Today we look at a company that operates in the secure sector, and there is a certainty that the demand for their products will always be there. Let's take a look at one player in the food space together here. That player is United Natural Foods.

United Natural Foods, Inc. $UNFI is an American company that specializes in the distribution of healthy and organic foods. It was founded in 1976 and is headquartered in Providence, Rhode Island. The company distributes a wide range of food products such as organic and natural foods, specialty foods for people with food allergies, health food and more. UNFI focuses on supplying these products to retailers, supermarkets and other customers.

UNFI's business model is based on the distribution of food products from manufacturers to retailers and other customers. The company operates in three main segments:

- National Brands: In this segment, the company distributes a wide range of food products from national brands and manufacturers.

- Private Brands: UNFI also creates and distributes private label food products that are often competitive with national brands and can be sold at lower prices.

- Retailer services: UNFI also provides a range of services to retailers such as marketing, technical support, logistics and others to help them run their businesses.

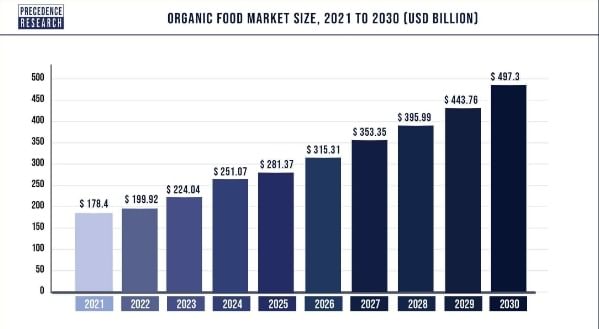

Analysts expect the healthy and organic food market to grow rapidly in the coming years. Growth is expected to be driven by several factors, including growing consumer awareness about health and the environment, younger generations' preference for healthier and more sustainable foods, and global regulatory changes related to the food industry.

Some estimates suggest that the global market for healthy and organic foods could grow at an average of around 12% per year, with some regions such as Asia and Latin America likely to experience even higher growth rates due to a growing middle class and increasing demand for healthy foods.

Of course, every company has its pros and cons, so the same is true in this segment, where there are a good portion of the benefits of investing in this company, but there are also drawbacks to think about.

The advantages of UNFI include:

- Strong market position: UNFI is one of the largest distributors of healthy and organic foods in North America, which gives them a competitive advantage.

- Wide range of products: UNFI offers a wide range of food products that includes organic and natural foods, specialty foods for people with food allergies, and health-conscious foods.

- Long-term relationships with suppliers and customers: UNFI has built strong relationships with suppliers and customers over the years, enabling them to ensure stable supply and demand for their products and services.

UNFI's disadvantages include:

- High Debt: The acquisition of Supervalu has led to an increase in the company's debt, which increases financial risk.

- Sensitivity to changes in commodity prices: The company is sensitive to changes in commodity prices such as food and fuel, which can affect its operating margins.

The company's finances and losses in 2019 and 2020

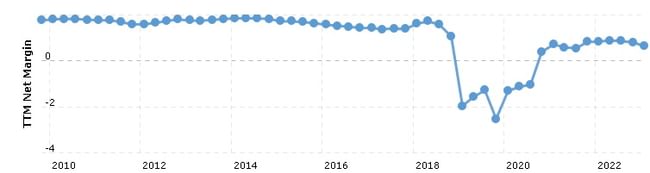

In the long term, the company has performed reasonably well, recording an average annual revenue growth of 37% over the last 5 years. In terms of net profit, the company has also seen an upward trend over the long term, but not as clear-cut as in the case of revenue. the company's net profit has grown at an average annual rate of about 10% over the last 5 years. UNFI reported losses in 2019 and 2020. The main reasons for these losses were:

- The acquisition of Supervalu: In 2018, UNFI acquired Supervalu, which increased debt and costs associated with the acquisition and integration. These costs had a negative impact on the company's profitability in subsequent years.

- Higher operating costs: the Company faced higher operating costs such as transportation and storage costs, which negatively impacted margins and profitability.

At first glance, we can notice from the chart that the company has very low net margins. These low margins are largely due to the nature of the company's business. Plain and simple, you cannot sell a roll with a margin of 100%, you simply cannot.

In the second quarter of fiscal year 2023, United Natural Foods, Inc. (UNFI) reported net sales growth of 5.4% to $7.8 billion, driven by increased sales of multi-category, private label and professional services. However, gross profit declined $6 million, net income fell 71.2% to $19 million, and adjusted EBITDA declined 17.7% to $181 million. Earnings per share declined 71.3% to $0.31 and adjusted earnings per share fell 42.6% to $0.78. The company also managed to reduce net debt by $427 million, including the benefit from the monetization of accounts receivable.

Looking at the balance sheet, the company appears to be relatively well stabilized in the short term, with sufficient current assets to cover its current liabilities. However, when we then look at the longer-term parameters, there is quite a bit of overleverage. The rapid increase in long-term debt occurred just in 2019 and 2020, when the company was making its acquisition of Supervalu. Since then, i.e. the last 2 years, the long-term debt has been slowly decreasing again.

Management's outlook

UNFI has updated its outlook for 2023, raising sales expectations but lowering profitability guidance. The company is also withdrawing its targets for fiscal 2024. The company's transformation agenda is focused on improving operational performance and profitability, and plans to combine sales growth with a more efficient and profitable platform. The goal is to gain a higher share of the core addressable market.

UNFI's CEO, Sandy Douglas, said the lower profitability in the quarter was due to a lack of inflation gains and inventory growth that were previously acquired. The company is working on a transformation plan that will support improving the customer and supplier experience and address gaps in its digital and physical infrastructure. The UNFI team is fully motivated to improve shareholder returns through its transformation agenda.

Conclusion

Personally, I would see the company as a more defensive option for the portfolio, given the nature of its business. In short, the demand for the company's products will always be there. On the other hand, I don't really like the large debt the company has accumulated just because of the acquisition. There is a visible effort to reduce this debt. The company has been able to reduce its interest costs since the acquisition, despite the current rise in interest rates, but it is questionable how the future will unfold with interest rates.

The other issue I see here is the profitability of the company. The company has somehow stable margins, but instead of growth, we see a decline. Personally, I am curious to see what transformation plan the company comes up with specifically and whether this plan will have a positive impact on the profitability of the company.

DISCLAIMER: I am not a financial advisor, and this material does not serve as a financial or investment recommendation. The content of this material is purely informational.