Solid companies can continue to grow in good times and bad. These are the types of stocks that you want to own for the long term because over time they deliver higher returns and net income, leading to a higher stock price. Patience is key because companies need time to build a solid base, reinvest profits and implement business development initiatives. These stocks are good for long-term holding as well as short-term buying and realizing gains just on the fact that companies will return to where they were not long ago.

1 . Roblox $RBLX

Roblox Corporation is an American technology company that develops and operates the online platform Roblox. It was founded in 2004.

Roblox is one of the most popular games and game creation platforms in the world. Users can create their own games using the simple Lua programming language and share them with other users. The platform allows players to interact with different game worlds and environments where they can create their own characters, buy and sell virtual items, and interact with other players.

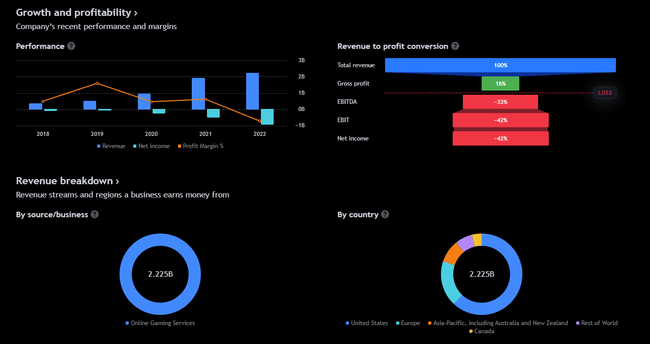

The company has seen strong growth between 2020 and 2022, with revenues more than doubling from $923.9 million to $2.2 billion. Although Roblox still suffers from losses, it has generated an average positive free cash flow of $312.5 million over the past three years .

Daily active users have nearly quadrupled from 15.8 million in Q1 2019 to 58.8 million in Q4 2022. Hours played have also more than quadrupled from 2.97 billion to 12.8 billion over the same period.

That momentum has carried over into 2023, when the company reported a 22% year-over-year increase in revenue to $655.3 million. Roblox announced a program to help expand its brand and introduce a global advertising system to its platform. This new affiliate program has signed up early adopters such as Century Games and Dentsu with experience in creating 3D content and has committed to minimal spending for the next 12 months.

2. MercadoLibre $MELI

Mercado Libre is one of the largest e-commerce platforms in Latin America. It was founded in 1999 in Argentina and today operates an online marketplace that allows users to buy and sell a variety of products, including electronics, fashion, cosmetics, housewares, books, cars and much more.

Mercado Libre provides a platform where buyers and sellers meet. Users can create their own accounts, post advertisements, and conduct transactions through a variety of payment methods, including credit cards, bank transfers, and electronic payment systems.

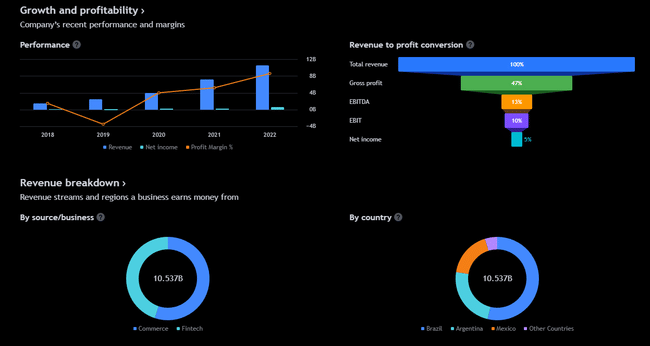

The number of payment transactions increased more than sixfold from 838 million to 5.5 billion from 2019 to 2022. Over the same period, gross merchandise volume increased from $14 billion to $34.4 billion, while total payment volume more than quadrupled from $28.4 billion to $123.6 billion.

Unsurprisingly, revenue jumped from $4 billion to $10.5 billion from 2020 to 2022, with the e-commerce company generating positive free cash flow for all three years.

There was no slowdown in MercadoLibre's growth in the first quarter of 2023. Revenue grew 35.1% year-over-year to $3 billion, while net income more than tripled year-over-year to $201 million.

3. Ulta Beauty $ULTA

Ulta Beauty is an American company specializing in the sale of cosmetics, shampoos, skincare and fragrances. It was founded in 1990 and is based in the state of Illinois.

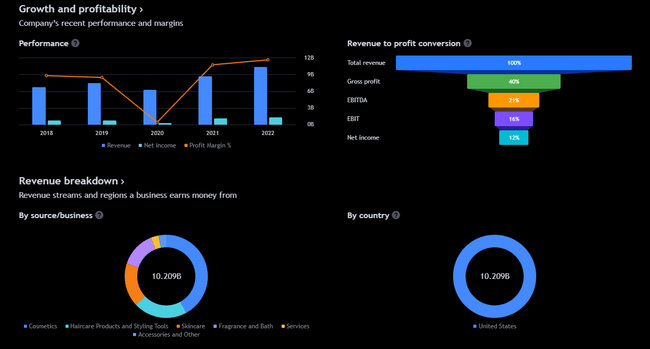

Ulta Beauty operates brick-and-mortar stores as well as an online platform that offers a wide selection of products from various brands. Their product range includes makeup, hair care products, skin care, nail care, perfumes and more. The company focuses on providing a wide selection of products, including high-end brands and affordable options.

Ulta Beauty has seen steady growth in sales and net income from fiscal 2019 to fiscal 2023, with an expected decline in fiscal 2021 due to the impact of the pandemic. Revenue climbed from $6.7 billion to $10.2 billion over the four-year period, with net income nearly doubling from $658.6 million to $1.24 billion.

Approximately 95% of the company's revenue comes from members with purchase and preference information, providing Ulta Beauty with a strong database it can leverage for consumer insights. The first quarter of fiscal year 2024 saw continued growth, with sales up 12.3% year-over-year to $2.6 billion, while net income increased 4.7% year-over-year to $347 million.

This is not financial advisory business. I am providing publicly available data and sharing my views on how I would conduct myself in these situations. Investing is risky and everyone is responsible for their decisions.

Great, thanks for the tips.

$MELI is an interesting company, but the price per share is quite high. I don't like buying factions...Roblox doesn't appeal to me personally, but Ulta could be interesting. Check it out more.