Warren Buffett's favorite stock has done an insane 131% this year. Find out if it's worth buying here

If Warren Buffett buys something, it's usually a slam dunk. And this was no different. One of his investments has already made 133% this year! And according to many, there's a very good chance it's far from over! Which company is it?

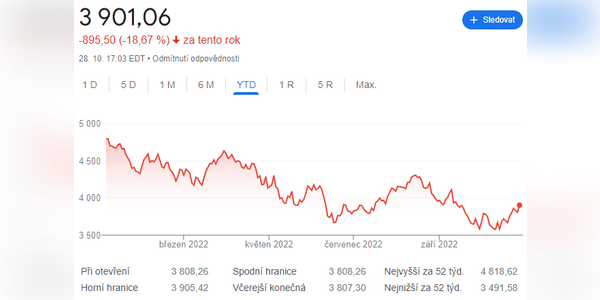

The combination of "great performance" and "stocks" may seem like a pretty unrealistic pairing this year. But despite double-digit losses for the major indices in 2022, there are still some individual stocks that have generated significant gains.

Occidental Petroleum $OXY A company that has managed to increase its value by 131% this year. It has come to the forefront of investor interest, especially after legendary investor Warren Buffett took notice and added an additional 5.99 million shares to his portfolio, according to a September 28 Securitiesand Exchange Commission report . Since July, Buffett's investment company, Berkshire Hathaway $BRK-B,…

good