Analysis of L3Harris Technologies, a company that is sure to impress you with its products

L3Harris Technologies is a stable and strong company with an excellent technological background and a wide range of products. But are these enough factors to convince us to invest? That's what we'll look at today.

What's the company's business?

L3Harris Technologies $LHX is an American company that develops and manufactures technologies for the defense, security, and commercial markets. The company was formed in 2019 through the merger of L3 Technologies and Harris Corporation.

L3Harris Technologies' core competencies include:

Defense Technologies: development and manufacture of control systems, communications equipment, sensors, navigation systems, avionics, optical and electro-optical systems, defense vehicles and other technologies for military and government agencies.

Security technologies: development and manufacture of security systems, detection equipment, camera systems, research and development tools for securing buildings, infrastructure and other assets.

Communications technology: development and manufacture of high-speed data systems, telecommunications technologies, wireless and satellite communications equipment used in industry, government agencies and other sectors.

Flying technologies: development and manufacture of avionics, control systems and other equipment for aerospace applications.

Technologies for civil markets: development and manufacture of security, communications and research equipment for industry, energy, transport and other sectors.

Where does it operate?

L3Harris Technologies is a multinational company and operates in many countries around the world. The main markets in which the company operates include:

- North America (USA and Canada)

- Latin America (Brazil, Mexico, Colombia and others)

- Europe (UK, Germany, France, Italy, Spain and others)

- Middle East and Africa (Saudi Arabia, United Arab Emirates, Qatar, South Africa and others)

- Asia Pacific (Australia, Japan, South Korea, Singapore and others)

A closer look at what they do:

Security and Defense Technology: This segment includes products and services that help secure government and commercial organizations and protect them from threats such as terrorism, cyber attacks, crime, and more. Products include security scans, hazardous materials detectors, video surveillance systems, and communications equipment.

Communications and Information Technology: This segment includes products and services for communication and information exchange via satellites, mobile networks and other technologies. Products include communications satellites, mobile networks, antennas and others.

Aerospace: This segment includes products and services for aerospace, including avionics systems, unmanned flight control systems, navigation systems and others.

Rail Technology: The company also offers products and services for rail technology, including signaling and safety systems, train equipment, and others.

Other Products and Services: In addition to the above segments, L3Harris Technologies also offers other products and services such as medical technology, energy systems, exploration technology, and others.

Competitive advantages

L3Harris Technologies has several competitive advantages that help it grow and maintain its market position. The main competitive advantages include:

Strong Technology Background: L3Harris Technologies has excellent research and development resources, which enables it to create new and innovative products and services. The company also uses advanced technologies such as artificial intelligence and machine learning.

L3Harris Technologies offers awide range of products and services for different markets and customers. The company also provides integration and maintenance of its products, enabling it to provide end-to-end solutions to its customers.

Long-term experience. The company also has strong relationships with government and industrial customers, allowing it to better understand and meet their needs.

L3Harris Technologies has offices around the world and its products and services are distributed to more than 100 countries. This global presence allows it to better respond to local needs and attract new customers.

Risks

Competition: L3Harris Technologies operates in a competitive environment where there are many other companies offering similar products and services. Competition can have a negative impact on the company's sales and profits.

Dependence on Government Contracts: L3Harris Technologies is heavily dependent on contracts from governments and other public bodies. If these contracts were to be significantly reduced, the Company's revenues and earnings could be adversely affected.

Global Political and Economic Instability: L3Harris Technologies operates in a global environment that is sensitive to political and economic changes. Instability could have a negative impact on business operations and results of operations.

Finance

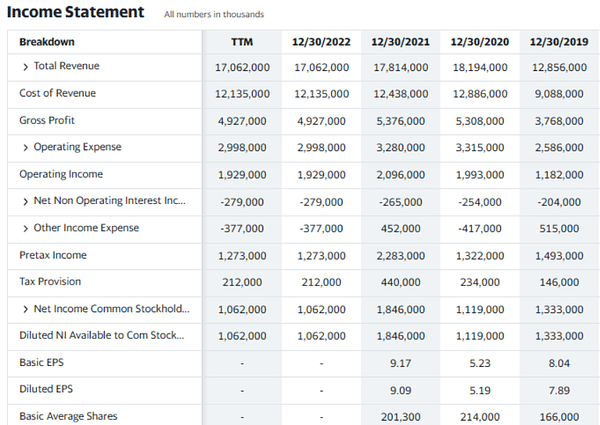

The Income Statement shows that the company's total revenues have been stable at around $17-18 billion for the last 3 years.

The cost of production is high and accounts for most of the cost of total sales. The cost of production (Cost of Revenue) for 2022 is $12.14 billion, which is approximately 71% of total revenue.

The company's Gross Profit (Gross Profit) is relatively stable and has been around $5 billion for the last 3 years. In the last 12 months, gross profit has reached $4.93 billion.

From the financial analysis, it can be concluded that the company has stable sales, but the high cost of production causes the gross profit to be lower, but this is not entirely surprising in this sector.

Balance Sheet

- From the financial position statement (Balance Sheet), it can be seen that the company has high total assets which ranged between $33.5 - $37 billion in the last 3 years. In the most recent year, the company achieved total assets of $34.7 billion.

- Total liabilities including minority interests are high and ranged between $14.9 - $16.1 billion in the last 3 years. In the most recent year, total liabilities reached $15.39 billion, with total equity ranging between $24.7 - $27.6 billion over the past 3 years.

- The company has a solid equity, which has ranged between $18.6 - $20.8 billion in the last 3 years. In the most recent year, equity reached $19.32 billion.

- Net tangible assets are negative and have ranged between -$6.1 billion and -$5.5 billion over the past 3 years. This means that the company has more liabilities than assets.

Cash Flow

The cash flow statement shows that the company has a positive net operating cash flow, which has ranged between $1.7 billion and $2.8 billion over the last 3 years. In the last 12 months, the company's net operating cash flow was $2.16 billion. This means that the company has plenty of cash from the operation of its business.

The company's investing cash flow is negative and has ranged between -$159 and $1.4 billion over the past 3 years. In the last 12 months, the investment cash flow was -250 million dollars. This means that the company spent more money on investments than what it earned from investing activities.

The company's financial cash flow is also negative and has been between -2.4 and -4.4 billion dollars over the last 3 years. In the last 12 months, the financial cash flow was -1.95 billion dollars. This means that the company spent more money to fund its business than what it earned from financing activities.

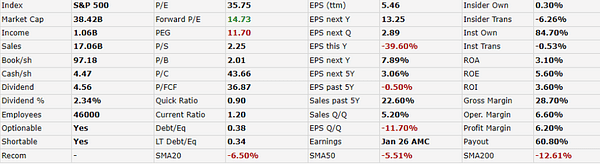

The company has a PEG ratio (price/earnings to growth) of 11.70, which may indicate that the market expects very low profitability growth in the future. This ratio also indicates that the company's stock is overpriced compared to the expected profitability growth.

- The dividend yield is 2.34%.

The market expects the company's profitability to grow in the coming year, with expected EPS (earnings per share) of $13.25. The market also expects profitability growth over the next five years, with expected EPS growth of 3.06%.

The market is currently skeptical about the company's performance as shown by the negative performance in recent weeks, months and quarters. The stock's decline of more than 19% over the past year also suggests that the market is currently quite pessimistic about the company's future.

Overall, the company has a high P/E ratio and a lower forward P/E ratio, suggesting that the market is becoming skeptical about the company's profitability growth. However, the company has a solid market capitalization and dividend yield, which may be attractive to some investors.

What do analysts expect?

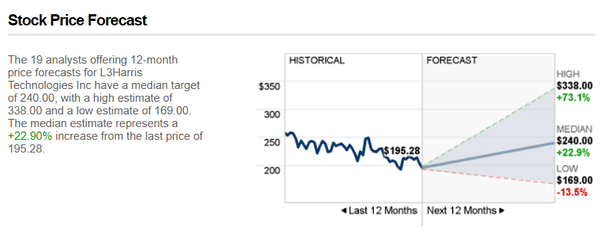

The 19 analysts offering 12-month price forecasts for L3Harris Technologies have a median target of 240.00, with a high estimate of 338.00 and a low estimate of 169.00. The median estimate represents a +22.90% increase from the last price of 195.28.

- What do you think about the company? 🤔

Please note that this is not financial advice. Every investment must go through a thorough analysis.