Are you an advocate of passive investing? Then you might like these 2 ETFs.

Passive investing has become quite a trend recently. This is because it allows ordinary people to invest without any complex knowledge and expertise. So let's see how this method can also generate additional income for us.

Dividend ETFs are becoming an increasingly popular choice for investors looking for regular income and potential capital appreciation. In today's article, we'll look at the benefits of investing in dividend ETFs and introduce two great income-generating funds: the Schwab US Dividend Equity ETF and the Vanguard International High Dividend Yield ETF.

Schwab US Dividend Equity ETF $SCHD

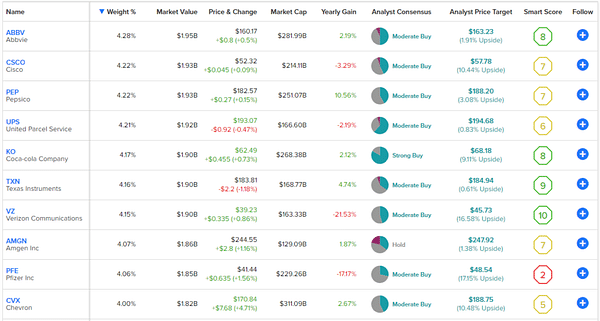

SCHD focuses on U.S. companies with high dividend yields and quality fundamentals. With a yield of 3.6% and a low expense ratio of 0.06%, SCHD is an attractive option for investors looking for solid dividend income.

One of SCHD's main advantages is its diversification among 103 stocks in different sectors. The top 10 positions make up 41.6% of the fund and include such giants as Microsoft, Apple, Johnson & Johnson and Procter & Gamble. SCHD has more technology exposure than VYMI, which may be attractive to investors looking to have a larger stake in this fast-growing sector.

SCHD has posted an average annual performance of 13.8% since its inception in 2011, indicating strong historical performance. The "Hold" analyst rating suggests the fund may be a good choice for long-term investors.

Vanguard International High Dividend Yield ETF $VYMI

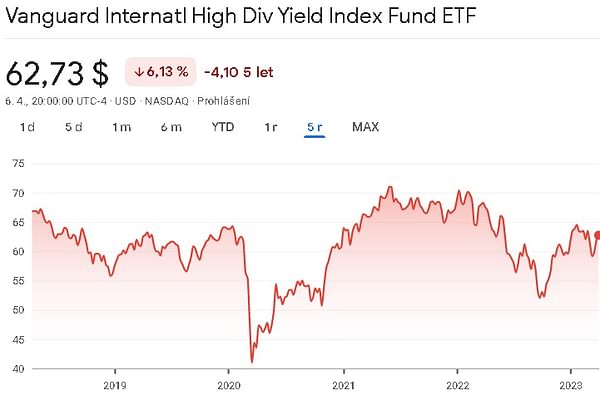

VYMI is an extremely diversified fund with 1,276 stocks and a focus on international high dividend yield companies. With a dividend yield of 4.5% and a low expense ratio of 0.22%, VYMI is suitable for investors seeking regular income and exposure to international markets.

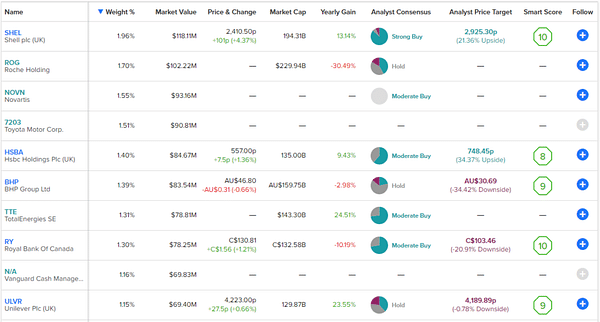

The top 10 positions account for 14.4% of assets and include companies such as Shell, Roche, Novartis, Toyota, Royal Bank of Canada, HSBC, BHP Group and Unilever. VYMI invests in companies around the world, allowing investors geographic diversification and potentially lower correlation to the U.S. market.

VYMI has achieved an annualized return of 7.6% since inception, reflecting the fund's solid historical performance. While this yield is lower than SCHD, it is important to keep in mind that VYMI provides a higher dividend yield and greater international diversification, which may be a priority for some investors.

SCHD vs. VYMI: How to choose

When choosing between SCHD and VYMI, it is important to consider individual investment goals and preferences. SCHD offers a lower dividend yield but higher historical performance and greater technology exposure. This may be attractive to investors looking for a combination of growth and income, and prefer more exposure to U.S. stocks.

On the other hand, VYMI provides a higher dividend yield and greater international diversification, which may be suitable for investors seeking regular income and looking to expand their portfolio with international stocks. VYMI also offers a less concentrated portfolio than SCHD, which may be beneficial in terms of risk reduction.

Conclusion

Dividend ETFs such as SCHD and VYMI offer a number of benefits for investors seeking regular income and potential capital appreciation. Both funds feature low expense ratios and good diversification, making these funds attractive options for a wide range of investors.

When choosing between SCHD and VYMI, it is important to consider individual investment objectives and preferences. SCHD may be better suited for investors seeking higher historical performance and greater technology exposure, while VYMI may be better suited for those seeking higher dividend yields and exposure to international markets. Regardless of which fund you choose, investing in dividend ETFs can be a great way to achieve regular income and potential capital appreciation.

WARNING: I am not a financial advisor, and this material does not serve as a financial or investment recommendation. The content of this material is purely informational.