Transport is a key part of the economy. So why not get involved here through at least one of these ETFs??

Let's look today at one sector that I think is a key part of the economy. Yes, it is transport. But how can you be invested in this sector without it costing you a lot of effort? That's what we're going to talk about today.

Over the past year, the transportation sector has lagged the broader market, which presents an interesting opportunity for investors looking for sectors with growth potential. In this article, we'll take a quick look at the top three transportation ETFs (exchange-traded funds) . These funds represent attractive options for investors looking to gain exposure to the transportation sector, which has benefited from the reopening of the economy, the passage of the Infrastructure Act by the U.S. Congress and the growing use of electric vehicles.

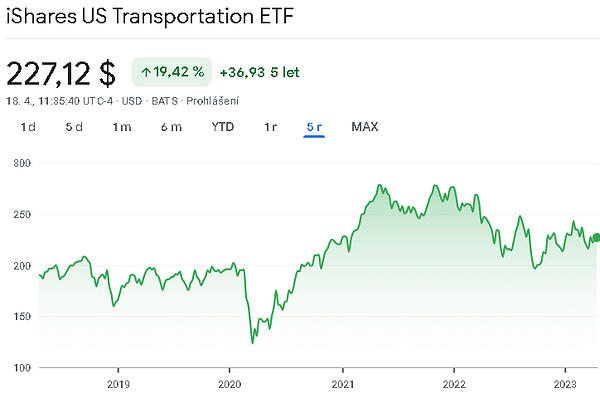

iShares US Transportation ETF

This ETF tracks the S&P Transportation Select Industry FMC Capped Index (USD), which provides exposure to U.S. airlines, railroads and trucking companies.

Air cargo companies receive the largest allocation from the fund (26.5%), followed by railroads (23.5%) and logistics and trucking companies (22.3%).

The three largest holdings of this ETF are United Parcel Service Inc (9.6%), Union Pacific Corp (9.2%) and CSX (8.8%).

Over the past year, IYT has posted a total return of -10.4% with an expense ratio of 0.41% and an annual dividend yield of 0.73%. The ETF has total assets of $1.1 billion.

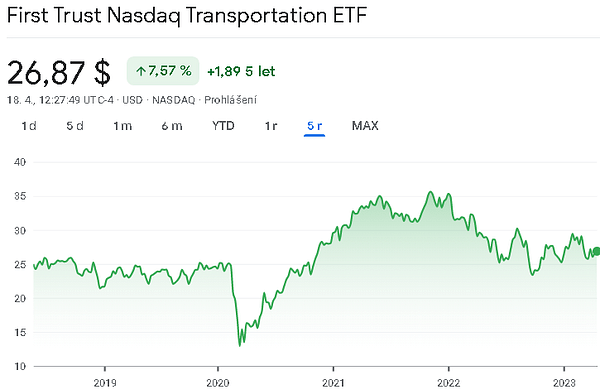

First Trust Nasdaq Transportation ETF

This ETF tracks the Nasdaq US Smart Transportation Index, which includes securities weighted based on three factors: volatility, value and growth. The fund provides exposure to a number of transportation companies.

Transportation companies receive the largest allocation (32.4%), followed by railroads (24.6%), auto parts manufacturers (21.8%) and airlines (12.3%).

The three largest FTXR allocations are CH Robinson WorldwideInc. (8.9%), PACCAR Inc. (8.7%) and Union Pacific (8.1%).

Over the past year, FTXR has posted a total return of -13.5% with an expense ratio of 0.60% and an annual dividend yield of 0.57%. The ETF has total assets of $455 million.

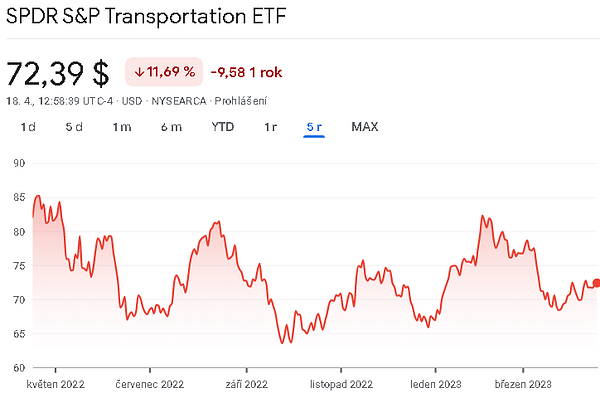

SPDR S&P 500 Transportation ETF

This ETF is the newest and tracks the S&P Transportation Select Industry Index, which provides exposure to air freight and logistics, airlines, airport services, highway and railroads, marine, seaports and services, railroads and trucking companies.

Nearly two-thirds of the fund is made up of transportation companies (36.4%) and airlines (28.9%).

XTN's three largest holdings include Atlas Air Worldwide Holdings Inc (3.7%), Frontier Group Holdings Inc (3.6%) and Uber Technologies Inc (3.5%).

The one-year total return is -17.1% with an expense ratio of 0.35% and an annual dividend yield of 1.08%. The ETF has total assets of $398 million.

Strategy for investing in transportation ETFs

IYT, FTXR and XTN follow a blended strategy of investing in a mix of growth and value stocks of companies with a range of market capitalizations. As the transportation sector is heavily dependent on the economic cycle, investors should be cautious when investing in these ETFs as the volume of goods and people transported fluctuates with the economy. However, the transportation sector can also benefit from long-term trends such as growing demand for e-commerce, infrastructure development and the shift to more sustainable modes of transportation such as electric vehicles and trains powered by clean fuels.

Conclusion

IYT, FTXR and XTN represent the top three transportation ETFs that offer investment opportunities in a sector that has lagged the broader market. Although the transportation sector is susceptible to economic cycles, long-term trends such as growing demand for e-commerce, infrastructure development and the shift to more sustainable modes of transportation suggest these ETFs may offer long-term growth potential. Investors should consider their risk tolerance and investment objectives before deciding to enter these transportation ETFs.

When investing in these ETFs, it is important to monitor economic indicators and news from the transportation sector to better understand trends and events that could affect the fund's performance. Additionally, diversifying your portfolio by investing in different sectors and geographic areas can help reduce overall risk.

It's also important to keep in mind that transportation ETFs with lower total expenses and higher dividend yields may be more attractive to investors. When selecting a transportation ETF, consider these factors as well to achieve the optimal outcome.

In the current global economy, which is recovering from the effects of the COVID-19 pandemic, transportation ETFs may offer interesting investment opportunities. Rising demand for the transportation of goods and people, along with new investments in infrastructure and innovation, suggest that the sector could be on track for further growth. Investing in transportation ETFs such as IYT, FTXR and XTN can help investment portfolios benefit from these trends and opportunities.

This was just a quick look, if you want to break down any of the ETFs in question more, be sure to let me know in the comments.

WARNING: I am not a financial advisor, and this material does not serve as a financial or investment recommendation. The content of this material is purely informational.