Recent upbeat news from the stock markets has put some investors back on the bullish bandwagon. Unfortunately, according to BofA analysts, this news does not bode well at all, perhaps the opposite.

We are currently seeing a relatively strong labour market in the US, we are also seeing Fed chairman Jerome Powell slowly start to talk about disinflation, and overall, on the face of it, the economy seems to be stable and resisting all the pitfalls. But not everything can be as it seems at first glance. There is a need to put these data, and events, into a bit of a higher perspective.

How is inflation rising?

Rising inflation causes prices for all products and services to rise. This rise is usually caused by too much demand for the products or services in question. Simply put, if a lot of people are buying it, why not sell it at a higher price. In this case, inflation was triggered by the rise in energy prices caused by the war in Ukraine. Through this item, the growth began to affect all segments of the economy. Energy is, in short, the basis for the functioning of almost everything these days. We need energy both to produce and to provide services. It is practically everyone's cost item.

Reducing inflation

So how can we get inflation to start to come down? The general answer is to reduce demand, and force people to save. Quite simply, you can't get inflation to fall rapidly without the economy taking a hit.

And that is not what is currently happening. The US economy is still showing some stability and strength, which is causing some headwinds in the fight against inflation.

This means only one thing. The central bank is going to have to step up its fight, and that will trickle down to the stock markets. The longer this fight goes on, the worse it will be for investors and normal consumers alike.

It will get worse

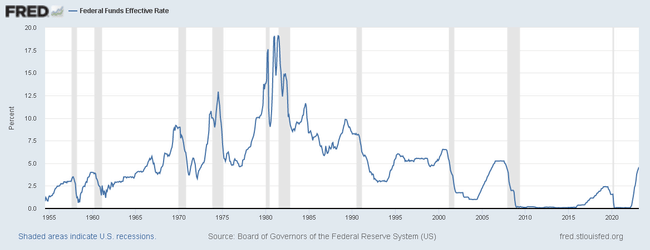

US interest rates are currently at a 16-year high. The economy is still not slowing as fast as it needs to. This could be a problem for us.

This whole situation leads BofA economist Aditya Bhave to warn that the situation will get worse, and the Fed will have to raise target interest rate levels.

The Fed will have to keep raising rates until it finds a pain point for consumer demand. At this stage, a 25 basis point rate hike in March and May seems extremely likely. We recently changed our Fed forecast to include another 25 bps hike in June. But the resilience of demand-driven inflation means the Fed may need to raise rates closer to 6% to get inflation back on target.

In short, we will have to find a point where interest rates hurt consumers, who act as a headwind in the battle against inflation. This will mean a weakening of the labor market, a weakening of corporate investment, and of course all of this will lead to a weakening of the economy overall.

According to Bhave, to curb inflation, it is also necessary to curb consumer demand. Here, it is a question of how much consumers can hold out. Bhave also fears that a recession is becoming a far more likely scenario than a soft landing.

A slowdown in consumer demand, which our analysis suggests is necessary for inflation to return to target, would likely lead to an outright recession. Consumer spending accounts for 68% of GDP and another Fed hike would also mean more pain for non-consumer sensitive sectors such as housing. Our base case is that a recession will begin in Q3 2023. The risks are skewed toward a longer period of consumer resilience, stickier inflation, and another Fed hike. In any case, the lesson for investors is: no pain, no gain.

Bhave's last sentence in particular may give investors a dose of optimism. After all, if we look back at history, after every crisis came growth. So it is quite possible that we are approaching a period that will allow investors to make a lot of money. Just follow a simple motto. The bear gives wealth away and the bull pays it out.

In times of recessions and crises, dividend stocks have always proven to provide investors with additional income. Therefore, there is no harm in building a dividend portfolio.

Bulios has put together a solid dividend portfolio to hold you through these tough times, so feel free to check it out here.

WARNING: I am not a financial advisor, and this material does not serve as a financial or investment recommendation. The content of this material is purely informational.