ASML

ASML

ASML Fair Price

My Notes

Začít psátFeed

Investors, which semiconductor stocks do you have in your portfolio?

For me, this sector makes up a fairly large part of my portfolio. I've had $ASML-2.9%stock for quite some time and recently bought $AMD-4.0% and $AVGO-4.8% after the downturn .

European stocks have been relatively cheap lately, which has caught my eye, and I invested quite a bit in them last year. Currently my portfolio includes $ASML-2.9%, $NVO-2.6%, $MC.PA-0.6%, plus Czech banks.

What European stocks do you have in your portfolio?

Zobrazit další komentáře

I bought $MC.PA-0.6% and $ASML-2.9% on sale. I'm still waiting on $NVO-2.6%. I don't have anything there yet.

In the end, ASML's results turned out great - sales and net profit exceeded expectations and overall it is clear that the company really did well. Shares of $ASML-2.9% are up 11% today, which makes me personally quite happy as ASML is one of my largest positions.

What do you think of $ASML'-2.9%s results ?

ASML

ASMLWhat do you think about the current DeepSeek sale? What stocks do you plan to buy after the market opens?

Shares of U.S. technology companies have fallen sharply following news of Chinese artificial intelligence company DeepSeek's breakthrough. In the pre-market so far, $NVDA-5.8%, $MSFT-1.3% and $META-2.5%have fallen significantly , and $ASML-2.9% shares have lost over 10% after the opening bell...

Read more

Zobrazit další komentáře

The trady is just pouring in :) Great opportunity to trade this high volatility.

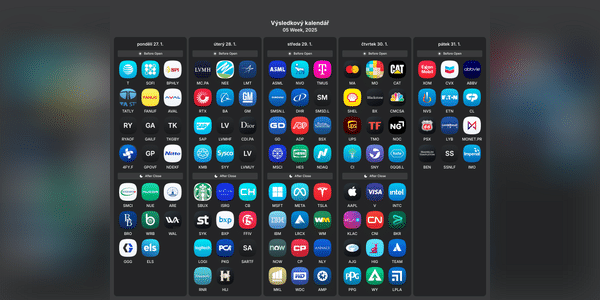

🗓️Klíčové market events of the week: the most important week of the month!

This week is full of interesting macroeconomic data and earnings reports from key companies. Here's a summary of the highlights! 👇

🏠Monday: New home sales!

Let's keep an eye on how the U.S. housing market is doing, which may indicate the health of consumers and the economy as a whole.

📊 Results before the...

Read more

Zobrazit další komentáře

As mentioned, the Fed's decision will be so important. In addition, I will be watching the results of $ASML-2.9%, $META-2.5% and $AAPL-1.0%.

We have a lot to look forward to this week as the biggest and most watched companies will be reporting results. I will be interested in the results of $SOFI-3.5%, $TSLA-5.6%, $META-2.5%, $ASML-2.9% and $AAPL-1.0%.

Which companies' results will you be interested in?

Zobrazit další komentáře

The $TSLA-5.6% and $NVO-2.6% will certainly be interesting, but Wednesday's Fed rate decision will be the most important.

Foxconn reported record sales earlier this week, leading shares in the semiconductor sector higher. Shares of $MU-2.2%, $NVDA-5.8%, $ASML-2.9% and $KLAC-2.3%, for example, rose significantly . I think it's great news and I'm happy for $ASML-2.9% stock as it's up 10% this week.

Do you have any of these stocks in your portfolio?

ASML

ASML🚀 Microsoft and the AI revolution: what does $80 billion mean for the future of technology? 💡

Microsoft $MSFT recently announced that it plans $80 billion in data center and AI investments for 2025. That's almost double the $44 billion last year ! This massive investment confirms that tech giants will continue to aggressively push the development of AI and related industries.

...

Read more

Zobrazit další komentáře

I honestly trust Google more, as I think they have more potential, but this news is great. Microsoft is really doing well and can simply afford such investments.

Investors, I have a question to lighten the load.

Do you use a company's products/services on a daily basis, and do you also hold its stock in your portfolio?

For me, it would definitely be $AAPL-1.0%, $GOOG-3.3%, and you could say $ASML-2.9%.

Zobrazit další komentáře

Bulios Black

This user has access to exclusive content, tools and features of the Bulios platform thanks to their subscription.

So I would say $NVDA-5.8%, $AMD-4.0%, $GOOG-3.3%, $MSFT-1.3% 😁

Which market do you invest in the most besides the US?

For me it's definitely Europe, mainly $ASML-2.9%, $MC.PA-0.6% and I have a little bit in Czech stocks. Eventually I plan to probably include Chinese stocks as well.

How much do you take into account the outlook of companies in your analysis? It's just that such $ASML-2.9% is not looking bad at all right now price-wise and I came across its outlook this morning which looks pretty good.

ASML

ASMLRead more

Zobrazit další komentáře

I definitely look at the outlook, and with ASML it's also one of the reasons I have their stock in my portfolio.

Are you buying $ASML-2.9%stock now that the price is so low?

Shares of $ASML-2.9% have been on a tear this year, down several dozen percent since its ATH. The outlook is still very bullish for next year and currently the stock is very undervalued, which is why I overbought this week.

ASML

ASMLZobrazit další komentáře

So far in this sector I'm in $LRCX-2.0% but the price here is already very interesting, I think it's just some reaction and uncertainty of what all is to come from Trump and his cells. But once things calm down I think the price will go up again. The outlook is great and the world just needs this company. 😁 I already have a lot of these technologies in my portfolio but I will probably open a position here as well.

Investors, which stock is most represented in your portfolio?

For me it is currently $ASML-2.9%, followed by $GOOG-3.3% and $AAPL-1.0%.

What stocks have you bought or sold the most so far this month?

I've sold $PFE-1.4%stock this month and have been buying $ASML-2.9% stock quite heavily during the current downturn .

Zobrazit další komentáře

I also used to buy $ASML-2.9% and otherwise I still regularly buy $SPY-1.2%.

In addition to $ASML-2.9%, $UNH0.9% stock also fell significantly today . Due to lowered expectations, the stock fell more than 7% today. I have $UNH0.9% stock in my portfolio, but it's only a small position and I'm not likely to overbuy.

Are you buying $UNH0.9%stock on the current downturn?

UnitedHealth

UNHZobrazit další komentáře

It's too late to buy now, but for example, $CVS1.1% stock is still at an interesting price.

I only have $ASML-2.9% for now, but I'm thinking of buying $AVGO-4.8% since the stock has dropped significantly this year.