This is probably the oldest working investment strategy in the world. What makes it so special?

There are countless investment strategies. Some better, some worse. Some work for a short time, some for a long time. But there aren't many that survive and work after 70 years. But there is one!

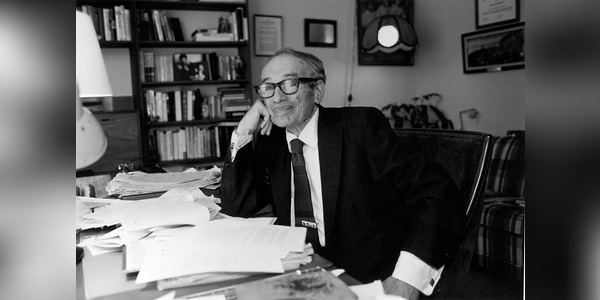

And that is none other than Benjamin Graham' s legendary strategy , which proved its power in his hands and in the hands of his disciple Warren Buffett - arguably the greatest investor of all time. Graham's ideas and methods of investing are well documented in his books Security Analysis (1934) and The Intelligent Investor (1949), two of the best-known texts on investing ever written.

And it seems to be something that really works. Thousands of investors, including Warren Buffett, have been following these fundamentals for 73 years. And they're still mostly successful!

https://www.youtube.com/watch?v=npoyc_X5zO8

What is the essence of Graham's investment philosophy?

Benjamin Graham's investment philosophy boils down to…

i like information

NICE POST THANKS!

https://communityin.oppo.com/thread/1257017037646725120https://communityin.oppo.com/thread/1257019883783716870https://communityin.oppo.com/thread/1257019890276499461https://communityin.oppo.com/thread/1257019896350113793https://communityin.oppo.com/thread/1257019901584605185https://communityin.oppo.com/thread/1257027661189349382https://communityin.oppo.com/thread/1257028217236881415https://communityin.oppo.com/thread/1257029618385813506https://communityin.oppo.com/user/1257016204397903876

https://communityin.oppo.com/thread/1257024250809155591https://communityin.oppo.com/thread/1257024355155050505https://communityin.oppo.com/thread/1257024863395905541https://communityin.oppo.com/thread/1257025179948417025https://communityin.oppo.com/thread/1257025538007760900https://communityin.oppo.com/thread/1257029650715508742https://communityin.oppo.com/thread/1257029703454949378

https://bulios.com/status/83355-avatar-2-the-way-of-water-2023-fullmovie-online-streaming-for-free-at-homehttps://bulios.com/status/83356-avatar-2-the-way-of-water-2022-yts-torrent-download-yify-movieshttps://bulios.com/status/83357-avatar-2-the-way-of-water-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83358-watch-avatar-2-the-way-of-water-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83354-download-avatar-2-the-way-of-water-2022-full-movie-download-free-720p-480p-and-1080p

https://bulios.com/status/83359-watch-m3gan-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83360-m3gan-2022-yts-torrent-download-yify-moviehttps://bulios.com/status/83361-m3gan-2023-fullmovie-online-streaming-for-free-at-homehttps://bulios.com/status/83362-m3gan-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83363-download-m3gan-2022-full-movie-download-free-720p-480p-and-1080p

https://bulios.com/status/83364-the-legend-of-maula-jatt-2022-yts-torrent-download-yify-moviehttps://bulios.com/status/83365-watch-the-legend-of-maula-jatt-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83366-the-legend-of-maula-jatt-2023-fullmovie-online-streaming-for-free-at-homehttps://bulios.com/status/83367-the-legend-of-maula-jatt-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83368-official-watch-the-legend-of-maula-jatt-full-movies-online-for-free

https://bulios.com/status/83369-babylon-2022-yts-torrent-download-yify-moviehttps://bulios.com/status/83370-watch-babylon-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83371-babylon-2023-fullmovie-online-streaming-for-free-at-homehttps://bulios.com/status/83372-babylon-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83373-download-babylon-2022-full-movie-torrent-download-free-720p-480p-and-1080p

https://bulios.com/status/83374-download-pathaan-2022-full-movie-torrent-download-free-720p-480p-and-1080phttps://bulios.com/status/83375-pathaan-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83376-pathaan-2022-yts-torrent-download-yify-movieshttps://bulios.com/status/83377-pathaan-2023-fullmovie-online-streaming-for-free-at-homehttps://bulios.com/status/83378-watch-pathaan-2022-fullmovie-free-online-on-123movies

https://events.ydr.com/event/582f22dd5cde86196591ccd7379b3f2ahttps://events.ydr.com/event/573341f4113336a527af765f08463ebehttps://events.ydr.com/event/356d50ea9c09dff5d88c6c6fdefa586chttps://events.ydr.com/event/c066c2529f223ea4cff6f63314f78ee5https://events.ydr.com/event/0865b749a930290be16a9ff1cf85c69bhttps://events.ydr.com/event/f31348ee5633c663265b8816351a5489https://events.ydr.com/event/69b5a43617fb3a889827b440a4d047bbhttps://events.ydr.com/event/72d1ef690f0d0b66a35aa7b45774367chttps://events.ydr.com/event/5977affb36183b91f68bfb51b84b81dchttps://events.ydr.com/event/52ebad4abd13a616d6f06ea30324bf6b

https://communityin.oppo.com/thread/1257102198744809477https://communityin.oppo.com/thread/1257103344284467203https://communityin.oppo.com/thread/1257103372436635653https://communityin.oppo.com/thread/1257103395740188676https://communityin.oppo.com/thread/1257103417709953026

https://communityin.oppo.com/thread/1257033504483966982https://communityin.oppo.com/thread/1257033538994700292https://communityin.oppo.com/thread/1257033611170545669https://communityin.oppo.com/thread/1257033634935472129https://communityin.oppo.com/thread/1257033653390409734

vary good

Great quality investment

good information

Is forex hard?

The S&P 500 fell 0.40% to close at 3,824.14 slipping from highs of the day when December’s manufacturing index declined at the fastest pace since May 2020. The Dow Jones Industrial Average ended the day down 10.88 points, or 0.03%, to 33,136.37 as shares of Boeing offset losses. The Nasdaq Composite shed 0.76% to 10,386.99.

special

Amazing post. I like this.