An analysis of one of my favorite stocks that I hold for the long term

Today, we'll be talking about perhaps one of the most important companies in the U.S., as it represents a critical link in the global supply chain by connecting as many as 23 states in the western two-thirds of the country by rail.

Union Pacific Corporation $UNP is one of the most recognized and important companies in America. We provide a critical link in the global supply chain by connecting 23 states in the western two-thirds of the country by rail.

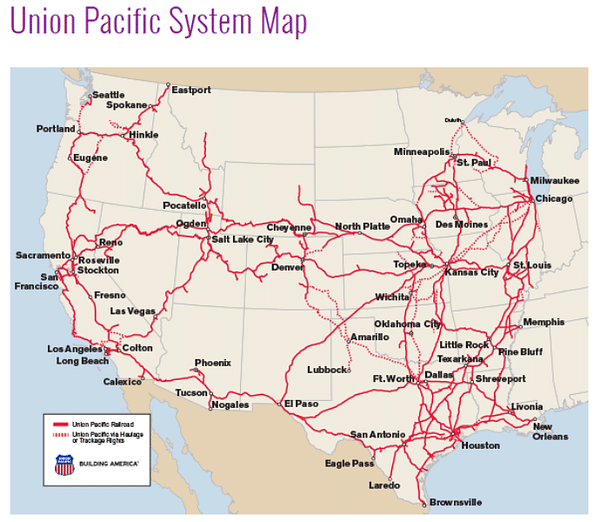

- At the same time, we serve many of the fastest growing population centers in the U.S., operating from every major port on the West Coast and Gulf Coast to the East Coast. It connects with Canadian rail systems and is the only railroad to serve all six of Mexico's major gateways.

The company operates over 8,300 locomotives on more than 32,200 miles of track in 23 U.S. states, making it the second largest railroad in North America.

The company operates freight transportation and offers logistics services to customers across a variety of industries, including mining and resource processing, agriculture, chemicals, automotive and many others.

Union Pacific also offers cross-border shipping to Canada and Mexico and operates transshipment terminals. In addition, the company is also committed to sustainability and reducing the environmental impact of rail transportation, for example, through the use of advanced technologies and alternative fuels.

As you can see, they cover a really massive part of the US and connect very important places 👇

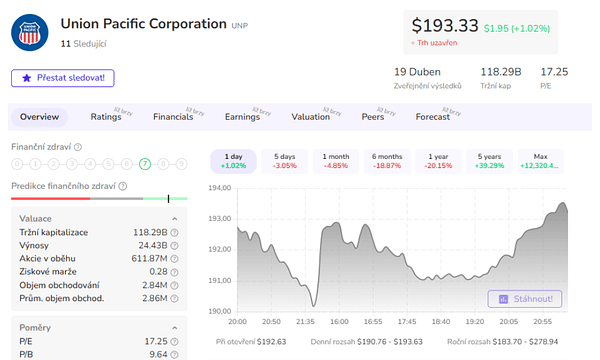

Let's take a look at the company's performance financially 👇

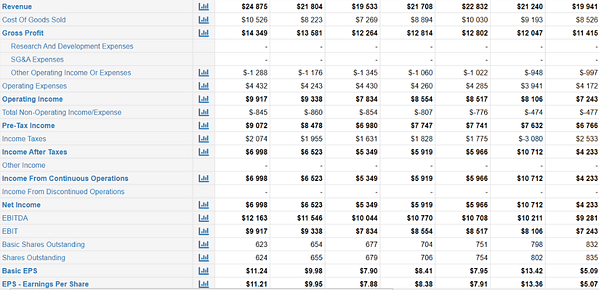

Revenue

Looking at the revenue, we don't see any giant jumps, which in this case is fine on my part, I didn't even imagine anything like this from the company. When we look at the last 5 years, on average sales are growing at 3.22% per year, but if you need to see the bigger picture, looking at the last 10 years we are talking about an average annual growth of 2.39%.

Net profit

Union Pacific's net profit has ranged from $2.8 billion in 2010 to $5.9 billion in 2019. It dropped to $5.3 billion in 2020 due to the pandemic and increased to $6.4 billion in 2021. Then, in the first three quarters of 2022, Union Pacific's net income reached US$5 billion.

Union Pacific's average annual net profit growth rate over the past ten years has been approximately 7%.

Debt

Union Pacific's debt ranged from USD 8.9bn in 2010 to USD 28.8bn (of which some USD 27.7bn is long-term debt) in 2021. In the first three quarters of 2022, Union Pacific's debt was almost constant at USD 28.9bn.

Union Pacific's average annual debt growth rate over the past ten years has been about 12%, with a debt-to-equity ratio of 2.60.

Reasons for high debt growth:

- Union Pacific has invested in developing and upgrading its rail network and infrastructure. This required large capital expenditure and borrowing.

- It also made acquisitions and mergers with other railway companies such as Southern Pacific Railroad and others.

- Union Pacific has also taken advantage of low interest rates in the past to refinance its older debt and extend its maturities. This reduced its interest costs but increased its total debt.

Assets

Union Pacific's assets have ranged from $41.4 billion in 2010 to $65.4 billion in 2022 (we're talking about an average growth rate of 4% per year here).

Cash flow

Union Pacific's cash flow ranged from $3.6 billion in 2010 to $8.4 billion in 2021. Union Pacific's cash flow consists of cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities. Union Pacific's average annual cash flow growth rate over the past ten years has been approximately 9%.

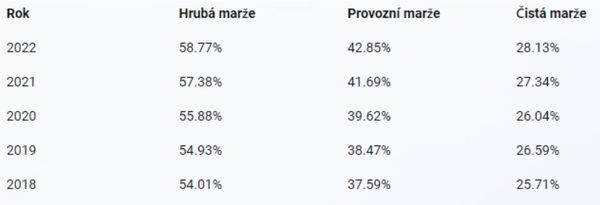

Margin view 👇

Share buybacks

$UNP is widely known for its regular share buybacks, spending just under $42 billion on buybacks over the past 10 years alone.

This is also one of the reasons why the company's debt to equity ratio is increasing. This is because share buybacks reduce the amount of shares outstanding and thus the value of the company's equity. If the company's debt remains unchanged or even increases (for example, if the company finances the buyback with debt), then the debt-to-equity ratio increases. Well, Union Pacific has financed some of its buybacks with debt in the past, so here we have another clue to higher debt.

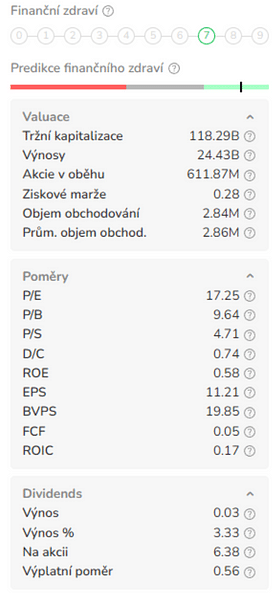

Dividend

Union Pacific has paid a dividend continuously since 1989 and has increased it every year since 2007 . Union Pacific's payout ratio over the past 12 months was 41.9%, which is lower than the industry average.

In terms of the key metrics of P/E, P/S, P/B, P/C and P/FCF, we are tracking at the sector average (excluding P/B, that's slightly higher) 👇

As for me and my stance on the UNP

I first bought in at $130 and my investment thesis was simple, this sector is indispensable for me, plus when someone connects important sections or places where no one else operates, we have a competitive advantage in the world.

The company has a long track record, it's a share buyback machine, and it's literally such a solid component of my portfolio that I believe it's going to be there for a long time. Personally, I'm not too worried about the future either, the company doesn't rely at all on where it currently is, and therefore is constantly innovating and trying to adapt to new trends and demands.

However, I also really liked the margins and return on equity, which was (and still is) quite high. However, if I were faced with considering an initial investment at this point, I would not find the $193 price attractive and would demand a larger drop.

More reasons why I like this company - As I mentioned in an article about UNP a while back, the company 👇

- Has been outperforming its industry, sector and indeed the entire market for over 10 years.

- It represents the finest business model of the North American freight rail oligopoly.

- It has excellent management that works to deliver current returns to the company and shareholders. Moreover, they are not only looking at the present, but also pursuing innovation for long-term future growth (eco-innovation).

- It is a fundamentally sound dividend payer with high margins and regular share buybacks.

- How do you like the company? 🤔

Please note that this is not financial advice. Every investment must go through a thorough analysis.