In the covid years, the world bowed before the great visionary and fund manager of $ARKK Invest, Cathie Wood. Her fund invests mostly in technology companies with great potential for the future. For larger companies, success has already taken place. For example, in the case of $TSLA stock, but some smaller companies haven't performed well yet. In 2020, as the market in general grew, so did the value of Arkk as its holdings increased, which included small growth companies that have seen huge growth. But after the peak 2 years ago, the situation changed and the market started to fall. $ARKK has fallen 74% since the peak. Now Cathie is trying to buy more companies and for the ones he already owns at least predicts future prices. Sometimes that's really something.

1. Tesla ($TSLA)

Cathie Wood loves Tesla. She even thinks Tesla will be worth $2,000 by 2027. At today's prices, with Tesla up nicely since the beginning of the year, that's an appreciation of over 800%. Let's take a look at why he thinks so.

It starts with expanding production numbers. With every Tesla that rolls off the assembly line, the company gains a new platform for a technology that Kathie Wood sees as the next chapter in the Tesla story.

Once Tesla hits the road, consumers can enable full-service driving (currently in beta). And while the system is far from perfect, Tesla is quick to note that full-autonomous driving is already safer than human-only vehicles.

A fleet of self-driving cars could revolutionize transportation - and skyrocket Tesla's stock price. And while there are plenty of naysayers when it comes to fully automated driving and robotaxis, $ARKK isn't worried. After all, they've proven the critics wrong before with Tesla. Remember, they bought their first Tesla stock at a price of $13 per share. So while owning Tesla stock isn't for everyone, for Kathie, it might make a difference.

For me, Tesla is really expensive right now and doesn't make sense to me. This stock is actually I would say cursed to the point of being cursed for me, and I probably won't be a part of its journey. It's still a great deal for some, but my portfolio isn't ready for Tesla yet, and certainly not at these prices...

2. Coinbase

As a crypto exchange, Coinbase makes money in several ways, including transaction fees when customers trade (individuals and institutions), subscriber services, crypto asset deposit and custody, and more. The company's revenue for the last 12 months is $2.8 billion, but you can see that dropping significantly, mainly due to the bear market in cryptocurrencies.

But Kathie Wood likes Coinbase simply because it invests in cryptocurrencies, and exclusively in Bitcoin $BTCUSD.She predicts that its price will be above the $1,000,000 mark by 2030.

Coinbase is not a risk-free investment. The company is going through a challenging regulatory environment, including clashing with US regulators over how cryptocurrencies should be governed. This is only glaring after the collapse of its competitor FTX. In addition, Coinbase can be a volatile business at times because it essentially revolves around the crypto economy.

But the potential reward is also greater. Coinbase becomes a more significant industry leader as competitors fail and the crypto economy can be huge.

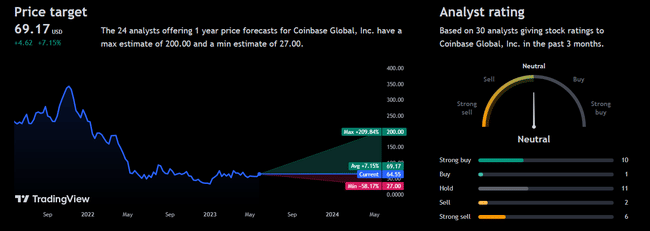

Coinbase has hit analyst price targets as high as $200, a 245% gain, but imagine the bigger picture. For some reason, Kathie has made Coinbase a key holding, and if her prediction about bitcoin comes to fruition, Coinbase could be an exciting investment in the coming years.

3. Roku ($ROKU)

Kathie's team believes revenue will grow an average of 39% per year, with most of the increase coming from video advertising revenue. This makes this prediction amid an advertising slump that has dramatically slowed Roku's growth in 2022.

To that end, Wood and her team are continuing to shop Roku. Share counts have climbed from a low (more than 3 million shares) in the summer of 2021 to just over 11 million today . Today, Roku accounts for nearly 5% of Ark Invest's shares.

Despite the ad slump, however, streaming hours grew 20% year-over-year in the most recent quarter . Ad markets also tend to act cyclically, and such growth should boost ad revenue when spending recovers. Roku's market share, which was 31% in the second quarter of 2022, is also the largest, according to Conviva. That would likely make Roku the biggest beneficiary of digital ad renewals.

Cathie's bet could pay off if Roku rises to Ark Invest's expected price, which is $605 per share or, in a bullish scenario, to a high of $1,493 per share. Yet Ark Invest has also outlined a possible bearish scenario where its price rises to just $100 per share.

All of these companies are at least on my watchlist and I follow their charts. I'm actively tracking Tesla, and I'm watching its upward gallop so far this year. I've also traded Coinbase a few times but it's different with Roku. I only follow that stock a little and haven't made any trades on it yet.

I understand that sometimes the guesses are good, but I've been following Cathie Wood lately mostly for my personal amusement...some of her predictions seem completely out of whack, but maybe she has other information. Do you invest in these companies? More likely in Roku or Coinbase, everyone probably knows Tesla.

Tesla is finally coming to my shopper. It was a very unwise purchase, so I hope I can sell it without a loss. It's not that I don't trust Tesla, I just want only well thought out investments in my portfolio. But then again, I don't trust it as much as Cathie. 😁