Feed

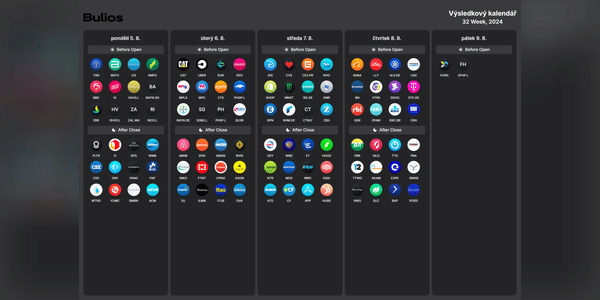

Questa settimana è stata piuttosto movimentata e sono successe molte cose sul mercato azionario. Anche la prossima settimana ci saranno molte società interessanti che presenteranno i risultati. Saròinteressato ai risultati di $O, $CAT, $DIS, $CVS, $WBD e $BABA.

Quali risultati delle società vi interesseranno la prossima settimana?

🗓️Následující settimana nel mondo degli investimenti: notizie ed eventi chiave!

Questa settimana seguirò soprattutto dati macroeconomici dagli Stati Uniti. Naturalmente ci saranno anche alcune società da tenere d'occhio!

Ecco una panoramica di ciò che accadrà:

🚬 Lunedì seguirò gli utili di British American Tobaccoprima dell'apertura dei mercati $BTI.

💬 Martedì avremo i dati...

Read more

Vedo che le azioni di $BABA sono scese di oltre il 20% nell'ultimo anno e, anche se si tratta di una società cinese, sto considerando di acquistarle. Tuttavia, questo titolo non è così importante per me e comprerei le azioni al di sotto dei 72 dollari.

Avete azioni $BABA in portafoglio e a quale prezzo siete in ipercomprato?

Oggi Alibaba Group ha comunicato i suoi risultati, che hanno battuto le aspettative. Non mi piace la politica cinese e al momento non so se voglio investire in azioni cinesi. Tuttavia, se il prezzo delle azioni dovesse scendere a 85 dollari o meno, probabilmente penserei di acquistarle.

Ha azioni di $BABA in portafoglio e come valuta i titoli cinesi?

Ragazzi, e voi e $BABA? State tenendo, state acquistando a questi prezzi? È da un po' che non ne parliamo qui su Bulios. Sì, si tratta della Cina, che anche per me è un ostacolo piuttosto grande, e per alcuni è un rischio sufficiente per evitare del tutto quel mercato. Dal punto di vista della valutazione, però, potrebbe non essere un cattivo acquisto, qual è la sua opinione?

Qualcuno potrebbe spiegarmi una cosa?

Le azioni di Alibaba Group e Tencent a Hong Kong si sono rafforzate lunedì dopo la multa di 984 milioni di dollari contro Ant Group, fondata da Jack Ma (Alibaba $BABA). Questo potrebbe segnare la fine delle restrizioni normative contro il settore tecnologico del Paese.

...Read more

Qualcuno segue più attivamente la Cina? Venerdì ho acquistato la mia prima posizione in $BABA.

Questa settimana molto probabilmente acquisterò $KWEB. Per chi non lo sapesse, si tratta di un ETF composto per il 50% da società tecnologiche cinesi, per il 25% da società di vendita al dettaglio,... (la quota maggiore è costituita da società come Tencent, Alibaba, JD.com). In...

Read more

LA SOCIETÀ DI INVESTIMENTO BERNSTEIN DECLASSA ALPHABET E ALIBABA

Secondo Bernstein, con l'aumento della concorrenza è arrivato il momento di mettersi in disparte.

Lunedì la società ha declassato il gigante tecnologico a Market Perform da Outperform con un prezzo obiettivo di 125 dollari per azione, pari a una crescita del 6% circa nel prossimo anno.

...Read more