Morgan Stanley: Sell this stock immediately, its price could fall 87%

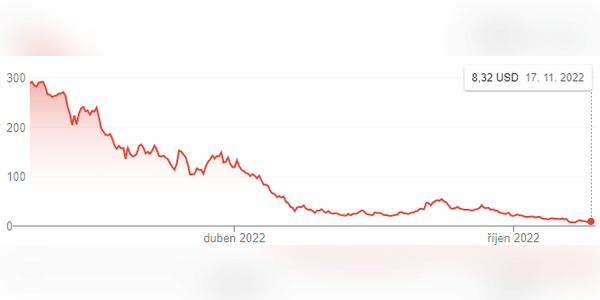

While in 2020 and 2021, Carvana stock was seen as the clear winner of the pandemic era, this year it's exactly the opposite. You'd be hard pressed to find a stock that, like CVNA, has fallen more than 97% in the past year. That may not be all, however, as analysts are already looking for further declines in the higher teens.

So what's going on?

Carvana' s $CVNA stock has risen sharply for most of 2020 and 2021, earning it a peak market valuation in excess of $60 billion. Supply chain snafus kicked off a shortage of new cars that sent buyers flocking to the used car market in droves. The price of used vehicles began to skyrocket as a result. And during the scariest period of the pandemic, Carvana offered people the option to buy cars online and have them delivered to their homes. But now the used car market is slowing, which has dealt a blow to Carvana and other dealerships.

Q3 results

Here's how Carvana fared compared to…

few quarters have shown

Great!

nice information

im interest about Other tools

Education - it's not necessary, you can find a lot of quality content elsewhere than directly at the broker (for example here on Bulios 😇), but it's not a bad thing if the broker offers it.

Verry nice information, Thanks for sharing.

Greats