Feed

Zobrazit další komentáře

I see the most potential in WBD. I also like the management and their passion.

Zobrazit další komentáře

It's a great company and I believe NFLX stock will continue to grow for a few more years, but I'm investing in $DIS.

Netflix $NFLX said Wednesday that its quarterly revenue and subscriptions rose as efforts to curb password sharing took hold.

Here are the company's second-quarter figures compared with analysts' expectations, according to Refinitiv:

Earnings: $3.29 per share versus $2.86 per share expected.

Revenue: $8.19 billion versus $8.30 billion expected.

The streaming giant said it added 5.9...

Read more

Zobrazit další komentáře

Thanks for the summary and new information. Netflix is going in a good direction and I was surprised to see that they added 5.9 million customers due to password sharing restrictions. I don't own Netflix stock, however I do own Disney stock in portoflio. If NFLX stock somehow dropped significantly, I would happily buy some of the stock.

Tesla $TSLA Earnings per share (non-GAAP): $0.91 vs. $0.80 estimate. EPS (GAAP): $0.78 vs. $0.68 estimate. Revenue: $24.97 billion vs. $24.7 billion estimate. GAAP net income: $3.14 billion. GAAP gross margin: 18.2

Tesla surges in aftermarket after the earnings announcement.

Netflix $NFLX 2Q sales of $8.19 billion, $. Estimate $8.3 billion.2Q eps $3.29. Estimate $2.85.3Q EPS...

Read more

Zobrazit další komentáře

I'm looking at a little late, but I haven't looked at the results yet, so thanks for the recap.

I can't judge whether it turned out positively or negatively as I don't invest in Tesla.

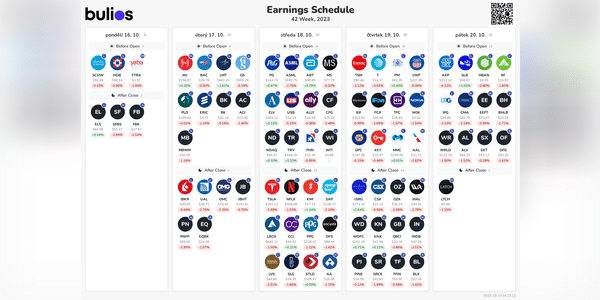

Stock Market Calendar (July 17 - July 21, 2023)

Earnings season is upon us, with quarterly economic numbers coming out in the third week of the holiday season, including $TSLA, $BAC, $NFLX and $AXP in the US. Investors will also be evaluating macro data and, on the old continent, the new economic forecast from the European Commission.

Outlook

"The coming week will belong to...

Read more

Zobrazit další komentáře

Netflix $NFLX has stabilized nicely after its big drop and is growing nicely. It's now getting to the level where it fell after earnings for the first time on January 21, 2022. If the price gets above that zone, the gap could be closed, so the price could rise another 11%.

With the positive market developments we are now experiencing this seems very likely. I will certainly keep...

Read more

These are the three biggest streaming platforms that have been competing quite a bit in recent years.

While$WBD competes with Netflix and Disney, I don't like the stock of this company at all. Over its entire history, the stock has been in the negative, which is not pretty at all, and it pays no dividend. Thus, I don't see much potential with this company...

Read more

Zobrazit další komentáře

I have a question more suitable for discussion. I often see in the premarket that various stocks are rising, and in a given report on investment sites, for example, it's stated that it's rising based on a change in analyst ratings.

Does it really work like that? But then that can also smack of market manipulation can't it? I'll give you an example 👇

...Read more

Zobrazit další komentáře

Sometimes it really is. Movements outside of trading hours are mostly based on news...

Well, I'm going to pretend I didn't read it and continue to trust Disney.