Bank of America

BAC

BAC Fair Price

My Notes

Začít psátFeed

In the end, the results of the big banks turned out very well - almost all items exceeded expectations. I have $BAC-3.1%stock in my portfolio and was recently intrigued by @m wise_investor' s article on the City, so I bought $C-2.1% at the beginning of the year and am very happy so far.

Which bank stocks do you have in your portfolio?

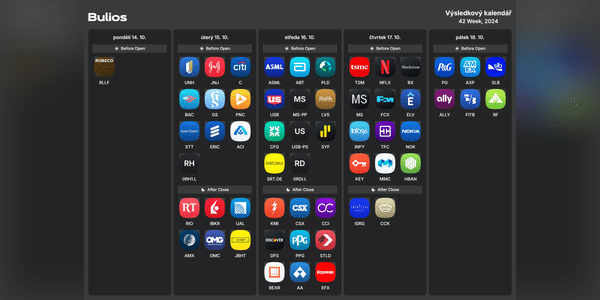

🗓️Týdenní investment overview: key events that move the market!

Earnings season is upon us, with the biggest banking houses in the US kicking off first. Stay tuned for what's ahead! 👀📊

Tuesday:

US PPI inflation: Producer price inflation will reveal whether inflationary pressures in the supply chain are easing. 📦

Wednesday: Big Bank Day! 🏦

U.S. Consumer Price Inflation (CPI): A key...

Read more

Zobrazit další komentáře

Today's inflation will be very important, as it can change a lot of things again and it can influence the Fed's next decision.

Zobrazit další komentáře

Much more important will be how inflation in the US turns out today. Otherwise, I want to look at the $TSM-1.8% results tomorrow

I think yesterday was very interesting for everyone and it had a very positive impact on the stock market. From what I looked at, the stocks that rose the most in my portfolio were $TSLA-3.5%, $CAT-2.9%, $CVS-0.7% and $BAC-3.1%.

Which stocks in your portfolio rose the most yesterday?

🏦Trump's victory affects the banking sector and its future! US bank stocks are rising, bringing hope that the Trump administration will bring a fresher wind to Wall Street.

💸Shares of financial institutions like JPMorgan Chase $JPM-2.1%, Bank of America $BAC-3.1%rose after the election results were announced and Citigroup $C-2.1% by as much as 10 % and banking giants like Morgan Stanley $MS-3.1%,...

Read more

Zobrazit další komentáře

I have $JPM-2.1% in my portfolio and I'm in a big profit, but probably like Tesla the growth will stop in a while and there will be some minor correction and a return to reality😃

Finally, Bank of America also reported very solid results. I have shares of $BAC-3.1% in my portfolio and they make me happy. While the stock is already up more than 20% for the year, the price doesn't seem that high to me yet.

Would it make sense for you to buy shares of $BAC-3.1% even at the current price?

Bank of America

BACZobrazit další komentáře

The bank is good, but not as great as it could be. I'm not changing anything in my portfolio here and I'm still holding $JPM-2.1%.

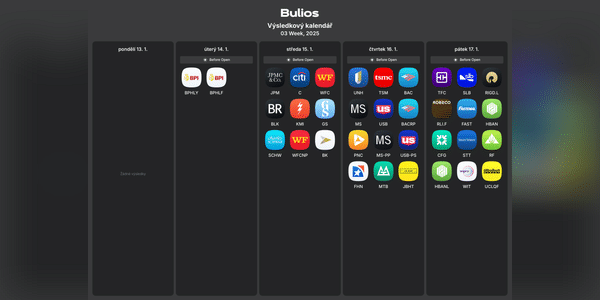

📅Key events of the upcoming week on the markets!

As earnings season gets underway there will be a lot to watch, last week $JPM-2.1%Bank kicked it off nicely by presenting beautiful results above analyst expectations. Let's see what the banks show us this week and they will also be joined by two tech giants along with the world's largest streaming platform. Here I bring you my...

Read more

Zobrazit další komentáře

Choose turnkey sportsbook software. Access 2000+ premium sports with crypto payments, bets management,risk management and payment processing to betting markets and odds. Enquire now!

Next week will be very interesting in terms of company results. I will be most interested in the results of $BAC-3.1% and $ASML-2.3%, as I have these stocks in my portfolio. But I will also be interested in the results of $TSM-1.8%, $UNH0.0% and $NFLX-4.4%.

Which companies will you be most interested in next week?

Zobrazit další komentáře

I was a little bummed about $ASML-2.3%, but it's still a great company and it doesn't change my opinion of the company.

Bulios Black

This user has access to exclusive content, tools and features of the Bulios platform thanks to their subscription.

Hey, guys,

We all have some diversification in our investment portfolios, like the technology sector ($GOOG-4.9%, $NVDA-1.6%) or banking ($JPM-2.1%, $BAC-3.1%) and other various sectors...

I would be interested to know if anyone invests in bonds, for example, and if so, where and how they do it.

Roughly how much cash do you try to hold (as a % of your portfolio)?

So I personally hold the most cash...

Read more

Zobrazit další komentáře

I didn't do any digging. If I had to guess, I'd say he sold it to collect a profit and get cash.

I still hold $BAC-3.1% stock.

Which banks other than the US do you hold in your portfolio?

I have $KOMB.PR-0.9% in my portfolio besides $BAC-3.1% at Fio and I recently bought shares of Erste.

📊 US banks under pressure: Recession fears shake the market!📉

US bank stocks are losing ground, a direct result of growing fears of a possible recession. Investors are turning to safer assets, fleeing a sector that is closely linked to the state of the economy.

Citigroup $C-2.1%, along with Wells Fargo $WFC-2.2%, recorded the biggest loss over the past five days by more than 13 %, followe...

Read more

Zobrazit další komentáře

All I have from the US is $BAC-3.1%. If one buys shares of those big banks, I don't think one has much to worry about. I would be much more afraid of the small ones.

📊 Bank of America shares jump 4% on positive earnings!🏦

Bank of America $BAC-3.1% saw its shares rise significantly by 4 % following the announcement that a recovery in net interest income is imminent 📈

Bank of America

BACRead more

Zobrazit další komentáře

Super results. I have $BAC-3.1% in my portfolio and the appreciation there is very nice. I have $KOMB.PR-0.9% from the Czech Republic, so we'll see what the results will be there. I don't even know when KB is supposed to report their results.

I have a few years of $JPM-2.1% stock in my portfolio and that's good enough for now. Overall financial sector stocks are very expensive right now.