Investors must prepare for difficult times as the idyllic market environment of the past decade comes to an end. Following the collapse of Silicon Valley Bank, fears of a new financial crisis are emerging as more banks in the US and Europe show signs of weakness.

The idyllic market environment that dominated the past decade is gone and investors are at the dawn of a more difficult era, Wall Street experts say.

The warnings come after the stunning collapse of Silicon Valley Bank, which shook confidence in the US banking system after it was taken over by the FDIC earlier this month. Since then, more banks in the US and Europe have shown signs of weakness, raising fears that a new financial crisis could soon erupt.

Investors have attributed the banking panic to the Federal Reserve's aggressive rate hikes over the past year, which have dramatically increased borrowing costs, drained the liquidity market and ended the era of cheap money.

"The JGB is a sign that the bubble has burst," experts say.

Now they warn of a handful of hurdles in the new era that investors will be forced to overcome.

The coming recession

A downturn is likely because the confusion following the SVB's collapse has greatly increased the likelihood of a recession, experts say. That's because banking problems naturally slow the economy. Combine that with tightening by the Fed and the recipe for a recession is there.

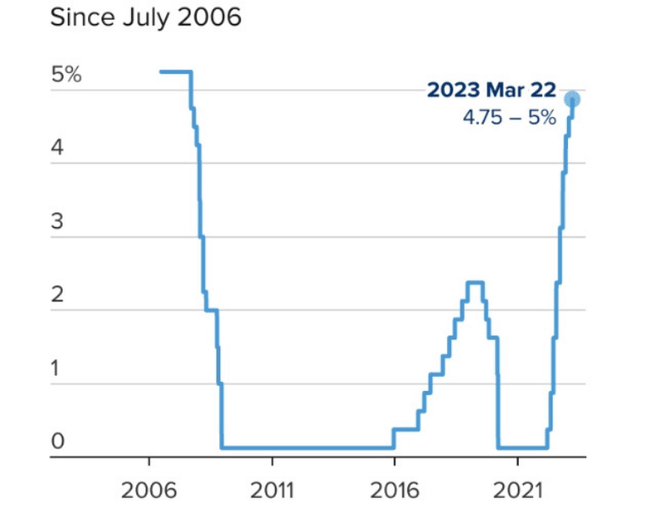

Central bankers have already raised interest rates more than 1,700% in the past year to curb high prices. Despite the volatility in bank stocks, Fed officials raised interest rates another 25 basis points this week, bringing the Fed's effective rate to 4.75%-5%.

That's the highest interest rate since 2007, and the impact of the SVB collapse likely equates to another 50-75 basis points in rate hikes, Moody's chief economist Mark Zandi estimated, making real interest rates even more restrictive.

"That's a pretty significant increase in interest rates and I think it puts the economy at risk," Zandi warned in a recent interview.

Goldman Sachs has also raised its odds of a recession in 2023 from 25% to 35%, and bond markets are flashing signs of a coming downturn as the inverted Treasury yield curve begins to deinvert. Although the inversion itself is a classic recession warning, the unwinding of the inversion is a signal that a recession could come in the next four months, "Bond King" Jeffrey Gundlach said, calling it a "red alert recession signal" in a recent tweet.

More bank failures

There could be more banking problems on the horizon, as the recent crisis is actually a global phenomenon that began long before SVB started stumbling, according to Harvard economist Kenneth Rogoff.

Some experts say SVB's collapse was caused by the bank's extraordinarily high exposure to bonds, which were heavily weighed down by rising interest rates. But the problem is likely more widespread, Rogoff warned, and will be revealed once rates rise higher.

"What has happened is that Silicon Valley Bank may be a little extreme in its naiveté, but almost any kind of investment strategy that has illiquid assets - longer-term assets - will lose money like this," he said in a recent interview.

Although Fed chief Powell and Treasury Secretary Janet Yellen have assured markets that the U.S. banking system is sound, neither is in a position to offer across-the-board insurance on all bank deposits, according to market veteran Ed Yardeni, who said the banking sector may be weaker than officials have suggested.

Luke Ellis, chief executive of Man Group, the world's largest public hedge fund, said he expects a "significant" number of banks to fail in the next two years, adding that there are similar deals such as the emergency takeover of Credit Suisse by UBS.

Stagnant stock returns

Finally, equities are unlikely to repeat the stunning returns of the last decade.

Nouriel Roubini, the "Dr. Doom" Wall Street economist who has repeatedly warned of another financial crisis, has predicted that stocks and bonds will see dismal returns for years as inflation and interest rates remain high. Higher rates will weigh heavily on both assets, he said, urging investors to flock to inflation hedges such as gold.

Billionaire investor Leon Cooperman warned that the U.S. is already going through a "textbook" financial crisis - meaning the S&P 500 won't reach a new high for a long time.

"I think 4,800 on the S&P is going to be the high where it will stand for some time," he said in an interview, referring to the high reached in January 2022. "I expect returns in the S&P to be very much lower."

- Do you think the hardest part is still yet to come? 🤔

Please note that this is not financial advice.