Benefit from the high dividend of these 2 REIT stocks, which have the benefit of having the U.S. government as their…

Today, we'll take a look at 2 REIT stocks that are sure to please any investor with a relatively fat dividend. However, these companies are all the more interesting when you consider that their main customers include the government.

Investors generally adore REIT stocks for several reasons. First, REIT shares offer the opportunity to invest in real estate without having to own the property outright. This makes investing in a REIT much easier, faster and more accessible than investing in the property itself. In addition, the returns on a REIT investment are generally more stable and predictable than other types of investments, which is important for investors seeking regular income.

So now let's take a look at 2 interesting tips 👇

Easterly Government Properties $DEA (dividend 6.62%)

Easterly Government Properties specializes in investing in properties that are leased to government and public institutions in the US. Its portfolio includes office buildings, office space, and laboratories that are leased to departments, agencies, and organizations such as the Department of Defense, NASA, the National Highway Traffic Safety Administration, and many others.

Easterly Government Properties' competitive advantage is its specialization in leasing properties to government and public agencies, which sets it apart from many other real estate companies that focus on commercial or residential properties. This market is relatively stable and resilient to economic fluctuations, which can be attractive to investors.

Another competitive advantage of Easterly Government Properties may be the quality of its portfolio, which consists primarily of new or recently renovated buildings, which reduces maintenance costs and increases its attractiveness to potential tenants. The company also applies strict criteria in selecting investment opportunities and works with quality tenants, which can contribute to long-term success.

Easterly is obviously not the largest REIT in the market, but it stands out among its peers for a very simple reason: the company's mission is to acquire, develop and manage commercial real estate leased to the U.S. government.

In its most recent investor presentation, the REIT said that 98% of its lease revenue is "backed by the full faith and credit of the U.S. government." Few tenants are more reliable.

As of September 30, 2022, Easterly's portfolio consisted of 86 properties totaling 8.7 million square feet. They were 99.3% leased, with a weighted average remaining lease term of 10.5 years.

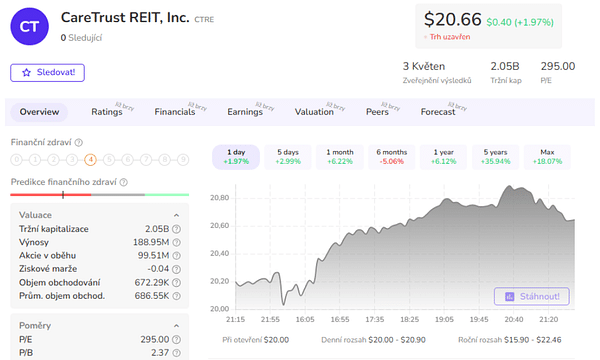

CareTrust REIT $CTRE (dividend 5.33%)

Since CareTrust REIT specializes in investing in health and welfare facilities, it is not completely on a direct line to the government, however, these are facilities that are supported by government programs.

The company was founded in 2014 and is headquartered in San Clemente, California. CareTrust REIT seeks to create long-term value for its shareholders through dividend growth and asset value growth.

The company invests in properties that are of high quality and well-located with potential for growth. According to the latest available information, the company has over 260 properties located in 38 different states in the U.S. and another in Canada.

Of this portfolio, approximately 83% is comprised of nursing homes, while the remainder of the portfolio is comprised of specialty hospital facilities, long-term care centers, and rehabilitation facilities.

The advantage of investing in CareTrust REIT is that healthcare is a high growth sector, while retirement homes are quite similar with respect to the aging population. With a growing number of retirees and the need for more and more healthcare facilities, healthcare is considered one of the most stable sectors to invest in.

CareTrust REIT has a careful selection of the healthcare facilities it buys and tries to enter into long-term agreements with landlords to minimize the risk of property vacancy and loss of income, another thing that pleases its investors.

- What do you think of these companies? 🤔

Please note that this is not financial advice. Every investment must go through a thorough analysis.