Feed

Vlagatelji, rezultati katerega podjetja so vas ta teden najbolj presenetili? Ali ste pred rezultati ali po njih kupili ali prodali delnice katerega od podjetij?

Zadovoljen sem bil z rezultati družbe $BAC in nekoliko presenečen nad rezultati družbe $ASML. V ponedeljek pred rezultati sem še vedno kupoval družbo $BAC, v sredo po rezultatih pa sem kupoval družbo $ASML s popustom.

Delnice družbe ASML so se letos povečale za več kot 10 %, vendar je zame cena delnice še vedno odličen nakup. Včeraj je ASML poročal o svojih rezultatih, na katere gledam precej pozitivno, vendar se je delnica po rezultatih znižala za približno 5 % in se mi je zdela malce prenapihnjena.

Ali imate v svojem portfelju delnico ASML in ali ste pri trenutni ceni preveč kupljeni?

Odločil sem se, da ta mesec kupim nekaj delnic ASML. ASML izdeluje predvsem stroje za izdelavo čipov. Čipov bo potrebnih vedno več, kar pomeni, da bo podjetje v prihodnosti zelo uspešno. Osebno tu vidim velik potencial, podjetje ima zelo dobre temelje, zato bom kupil nekaj delnic, čeprav delnice niso ravno poceni.

Ali imate v svojem portfelju delnice družbe $ASML in pri kakšni...

Read more

Že nekajkrat sem omenil delnice družbe ASML, ki mi je zelo všeč, in še pred nekaj tedni nisem bil prepričan, ali bi kupil te delnice ali ne. Prejšnji teden sem kljub visoki vrednosti delnice kupil del delnice $ASML. Tu vidim velik potencial, podjetje pričakuje visoko rast prihodkov in na splošno pričakuje veliko rast v prihodnosti.

Delnic, ki so visoko, ne kupujem pogosto,...

Read more

Vlagatelji, katere delnice in ETF ste nedavno kupili ali prodali in katere delnice nameravate kupiti ali prodati?

Kot vsak mesec sem kupil $SPY, $MO in $CVS, ta teden pasem kupil še del delnic $ASML. Ničesar še ne prodajam, naslednji teden pa nameravam prodati del delnic $MMM, sicer pa kopičiti denar za morebitne padce.

Ker je nekdo omenil $ASML - ali menite, da je na svetu podobno pomembno, a neznano podjetje? Mislim, da bi to lahko bil BASF. Kaj menite vi?

BASF je eno največjih kemičnih podjetij na svetu, ki je specializirano za proizvodnjo kemičnih izdelkov za številne industrije. Podjetje proizvaja na primer polimere, pesticide, barvila, farmacevtske izdelke, katalizatorje, elektronske...

Read more

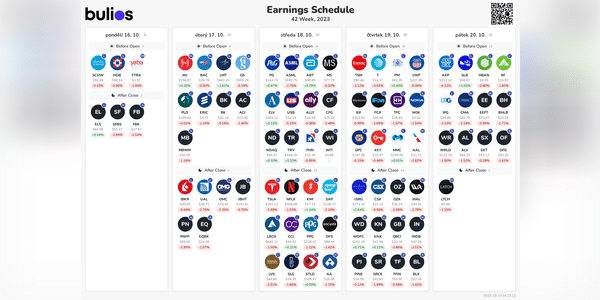

Jutri bodo o svojih rezultatih poročala številna zanimiva in znana podjetja, mene pa bodo najbolj zanimali rezultati nizozemskega podjetja $ASML. To podjetje proizvaja napredno opremo za proizvodnjo čipov. Podjetje ASML je finančno zelo stabilno. Poleg tega bi rad že zdaj kupil delnice evropskega podjetja. Vendar je vrednost delnic trenutno zelo visoka.

...Read more

ASML $ASML

To evropsko podjetje se osredotoča na proizvodnjo napredne litografske opreme, ki se uporablja za proizvodnjo polprevodnikov.

Njihov glavni izdelek so litografski sistemi EUV, ki ustvarjajo majhne in natančne strukture na polprevodniških čipih. Ti sistemi se nato uporabljajo za izdelavo naprednih in zmogljivih čipov, ki se uporabljajo v računalnikih, mobilnih telefonih...

Read more