The opportunity of the decade. Top stocks from a popular sector are almost free

Most of the market has been drowning in blood lately. But one sector is of more interest to investors - chips. And it's these stocks that analysts aren't afraid to say are now almost giving away for free! Which ones in particular?

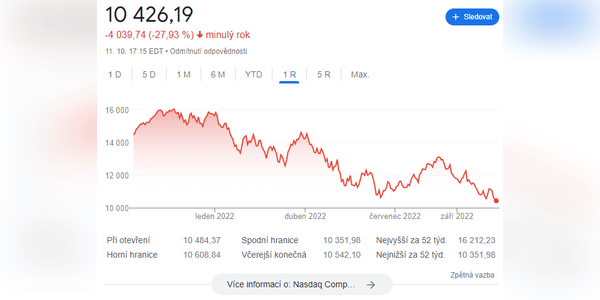

Stocks closed lower on Monday, with the Nasdaq Composite Index falling to its lowest level in two years, as technology stocks continue to be the hardest hit in this bear market due to the sharp rise in interest rates.

The Nasdaq Composite closed at around 10,542, hitting its lowest number since July 2020. But the important thing is that it was dragged down by specific stocks. Mainly Nvidia $NVDA and AMD $AMD, among others.

The policy change weighed on semiconductor stocks after the Biden administration announced new export controls that restrict U.S. companies selling advanced…

Great!

ghjgvjgv

I like this

a good choice

Motilal Oswal has given buy call to Brigade Enterprises Ltd with a target price of Rs 720 apiece. Current market price of Brigade Enterprises Ltd is Rs 451.70 apiece with intraday gain of 0.44%.

If you buy Brigade Enterprises Ltd now, you will potentially get 60% return. The stock's 52-week high is Rs 585.00 apiece and 52-week low is Rs 385.25 apiece, respectively. The company has a market capitalisation of Rs 10,419.04 crore.

The mid cap stock, operating in Real Estate sector, declined 10% in last 3-months and 4% in last 1-year.The stock has given 99% return in last 3-years and 131% in last 5-years.

very good reasom m here to disucss stock

Please!! note that this is not financial advice Every investment must go through a thorough analysis

Thanks!

https://www.flowcode.com/page/laguerredeslulusstreamingfilmshttps://www.flowcode.com/page/m3ganvoirstreamingfilmshttps://www.flowcode.com/page/babylonvoirstreamingfilmshttps://www.flowcode.com/page/vaincreoumourirstreamingfilmshttps://www.flowcode.com/page/tuchoisiraslaviestreamingfilmshttps://www.flowcode.com/page/maydayvoirstreamingfilmshttps://www.flowcode.com/page/divertimentovoirstreamingfilmshttps://www.flowcode.com/page/retouraseoulstreamingfilmshttps://www.flowcode.com/page/lafamilleasadastreamingfilmshttps://www.flowcode.com/page/pattieetlacoleredeposeidonvfhttps://www.flowcode.com/page/nenehsuperstarstreamingfilmshttps://www.flowcode.com/page/voirtarstreamingfilmshttps://www.flowcode.com/page/unpetitmiraclestreamingfilmshttps://www.flowcode.com/page/andrerieuindublin2023streaminghttps://www.flowcode.com/page/pomponoursstreamingfilmshttps://www.flowcode.com/page/saloumstreamingfilmshttps://www.flowcode.com/page/interditauxitaliensstreamingvfhttps://www.flowcode.com/page/elgatoconbotas2peliculaonlinehttps://www.flowcode.com/page/babylonpeliculaonlinevergratishttps://www.flowcode.com/page/loboferozverpeliculaonlinehttps://www.flowcode.com/page/tarverpeliculaonlinehttps://www.flowcode.com/page/theofferingpeliculaonlinehttps://www.flowcode.com/page/devotionheroespeliculaonlinehttps://www.flowcode.com/page/babylondeutschkostenloshttps://www.flowcode.com/page/m3ganganzerfilmstream

https://www.flowcode.com/page/xemphimnhabanuonlinehttps://www.flowcode.com/page/xemphimm3ganfullonlinevietsubhttps://www.flowcode.com/page/phimbacthaykiemdaofullhdonlinehttps://www.flowcode.com/page/xemchichiemem2phimonlinehttps://www.flowcode.com/page/xemphimavatar2vietsubfullhdhttps://www.flowcode.com/page/pororoxemphimfullhdvietsub2023https://www.flowcode.com/page/xemphivutoansaofullhdvietsubhttps://www.flowcode.com/page/phimmeobeosieudangonline

I Like Your Post.

Comment