Some investors have managed to achieve very interesting returns since the beginning of the year, simply by investing passively in ETFs. These are the 3 ETFs that have been the most successful since the beginning of the year. But it's certainly no coincidence, because these ETFs have one thing in common.

Every investor's dream is to make tens of percent in 2 months. These 3 ETFs have offered investors that opportunity. Those who own these ETFs are doing just fine today, and they are not complaining at all. In fact, these ETFs have provided investors with returns in the tens of percentages since the beginning of the year. Why has this been the case? And is it a coincidence that these are the ETFs? It's not a coincidence at all, because these ETFs have one thing in common that has ensured these ETFs have grown so much.

Why are these ETFs growing so much?

This tremendous growth is largely due to an underlying asset that these ETFs have in common. That's because these ETFs focus on the cryptocurrency space, and everything related to cryptocurrencies in general. Cryptocurrencies have been through hell in the past year, with their price being pushed down by inflation, high interest rates, and most importantly, the scandals that have been sweeping the crypto world. So it's not surprising that 2022 has had an impact on these ETFs, which have been falling over the past year.

After this deep bloodletting in 2022, it was almost clear that some growth was coming, which has also been happening since the beginning of this year, and these ETFs are riding the wave of growth in cryptocurrencies, and companies doing business in this sector overall. So let's take a quick look at these current winners. And is this performance even sustainable through the end of this year?

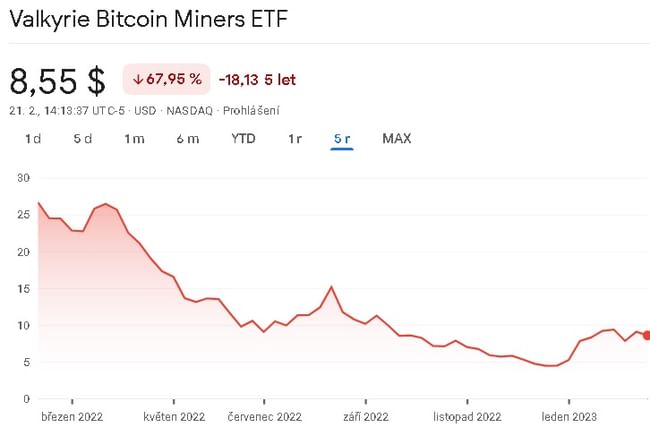

Valkyrie Bitcoin Miners ETF $WGMI

This ETF focuses exclusively on cryptocurrency miners that benefit from rising cryptocurrency prices. For cryptocurrency miners, it's virtually the same principle as for miners of common commodities like oil or natural gas. This is a very new ETF that was launched in early 2022. The size of the ETF is consistent with this, with $5 million in assets under management. USD

While this is an ETF, the company states on its website that it is an actively managed fund, as evidenced by the annual expense ratio of 0.75%. Moreover, this ETF does not offer any dividend yield, so investors only benefit from the growth of this ETF.

This ETF is also not large in terms of the holdings it has in its portfolio. The company has only 20 companies in its portfolio, but they all revolve around cryptocurrency mining. With that said, the top 10 holdings of the company are pure cryptocurrency miners. We can find companies such as Cleanspark $CLSK, Digihost Technology $DGHI, Bitfarms $BITF, HIVE Blockchain Technologies $HIVE and Riot Platforms $RIOT. The top 10 holdings make up about 75% of this ETF's portfolio, and Cleanspark's largest holding makes up almost 10% of the portfolio, which shows a lack of diversification.

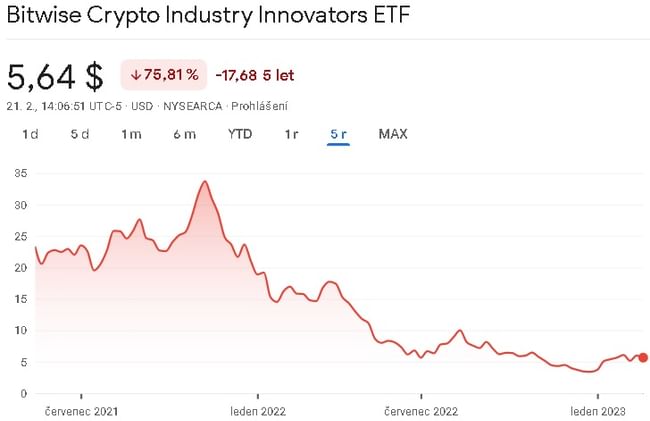

Bitwise Crypto Industry Innovators ETF $BITQ

This ETF is mainly focused on companies that are innovating in the crypto space. This is a larger ETF here than the previous case, where this ETF not only includes miners, but also other companies that are somehow active in the crypto space. The company has approximately 52 million in assets under management. USD, so it is still a relatively small ETF. It is also a relatively young ETF, having been launched on May 11, 2021.

This ETF is a bit more diversified than the previous case, where we find 28 companies in this ETF's portfolio. The top 10 companies here represent approximately 65% of the ETF's portfolio, with the 2 largest positions here representing 10% of the portfolio. In addition to cryptocurrency miners, we also find here, for example, Coinbase $COIN, Microstrategy $MSTR, where this is a company that holds a significant amount of Bitcoin on its balance sheet.

A huge drawback with this ETF is the fees, which are very high. The fees for holding this ETF come out to about 0.85% per year. Personally, I have not seen higher fees on an ETF yet, this is the highest I have ever seen.

Global X Blockchain ETF $BKCH

The company is similar in size to BITQ, with roughly $58 million in assets under management. USD. Here it is also an ETF that invests in blockchain and cryptocurrencies as a whole. That said, here too we find other companies besides miners that are involved in the crypto space. This is also a relatively young ETF, as this ETF was launched in late 2021.

Block $SQ has by far the largest weight in this ETF's portfolio, at roughly 18%. Among the company's 10 largest holdings, we can then find miners, but also, for example, Coinbase $COIN. But we also find one company that is not typical for crypto portfolios to such an extent. Among the top 10 holdings is in fact Nvidia $NVDA. The ETF takes this company as a company that is involved in the crypto space through the supply of its components, mainly graphics chips, which are used to mine cryptocurrencies. Overall, then, the ETF has 25 companies in its portfolio, with the top 10 holdings making up about 73% of the portfolio.

As with the previous two ETFs, there are higher holding fees of 0.5% to account for. However, this ETF does differ from the other two in one respect, and that is that it pays a dividend. The current dividend yield of this ETF is 0.7%. So you could say that this dividend currently covers the fees for holding this ETF.

Since these are all 3 ETFs from the same sector, we didn't break down the pros and cons of each ETF because they don't differ that much. So let's take a look at the overall pros and cons of these ETFs, and whether it makes sense to invest in them at all.

Advantages:

- By investing in this ETF, an investor gets a fairly diversified portfolio in the crypto sector, and blockchain as a whole.

- A less expensive way to average the purchase price, for passive investors. In short, buying one ETF will work out cheaper than buying all the stocks contained in that ETF.

Disadvantages:

- These ETFs are heavily dependent on the price movements of cryptocurrencies, and with that comes the high volatility that exists in cryptocurrencies.

- So another problem that is there is the low liquidity. Investors may have a hard time getting rid of these ETFs if needed. Usually when markets fall, liquidity falls with them. So liquidity plays an important role in highly volatile markets.

- Another problem that exists here is the high fees, which steal returns from investors. It does not matter that the fees are so high when the profits are almost 100%, but the moment there are lower profits, the fees will already show.

- Compared to traditional ETFs, these ETFs have a relatively undiversified portfolio, which contributes to the high volatility of this ETF.

Conclusion

The high growth of these ETFs has been mainly due to the rally in the cryptocurrency market, with companies involved in the industry benefiting from these gains. The problem here is that these ETFs are really dependent on how the cryptocurrencies themselves fare. If the price of cryptocurrencies is rising, so are the profits of the mining companies, and so is the share price of those companies.

So before investing in these ETFs, it's important to ask a basic question. How confident are you that cryptocurrencies will grow? Because that will determine your decision on whether you want to invest in this sector at all.

Personally, though, I think that if you want to be invested in the crypto sector, I would rather choose the option of investing in cryptocurrencies directly (just buy some of the crypto), or buy shares of some of the companies that are included in these ETFs, for example, and are involved in the crypto segment. You'll avoid unnecessarily high fees that way, and I also think you'll be involved in the sector just as much as if you bought some of these ETFs. For me personally, these ETFs are unnecessary.

WARNING: I am not a financial advisor, and this material does not serve as a financial or investment recommendation. The content of this material is purely informational.