Feed

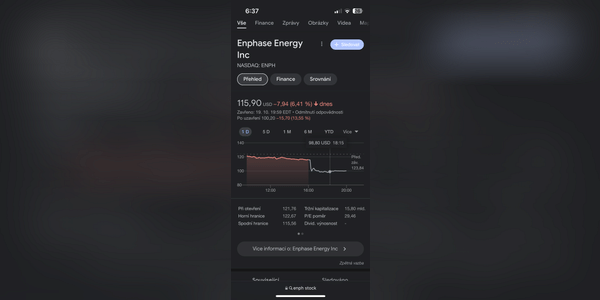

Quelle est votre opinion sur $ENPH? Je serais plus intéressé par votre point de vue sur les mouvements à court terme - allons-nous descendre plus bas ? Personnellement, je ne pense pas que nous verrons beaucoup de croissance ici jusqu'au pivot de la Fed. Le support solide devrait se situer à 110$, il ne nous reste plus qu'à franchir le niveau de 119$.

P/FCF : 19.59 et même le...

Read more

J'aime bien regarder les prévisions des analystes. Par exemple, pour le titre $ENPH, que j'ai acheté dans la fourchette 155-165$, les analystes ont donné une note neutre - sell. Aujourd'hui, le prix de l'action est de 182 $ et ils commencent à dire qu'ENPH est clairement un Achat 😅 ...Par conséquent, je ne me fie pas aux prédictions.

...Read more

J'aimerais ajouter au portefeuille des représentants du secteur de l'énergie. Mon meilleur pari est le $ENPH, souvent mentionné, qui pourrait être une excellente opportunité au prix actuel.

La direction a indiqué qu'elle était très prudente et judicieuse en ce qui concerne les rachats. Les derniers rachats ont eu lieu au quatrième trimestre 2021 à un prix moyen de 197 $....

Read more

Comme je l'ai écrit à plusieurs reprises par le passé, je m'y tiens. Je considère Enphase $ENPH comme une compagnie de qualité avec une vision prometteuse pour l'avenir. C'est pourquoi je ne vais pas attendre plus longtemps et je profite de la baisse massive d'aujourd'hui pour acheter.

Ce n'est pas une société étrangère pour moi, je l'ai achetée en 2022 et je l'ai vendue...

Read more

$ENPH Avez-vous des informations sur les résultats de cette société ? J'ai écrit plus sur ce sujet mais il n'y a pas eu d'intérêt et franchement je suis assez confus à propos de la chute. Je trouve des informations, de bonnes informations aussi je pense. J'ai passé la matinée à lire les infos sur cette société et je ne comprends pas les analystes car elle a publié de bons...

Read more

L'industrie solaire, qui est étroitement liée au secteur plus large des énergies renouvelables, est intrinsèquement attrayante. C'est en grande partie la voie qu'a empruntée l'Europe pour construire une infrastructure basée sur les énergies renouvelables. Les États-Unis, eux aussi, se concentrent sur les énergies renouvelables afin de réduire leur dépendance à l'égard des...

Read more