One of the world's largest cryptocurrency exchanges, Binance, will merge its customers' funds with the company's revenue in 2020 and 2021, which contravenes US financial regulations that require client money to be kept separate.

One of the sources said the sums involved were in the billions of dollars, which were commingled almost daily in the exchange's accounts held with US bank Silvergate Bank. Bank records show that on February 10, 2021, Binance commingled $20 million from its corporate account with $15 million from an account to which customers were sending money.

Binance's cash flows indicate a lack of internal controls to ensure that customer funds are clearly distinguishable and separate from the company's revenue. Three former U.S. regulators agreed that commingling these funds put client assets at risk by obfuscating their location.

"Binance customers shouldn't need a forensic audit to find out where their money is," said John Reed Stark, former head of the U.S. Securities and Exchange Commission's Internet fraud enforcement bureau.

The exchange has grown rapidly in recent years to become a key player in the cryptocurrency market. It allows a wide range of cryptocurrencies to be traded with minimal regulation, attracting both mainstream investors and fraudsters and criminals.

With the huge volume of transactions, one would expect there to be strict rules and controls, but the opposite was true and Binance commented on its practice as "cyber hygiene". Until last year, Binance allowed completely anonymous trading without verifying users' identities, which was quite strange given the nature of the business.

However, Binance denied that it commingled customer deposits and company funds in the same accounts.

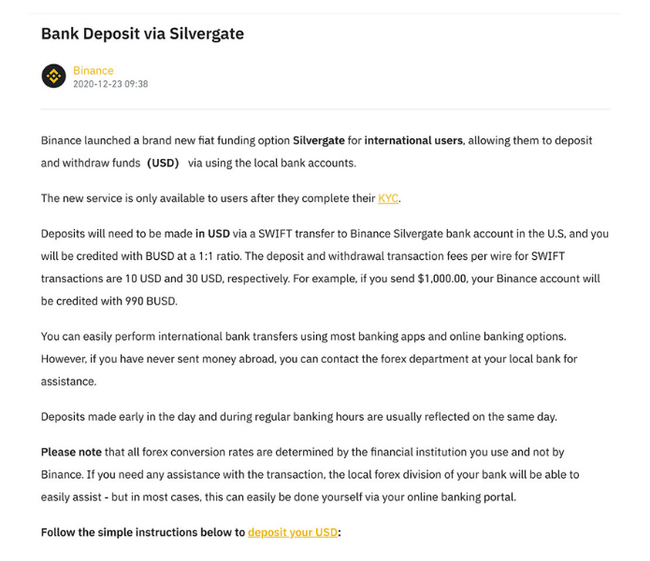

"These accounts were not used to accept user deposits; they were used to facilitate user purchases of cryptocurrencies, said spokesman Brad Jaffe. "There was never any commingling because these are 100% corporate funds." When users sent money to the account, they were not depositing money, but buying a custom-made BUSD cryptocurrency linked to the dollar."

The Binance exchange denies that it mishandled its customers' money. According to spokesman Brad Jaffe, the company did not use clients' accounts to store their deposits, but only to broker cryptocurrency purchases.

However, former regulators at the U.S. Securities and Exchange Commission said Binance had convicted itself of lying. Until recently, it informed clients on its website that they could send "deposits" in dollars to their accounts, which it would then hold in the form of BUSD cryptocurrencies. It even told customers that they could withdraw their deposits back in cash at any time. In doing so, such claims created a legitimate expectation in customers that their funds would enjoy the same protections as traditional bank deposits, one regulator suggested.

- However, Binance said that "the term 'deposit' is a communication term, it is not an indication of the technical treatment of funds."

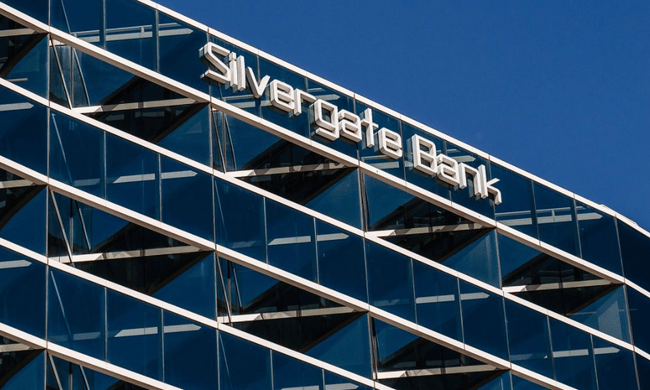

Silvergate Bank starring

Bank and company records from 2019-2021 and interviews with former employees revealed that Binance used US-based Silvergate Bank as the mainstay of its financial operations.

Binance's revenue flowed into a Silvergate account owned by Cayman-based Binance Holdings, according to sources and bank records. Customers' dollars went to the Silvergate account of Key Vision Development, a Seychelles company controlled by Binance CEO Changpeng Zhao.

In February 2021, Binance combined customer money and company revenue in a third Silvergate account belonging to a Cayman company controlled by Zhao, according to sources and bank records. Then Binance transferred money from this third account to a dollar-linked BUSD cryptocurrency. Records on the blockchain show that Binance bought at least $18 billion worth of BUSD between January 2020 and December 2021.

Former regulators have said transfers between accounts and into cryptocurrencies could allow Binance to hide funds from tax authorities in countries where it operates. A source inside Binance said there was another motive: Zhao distrusted banks and once told a reporter he feared they might freeze his company's accounts. So Binance converted cash into cryptocurrencies, mixing customer money and company revenue in the process.

Five months after launching the Shanghai exchange in July 2017, Zhao said in an interview with Asian TV station Tech that Binance has no banking partners because customers put money solely into cryptocurrencies.

But the situation changed in 2018 when Binance sought to launch several local exchanges where customers could buy cryptocurrencies with regular currency. Zhao sent representatives to find banks and payment companies willing to accept Binance as a client. But no one dared to put money and trust in the crypto industry, where there are many uncertainties.

After a long and unsuccessful search, Silvergate Bank finally came to the rescue. In recent years, the small San Diego-based bank has shifted from its original focus on real estate lending to local clients to serving crypto companies.

Over time, Zhao grew so fond of Silvergate that he opened 3 major accounts there for different company purposes. These were accounts for Binance Holdings, Key Vision and Merit Peak, which formed the core of the crypto exchange's global financial network.

Samuel Lim, then Binance's Chief Compliance Officer, had serious concerns about the exchange's over-reliance on Silvergate due to US banks' requirements to closely monitor client transactions. Lim wrote to executives in an internal memo in 2020 that "the best long-term solution is to reduce our dependence on US banks."

- The CFTC's March lawsuit accused Lim of aiding and abetting Binance's violations of U.S. law "by willful conduct that undermined Binance's compliance program."

Lim's concerns were not unfounded. As Binance grew rapidly, it became increasingly dependent on Silvergate and its services. Accounts with Silvergate accounted for a large portion of Binance's fund movements and allowed the company to accept customer deposits and convert them into cryptocurrency without having to face the strict scrutiny of traditional banks. For Binance, this was the ideal symbiosis that helped it rise quickly. At the same time, it represented a weak point that could easily be exploited by regulators if they found out how it worked.

Lim reportedly sought to free Binance from its dependence on the US financial system and urged the company's management to diversify its revenue sources and partner banks more. Binance executives, however, mostly ignored his recommendations and continued to rely on Silvergate, which provided a convenient way for them to circumvent regulations and gain an ever-increasing market share.

The fact remains that these funds in all accounts were commingled and eventually converted to the BUSD token. It is estimated that at least $18 billion was converted into BUSD tokens.

The BUSD ban

In February, however, New York regulators ordered Paxos to stop issuing BUSD, citing Paxos' failures in risk assessment and due diligence.

A Paxos spokesperson said the company "voluntarily announced its intention to terminate its relationship with Binance and has since successfully terminated all trading relationships with Binance."

Since Paxos stopped issuing BUSD, Binance has reduced its coin holdings to about $3 billion, according to Nansen. But no one has been able to determine why Binance reduced those holdings or how it converted them. Merit Peak also received money from other sources, including hundreds of millions of dollars from the Binance US account.

Then in 2020, another interesting announcement came that Silvergate would close the Key Vision account from Binance (one of the 3 main accounts) in mid-2021. Silvergate made the decision based on the fact that Key Vision had made transactions that were inappropriate for a bank account.

Binance then began using the Key Vision account at Signature Bank to receive customer funds, according to sources and screenshots of user transactions. Unfortunately, Signature Bank wasn't the solution either; Binance needed other banks.

Specifically, it needed a reliable bank account in euros. She found a solution in Lithuania, which provided her with a base in the European Union and a simple registration process. In May 2020, Binance established a Lithuanian company originally called Binance UAB with Zhao as the sole shareholder.

- Binance later introduced the company, renamed Bifinity, as its "official fiat-to-crypto payment provider".

Bifinity became an important part of Binance's business development. It recently obtained a license to provide crypto services in Lithuania, despite warnings from the central bank, which will allow Binance to offer its services throughout the EU via its Lithuanian base.

Last year, Litas received permission to operate a bank specializing in cryptocurrencies, which Binance plans to open in Europe. The move would significantly strengthen the exchange's financial infrastructure and allow it to better compete with major players in the industry.

To become a full-fledged bank, Binance must demonstrate to regulators that it has robust compliance systems and does not engage in money laundering activities. In the past, it has faced inadequate scrutiny of customers' sources of funds, prompting some countries to impose sanctions and authorities to investigate its activities. Binance has therefore had to strengthen its compliance controls recently.

The solution is its own bank

Opening a bank would represent a significant shift for Binance from its roots as an independent cryptocurrency exchange. It would allow it to have more influence over the traditional financial system and use its customers' savings to trade, lend and invest in other companies. This would make it more like the big investment banks.

However, in the beginning, it will mean more attention from regulators, who will closely monitor Binance Bank's development to avoid money laundering or circumvention of regulations. If Binance wants to become a truly serious global investment bank, it will have to gain their full trust and convince them that it is in control of all aspects of its vast business.

When the Lithuanian parliament debated a new law last year to tighten rules for crypto companies in the country, Saulius Galatiltis (CEO of Bifinity) urged a parliamentary committee to avoid stricter legislation. He highlighted Bifinity's tax payments last year, which made it one of Lithuania's biggest taxpayers.

"This business is global, in many countries around the world," Galatiltis told the committee when discussing Bifinity. "I think a business that operates globally and pays taxes locally must be attractive to every country," he said. Galatiltis.

Parliament ultimately voted for a watered-down set of rules. Lithuania's finance ministry said Bifinity was involved in a formal process of "providing comments and suggestions" on the draft law, along with other institutions and market participants.

More information about Bifinity can be found here: Binance Launches Payments Technology Company, Bifinity | Binance Blog

If something happens to the biggest crypto exchange in the world, that BTC will crash one or two. Then not even Musk can save it...

I don't trust Binance and I don't have a good experience, something is always not working and I always had the feeling that I might not get my money tomorrow.

It's an interesting one in terms of trying to become an investment bank as well. But I don't think I'd trust them either. I like BTC but simply in their hands. I like the way the blockchain is built and the sense it makes, but if this world were to merge with that of fia, it would definitely need some rules and regulations, otherwise it's going to get abused a lot.

Whether it's FTX or Binance, I don't trust them at all. That's not against cryptocurrencies at all, but it seems to me that they don't care about a lot of things with these crypto exchanges and then there are these ambiguities that they get around like in this case.