Many still believe that the majority opinion is wrong and big growth can still come. But that's certainly not what one of Wall STreet's most prominent investors and billionaires thinks.

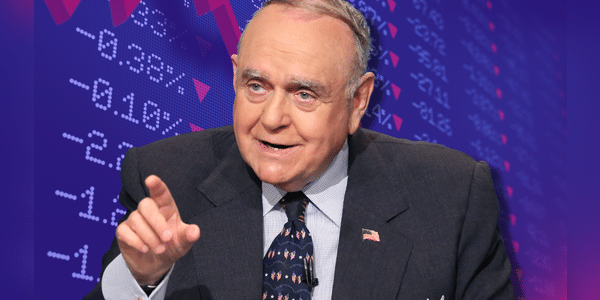

Billionaire and investor Leon Cooperman thinks the S&P 500 index will drop 22% from here on out , while predicting that it will drag the U.S. economy into a recession.

"I think Fed tightening, high oil prices, or maybe a strong dollar - some combination of those four things will create a recession and the ultimate bottom of the market will be about 35% below the 4,800 peak," the chairman and CEO of Omega Advisors elaborated .

The billionaire warns that the benchmark stock index could fall as low as 3,100 points.

Cooperman predicts stubborn inflation and further interest rate hikes and worries about the national debt. Leon Cooperman predicted that the S&P 500 index will fall about 22% before…