CDW continues to generate strong operating cash flow, it should be able to sustainably fund its growth strategy.

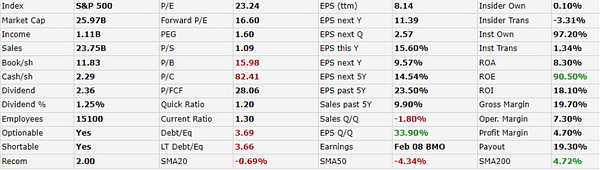

CDW looks like an attractive investment with strong fundamentals. CDW's growth also looks promising. Earnings per share are expected to grow by an average of 14.5% per year over the next 5 years, well above the estimated long-term earnings growth of the S&P 500. CDW is growing due to strong demand for technology from businesses and government.

CDW also has a very strong balance sheet with a debt-to-equity ratio of 3.66, which is below the industry average. The relatively low level of debt provides CDW with the financial flexibility to continue to invest for growth either organically or through acquisitions. CDW's operating margin of 7.3% and net margin of 4.7% are also above the industry average, indicating strong efficiency.

CDW generates strong and growing free cash flow, which is growing at an average of 10% per annum. This allows the company to finance most of its needs internally, reducing its reliance on external financing.

Overall, CDW represents an attractive stock opportunity for long-term investors looking for a growth company with a reasonable valuation, strong fundamentals and a healthy balance sheet. Although risks such as slowing IT spending growth need to be monitored, CDW appears well positioned to meet the challenges and continue profitable growth.

Analysts' expectations

The 8 analysts offering 12-month price forecasts for CDW Corp have a median target of 222.50, with a high estimate of 240.00 and a low estimate of 214.00. The median estimate represents an increase of +17.76% from the last price of 188.94.

Please note that this is not financial advice. Each investment must go through a thorough analysis.