These are the 2 most popular stocks of TipRanks analysts

Especially novice investors usually look for inspiration from various investors and analysts. So it doesn't hurt at all to look at what is popular among analysts. So today we will take a look at 2 stocks that are very popular among TipRanks analysts.

To be honest, I'm not really surprised by this choice or the nature of this choice these days. Simply, today's times being what they are, it was probably a given that analysts would gravitate towards this type of stock. But let's take a look at 2 specific stocks that are popular here.

Kimbell Royalty Partners $KRP

Kimbell Royalty Partners is a company that specializes in acquiring and managing mineral and royalty interests in the oil and gas sector. By owning these interests, the company is entitled to a portion of the proceeds from the production and sale of these natural resources.

The Company has a diversified portfolio of mineral and royalty interests in multiple states, which helps reduce the risk of underperformance of any asset. The Company's portfolio includes interests in more than 94,000 gross wells, which provide a stable and diversified source of cash flow. 1. Kimbell Royalty Partners' portfolio includes interests in more than 13 million gross acres in 28 states located primarily in the Mid-Continent, Rocky Mountain and Permian Basin. The company's assets are diversified across various producing formations, including shale, tight sand, conventional and coalbed methane.

The Company generates revenue primarily from royalties, which are based on a percentage of revenue generated from the sale of oil and gas produced from properties in which it owns interests. Kimbell Royalty Partners' revenues are also supplemented by lease bonus payments, which are one-time payments made by oil and gas companies to secure the right to drill on its properties.

Benefits:

- Diversified portfolio: Kimbell Royalty Partners' portfolio is well diversified across many states and producing formations, which helps reduce the risk of underperformance of any asset.

- Attractive Dividend Yield: Kimbell Royalty Partners has a strong track record of paying dividends to its shareholders, and as of March 6, 2023, the company's dividend yield is 8.3%, which is higher than the industry average.

- Acquisition-Driven Growth Strategy: the Company's growth strategy focuses on acquiring mineral and royalty interests from oil and gas companies that are successful in driving growth in its cash flow and dividends.

- ESG focus: Kimbell Royalty Partners has a strong commitment to ESG principles that could be attractive to socially responsible investors.

Disadvantages:

- Exposure to commodity prices: As an owner of mineral and royalty interests, Kimbell Royalty Partners is exposed to commodity price fluctuations that can be volatile and difficult to predict.

- Regulatory Risk: The oil and gas industry is subject to a complex regulatory environment and changes in laws and regulations could affect the Company's operations and financial results.

- Limited Growth Prospects: Kimbell Royalty Partners' growth is primarily driven by acquisitions and there may be limited opportunities for future acquisitions in the highly competitive mineral and royalty market.

- MLP structure: as European investors, this type of company is disadvantageous for us from a tax perspective. Quite simply, we have to reckon with much higher taxes here.

- Industry Risks: The oil and gas industry is exposed to various risks, including geopolitical, environmental and technological risks that could affect a company's financial performance.

As outlined above. Generally dividend stocks are now in demand. In my opinion, analysts like this stock mainly because of its focus on the energy sector, but more importantly the dividend yield which is over 8% here. In short, this will help investors beat inflation even if the share price is stagnant.

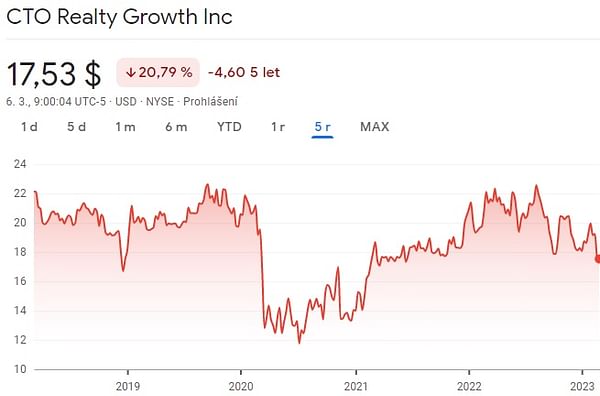

CTO Realty Growth $CTO

Moving on to CTO Realty, this is a real estate investment trust (REIT) that invests primarily in commercial real estate, including office buildings, shopping centers, and industrial warehouses. The company generates rental income and also has a good track record of making strategic acquisitions to expand its portfolio.

The Company operates in two segments, Income Properties and Commercial Loan Investments. The Income Properties segment is responsible for generating rental income from CTO Realty properties. This segment also includes property management, leasing and development activities. The Commercial Loan Investments segment focuses on originating and investing in commercial loans, including bridge loans, construction loans and mezzanine loans. CTO Realty's loan portfolio consists primarily of loans secured by commercial real estate.

CTO Realty's real estate portfolio includes over 50 properties in 11 states with a total leasable area of approximately 4 million square feet. The company's major tenants include Walmart, Publix and Wells Fargo.

The company has a history of paying dividends and its dividend yield is currently around 5.5%.

Benefits:

- CTO Realty has a diversified portfolio of income-producing properties, which reduces its exposure to risk from any particular property or tenant.

- The company has a history of paying dividends and its current dividend yield is higher than the industry average, making it an attractive investment for income-seeking investors.

- CTO Realty's Commercial Loan Investments segment provides further diversification to the Company's income stream by generating income from loans rather than just rental income from properties.

- The Company has extensive experience leasing its properties to high quality tenants, including large retailers and financial institutions.

- CTO Realty has a strong balance sheet with manageable debt levels, which provides the company with the financial flexibility to take advantage of growth opportunities.

Disadvantages:

- Like all real estate companies, CTO Realty is subject to the risks associated with the real estate industry, including changes in property values, fluctuations in rental income and changes in interest rates.

- The Company's geographic concentration in Florida exposes it to risks associated with this market, such as hurricanes, floods and economic downturns.

- CTO Realty's Commercial Loan Investments segment is subject to risks associated with lending, such as borrower default and credit risk.

- The Company has a relatively small market capitalization compared to some of its peers, which may limit its ability to access capital and compete for larger deals.

- CTO Realty's financial results have been somewhat mixed in recent years, with the company reporting a net loss in 2020, which may be a concern for some investors.

The bet here is on the real estate market, which is under pressure at this time thanks to interest rates. Another thing that I think plays a big role here again is the dividend yield, where the company offers a very good dividend yield that almost covers inflation in the US.

Conclusion

The main reason why these two stocks are popular among analysts is their high dividend yields. Both companies have a good track record of paying regular dividends, which makes them attractive options for income-focused investors looking for reliable and predictable sources of income.

In conclusion, Kimbell Royalty Partners and CTO Realty are two stocks that have caught the attention of financial analysts. Both companies have demonstrated a commitment to generating stable cash flows and maintaining strong dividend yields, making them attractive investment options for income-focused investors.

The Bulios team has created its own dividend portfolio, which it manages on a regular basis. This portfolio generates a stable dividend yield of around 7%. Unfortunately, these stocks are not in it.

If you want to start building stable dividend income from quality dividend stocks, here'syour chance.

WARNING: I am not a financial advisor, and this material does not serve as a financial or investment recommendation. The content of this material is purely informational.