Feed

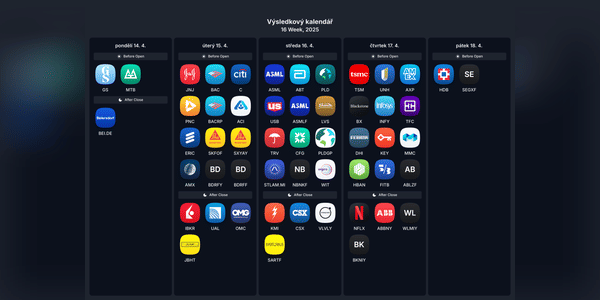

📅 This week's key events!

The results season begins! Apart from inflation data, US banks, tech firms and consumer companies are the main ones coming to the fore.

📌 Monday

Market reaction to Trump's tariffs announcement.

Results before markets open:

Orkla $ORKLY - Scandinavian giant in food, household chemicals and consumer goods.

📈 Tuesday

US CPI Inflation - The monthly consumer...

Read more

📆 Weekly Investment Review: earnings season in full swing, complete with important data and geopolitics!

A mix of corporate results, economic statistics and geopolitical challenges await us this shortened week. Markets will react not only to the numbers, but also to speeches by central bankers and politicians.

🏦 Monday

Results before the markets open:

Goldman Sachs $GS - I'll be...

Read more

Zobrazit další komentáře

There's quite a bit of this in there. I'll be interested to see where the shares go and there are also results of companies I'm interested in.

Zobrazit další komentáře

Netflix could be quite interesting, and if the results were worse and the stock fell, I might buy.

Lately I've been thinking about including $TSMstock in my portfolio . TSMC is a great and very important company that is performing well and still has great potential. The stock has fallen nicely since the beginning of the year and the P/E is not that high either.

Are you buying $TSMstock on the current downturn or are you buying other stocks in the sector?

Zobrazit další komentáře

I will be interested in the results of $NFLX, $BAC and $TSM.