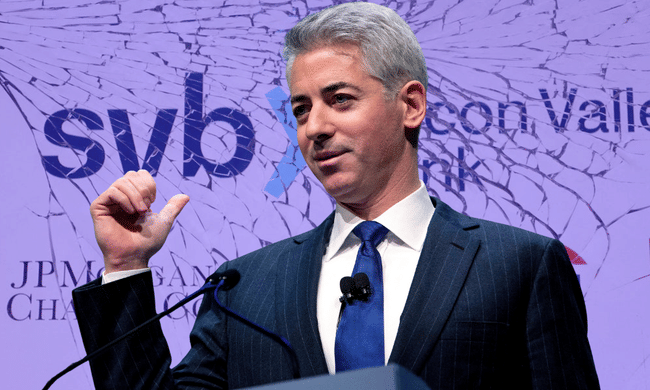

You've probably heard in recent days about the collapse of SVB Financial, which is now in the thick of things. The situation looks really critical for the bank, as it does for the financial system through which this "contagion" could pass. So today, we'll take a look at how respected investor Bill Ackman views the issue.

Description:

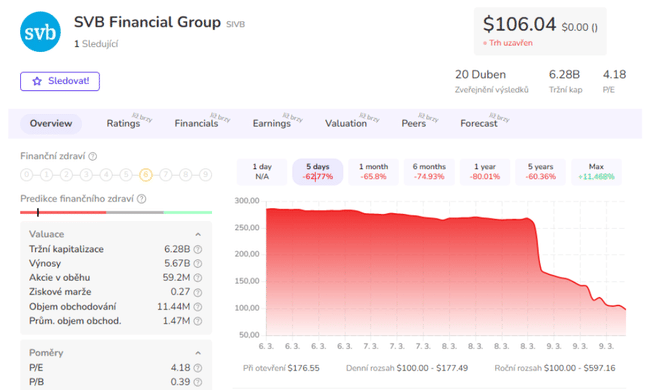

SVB Financial $SIVB plunged 60% on Thursday after the company completed a $21 billion sell-off of its bond portfolio, leading to a $1.8 billion loss and prompting plans to raise more capital from investors.

The bank said it will raise $2.3bn from investors through the share sale, essentially diluting shareholders to cover the losses associated with the bond sale.

The large losses the bank has suffered are directly related to the rise in interest rates over the past year because the company bought U.S. Treasuries at a time when interest rates were still relatively low = Bond prices fall as yields rise.

According to SVB Financial, its bond portfolio was worth $21 billion and had a yield of 1.79% and a duration of 3.6 years. Today, the yield on 3-year U.S. Treasuries is 4.7%, much higher than the levels at which the bank was buying Treasuries before 2022.

Another issue for SVB is that it predominantly lends to venture capital and private technology companies, which often rely on the public offering (IPO) market to raise money from investments and often park that money in the bank.

What does respected investor Bill Ackman have to say about the situation?

In a lengthy tweet, Bill Ackman said:

The government has roughly 48 hours to correct a soon-to-be-irreversible mistake. By allowing SVB Financial to fail without protecting all depositors, the world woke up to what is an uncovered liquidity claim on a bank that failed. Unless JP Morgan, Citibank or Bank of America take over SVB before the market opens on Monday, which I consider unlikely, or the government guarantees all of SVB's deposits, the huge sucking sound you will hear will be the withdrawal of most uncovered deposits from all but the "systemically important banks" (SIBs).

- SIB stands for "systemically important banks" and it stands for banks that are considered systemically important. These banks are usually large and have a major impact on the overall stability of the financial system.

The tweet goes on to say: These funds will be converted to SIBs, U.S. Treasury money market funds (USTs), and short-term USTs. There is already pressure to transfer cash to short-term USTs and UST money market accounts due to the significantly higher yield available on risk-free USTs compared to bank deposits.

These withdrawals will drain liquidity from community, regional and other banks and begin to destroy these important institutions. Increased demand for short-term USTs will drive down short-term rates and complicate the Federal Reserve's efforts to raise rates to slow the economy.

Already, thousands of the fastest-growing, most innovative companies with investments in the United States will not be able to pay wages next week. If the government had stepped in on Friday and guaranteed SVB's deposits (in exchange for penny warrants that wiped out most of the capital value), this could have been avoided and the market value of SVB could have been preserved and transferred to a new owner in exchange for an injection of capital. We would be willing to participate in this.

This approach would minimize the risk of any losses to the government and create the potential for significant gains from a bailout. Instead, I think it is now unlikely that a buyer will be found for a bank that has failed. The government's approach has ensured that more risk is concentrated in SIB at the expense of other banks, which in itself creates more systemic risk. For those who argue that depositors should be abandoned because it would create moral hazard, consider the feasibility where each depositor must make their own credit assessment of the bank they wish to do business with. I'm a fairly sophisticated financial analyst and still consider most banks a black box despite the thousands of pages of SEC filings available on each bank.

Back to the point, SVB's senior management simply made a fundamental mistake. They invested short term deposits in longer term fixed rate assets. Then short-term rates rose and a run on the banks ensued. Top management blew it and should have lost their jobs.

My review of SVB's balance sheet suggests that even in liquidation, depositors should eventually get about 98% of their deposits back.

Please note that this is not financial advice.