Feed

Hi everyone,

I've been investing for just under a year and my portfolio is mostly made up of Google, Amazon, Novo Nordisk, and SoFi. I recently bought more Grab. In recent weeks some stocks have been falling, so I decided to add to my positions—mainly Amazon and SoFi.

I want to further diversify and "secure" my portfolio, so I'd like to buy something. I thought of $WMT, $KO, $PEP...

Read more

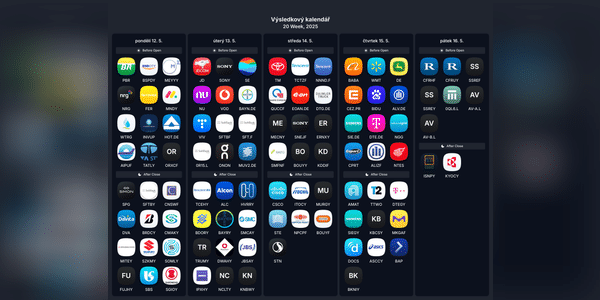

📈 Weekly Investment Review: inflation, Fed and interesting results!

This week is packed with crucial data from the US economy, the Fed Chair's speech and company results from around the world.

🌍Monday

Market reaction to positive feedback in the US-China negotiations.

📉 Tuesday

US inflation (CPI) - Key number of the week. Even a minor deviation can significantly change the mood of...

Read more

Zobrazit další komentáře

The stock is still expensive, but I established a small position yesterday. In fact, $WMT stock doesn't fall this much very often.

Walmart boosts market share on rising demand for savings

-Growth at the expense of competition:$WMT Walmart benefits from higher demand for affordable goods, weakening smaller players.

- Strong segments: Sales are boosted by food, healthcare and digital advertising, which offset weaker non-food sales.

- Threats to growth: High investor expectations, intensifying competition and...

Read more

Zobrazit další komentáře

For me, it's one of the best companies right now. I would love to include $WMT in my portfolio, but the price is too high right now.

📅 Key events of the week: What to watch out for in the markets?

This week will bring key economic data, earnings reports and events that could impact global markets. Here's my round-up of the highlights:

🟥Monday:

Presidents Day (Presidents Day) - US stock markets will be closed.

🗣️ Tuesday:

Trump & Musk interview on Fox News - possible market reactions to topics related to...

Read more

Zobrazit další komentáře

Awesome these posts are advisory, they always get me in the mood for the next week. Otherwise the Trump and Musk thing, well it may be interesting but I'm more interested in Apple and then the $VICI thing plus after the recent $CVS rise I'm also curious about the $MDT and Healthcare sector even if it doesn't have some direct effect on CVS. $OXY and $RIO I'm also holding so I'm curious.

Target reported its results on Wednesday, which were not good at all, and $TGTstock subsequently fell more than 20%. Overall, I'm not very impressed with this company and if I had to pick a company in this sector, I'd pick $WMT, but I don't want their stock in my portfolio either.

What is your opinion of Target?

Zobrazit další komentáře

This could be an interesting buying opportunity. But I'm definitely not buying TGT.

Walmart reported earnings today, which were not bad at all, and the stock rose about 3% in response. I don't have $WMTstock in my portfolio and probably don't want to, but you can see that the company is doing well and the stock has been steadily and very solidly rising over the long term.

What's your take on Walmart?

🚀 Walmart shines again: record sales and improved profit outlook!

Walmartshares $WMT have performed remarkably for the year! After announcing results that beat expectations, they are up more than 3 % and for the year to date, they're already up more than 64 %. This growth reflects not only market confidence, but also the company's strong position in the retail arena.

...Read more

Zobrazit další komentáře

I looked at Target's results, and they were terrible. $WMT is doing significantly better.

🗓️Klíčové events not to be missed this week!

Keep an eye on the markets as this week is packed with major events that can bring interesting opportunities and challenges. Nvidia is sure to be a major target this week as it announces its results, which will mainly affect the technology market.

🌍 Monday:

G20 meeting - Global leaders discuss economic issues, geopolitical risks and...

Read more

Zobrazit další komentáře

There are some interesting events again. I'll be interested to see some results and Monday could be interesting as well.

📆 Overview of interesting things for the upcoming week! 🚀

The results season is slowly coming to an end, this week I'll be taking it easy and enjoying the sunny weather!

Here's a list of interesting things to look out for:

💼Tuesday: U.S. Producer Price Index (PPI): This measure of inflation in the manufacturing sector can give us a clue as to what price pressures we can expect at...

Read more

Zobrazit další komentáře

I'll be interested in some results, but mostly I'll be interested in the CPI.

I agree with the others; safe stocks are very expensive right now, but I definitely wouldn't be afraid of Berkshire Hathaway — it currently sits on massive cash and if a downturn or crisis comes, it will certainly take advantage of it!