Morgan Stanley recommends buying these 3 stocks for the following bull market

Morgan Stanley says the bear market may not be over yet, but even so, it's not too early to start buying quality stocks that will prosper in the future.

If you're investing in quality stocks, you're probably always looking for companies that generate big profits relative to the size of their assets - and do so in a sustainable and expanding way. Fortunately, the analysts at Morgan Stanley may have made your hunt just a little easier - with their list of companies that should be good long-term choices.

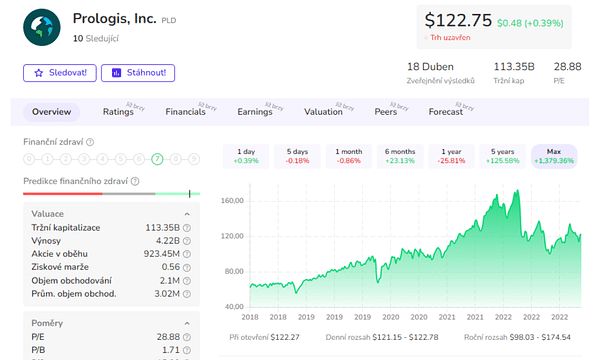

Prologis $PLD

Prologis, a real estate investment trust (REIT) specializing in logistics, was the top overall pick. The company owns and leases giant distribution centers (DCs) to the world's leading logistics companies(DHL and Amazon). Morgan Stanley likes this stock for several reasons. First, the average lease length for Prologis space is approximately seven years. Now, as you've no doubt noticed, there's a huge amount of stuff being delivered these days, and this has increased the rent that landlords can charge. According to Prologis, rents in U.S. and Canadian distribution and distribution centers jumped a record 34% last year.

A look at the latest quarterly numbers:

Here are the key numbers from Prologis' Q4 results:

- Occupancy reached 98.2%, an increase of 82 basis points.

- Overall portfolio occupancy reached a record 98.6%.

- Net rental growth was 51% on a quarterly basis.

- Market rents actually rose above expectations during the quarter, resulting in a record 67% increase in property values.

- Demand and market conditions remain healthy. Rental growth in the portfolio was 5%, and 28% for the full year.

- More than 99% of the portfolio is let or under negotiation.

- Average occupancy reached 86%, close to an all-time high. Prologis therefore recorded very strong operating results in Q4, exceeding expectations and reaching several new records. Demand for its space remains strong and the company continues to grow rents and property values.

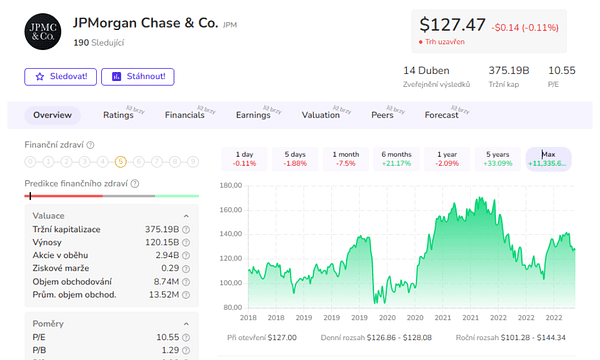

JPMorgan $JPM

Now, you wouldn't normally find banks on a quality investor's shopping list. That's because a number of unpredictable factors, such as macroeconomic data and interest rate movements, can affect their profitability.

What's more, the recent turmoil in the financial sector has only reinforced one of Morgan Stanley's central arguments: that the strong are stronger when it comes to banking. Morgan Stanley thinks JPMorgan's market share growth will continue: the bank is opening new branches across the country, and a sleek new local branch may help banks win customer deposits. About 20% of JPM's branches are under 10 years old - compared with 12% for its competitors in general and just 5% for its big-bank rivals.

In addition, JPM has been increasing spending in recent years to improve its high-end technology offerings. Morgan Stanley sees spending growth starting to slow, so if revenues continue to rise, that's a formula for profit margin growth.

A look at the latest quarterly numbers:

- Net income of $11 billion.

- Earnings per share of $3.57.

- Revenue of $35.6 billion.

- Return on capital employed (ROTCE) ratio of 20%.

- Profit of USD 914 million from the sale of Visa B shares.

- Net loss of $874 million on investment securities.

- Combined credit and debit card spending up 9% year-over-year.

- Growth in both discretionary and non-discretionary spending.

- Payroll volumes up 9% year-over-year, consumer credit up 14%.

- Net interest margin on base interest (NII) 14%, corporate and institutional banking 33%.

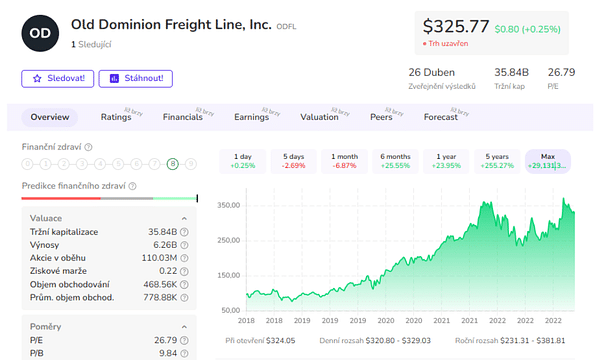

Old Dominion Freight Line $ODFL

As everyone knows, past performance is not a reliable indicator of future success. If it were, Old Dominion would be a world champion. The company has a 15-year record of more than 10% annual revenue growth and 20% earnings per share (EPS) growth. But trucking (which is this North Carolina company's business), like banking, is not exactly synonymous with quality. That's because the industry tends to be buffeted by macroeconomic crosswinds and lacks independent drivers of growth.

That said, ODFL has maintained a strong performance through various economic cycles, which means it can hold its own with elite quality companies. Its management takes a countercyclical approach to investing, a tactic common to all the best-managed companies. In fact, when the economy falls on hard times, Old Dominion leverages its advantage by investing in new trucks, service initiatives and new routes - while its weaker competitors hunker down. And it's a very successful and proven company strategy.

Trucking is not a sexy growth industry, but Morgan Stanley has identified several favorable factors that should support continued revenue growth. First, the cost of regulation has raised the barriers to entry into the industry, so Old Dominion faces fewer competitive threats than it once did. Second, trucking (although more expensive than rail) continues to gain share as supply chains shorten and speed up, increasing demand for ever-faster production and transportation. Finally, technologies such as autonomous or semi-autonomous driving are helping ODFL reduce costs and fatten profit margins.

A look at the latest quarter:

Old Dominion Freight Line (ODFL) reported Q4 EPS of $2.92, beating analysts' estimate of $2.68 by $0.24. Revenue for the quarter was $1.49 billion, compared to the consensus estimate of $1.5 billion.

- What do you think of the company? 🤔

Please note that this is not a financial advisory. Every investment must go through a thorough analysis.